Automotive exterior ornamentation parts such as bumper fascias, rocker moldings, claddings, and wheel lip moldings are generally injection molded and then painted. While grained, mold-in-color parts that are a contrasting color may also be used in these applications, designers generally prefer the look of color-matched, painted components. Unfortunately, the cost of painting these "hang-on" parts can often account for more than half of the cost of the part.

One potential option for eliminating the cost of painting is to use a mold-in-color material that can mimic the appearance of paint. There are several issues that limit the widespread use of this approach. First, the depth of image of a multilayer system (paint) is difficult to reproduce with a single, monolithic layer. In addition, matching the apparent "glossiness" of paint with a molded material has been difficult. Finally, any disruption in laminar flow through the tool alters the prevailing orientation of metallic flakes, resulting in visible flow lines. Consequently, eliminating visible defects in metallic colors on smooth, high-gloss surfaces is extremely difficult. The requirement that laminar flow not be disrupted means that designers are limited in the features that can be included in a part, and engineers must create attachment schemes that do not require molded-in features on the "B" side of the part.

To overcome the limitations inherent in molding high-gloss, Class "A" components "in-color," designers and engineers can choose colors that contrast with the body paint, design parts with only subtle changes in part cross-section, and eliminate molding of holes and "B" side features in the part. Molded-in-color parts with these characteristics will be found on production vehicles in the 2007 model year.

Although there will continue to be improvements in mold-in-color technology, the part design restrictions inherent to in-color molding have led some material suppliers to develop another alternative to paint - multilayer, in-color films. Also called film laminates, these materials can allow the same degree of part design flexibility and level of surface quality as painting without requiring a paint shop. By incorporating a clear layer similar to the clearcoat layer in paints, in-color films are able to more fully emulate the appearance of automotive paint finishes. In addition, the application of a clear layer can provide improved weatherability of the material system without requiring the use of expensive UV stabilizers throughout the entire part thickness. Furthermore, if the film is used in an in-mold process, the mold design restrictions inherent in in-color injection molding are eliminated.

One type of film laminate, "dry paint" film, has been available to the North American automotive market for many years. Additional suppliers from around the world are now entering the North American market with new versions of this film. In addition, several co-extruded multilayer films have been developed for exterior use.

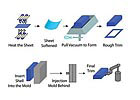

Figure 1. Schematic of the "dry paint" film manufacturing process.

Film Laminate History

Dry paint films have been available in the North American market for nearly twenty years. Films from Avery Dennison Corp. and Soliant LLC were the first multilayer films to be used in the automotive industry in North America. Construction of all paint film foils is essentially the same. A schematic of the foil production process is shown in Figure 1. A top layer of a clear, weatherable polymer provides the Class "A" appearance and material durability. A color layer is then applied to the clear layer, followed by an adhesive layer. This adhesive is necessary to create sufficient adhesion between the color layer and the backing layer. The backing layer is an extruded sheet of polymer, generally either acrylonitrile butadiene styrene (ABS) or thermoplastic polyolefin (TPO), that is laminated to the dry paint film foil. The backing layer is used to convert the foil to a material that is more easily handled in manufacturing.For most automotive applications, the backing layer to which the foil is laminated is a thin layer that provides only enough structure to accommodate the handling required in in-mold film (IMF) processes. A generic schematic of the process is provided in Figure 2. In an IMF process, a film is thermoformed, trimmed, and inserted into the injection mold. The "structure" of the part is then injection molded behind the film. The final trimming process shown in Figure 2 may or may not be necessary, depending on the type of film and the supplier's manufacturing process. Since the polymer used for the backing layer is compatible with that being injection molded, the substrate of the film and "structural" substrate essentially are melt-bonded during the injection molding process. In addition, the film acts as buffer between the visible surface and the resin flow; consequently, features can be injection molded into the part without causing flow lines to appear as defects on the surface of the part.

While the paint, primer, adhesion promoter, paint ovens, paint racks, etc necessary to paint an injection molded part add cost to the manufacturing of a painted component, the addition of film, thermoforming tool, and trimming operation to a traditional injection molding process adds cost as well. Since the polymer used to back mold a part must be very similar to that used in the film backing layer, some suppliers and OEMs have been looking to eliminate the injection molding step by laminating the foil to a thick sheet that will provide the part's structure in addition to the film's structure. This process is called in-color thick sheet thermoforming. A schematic of this process is depicted in Figure 3.

Since thermoforming tooling is far less expensive than the injection molding tooling and process steps are eliminated, this manufacturing process should be less expensive than an IMF process. However, since the thermoforming process cannot create attachment features on the back side of the part during forming, attachment features may have to be added in a secondary process. The design of a part's attachment scheme has a significant impact on the part's final cost and can eliminate any other potential cost savings. To date, the only dry paint film that has been used in the thick sheet thermoforming process has been the Fluorex® film from Soliant.

It should be noted that the thick sheet thermoforming process does not always replace an entire part. There are a number of applications where the thick sheet thermoformed component is still a relatively thin appliqué that is then taped to an injection molded and painted part to provide contrasting color without the use of two-tone painting. While the sheet used in these parts is still relatively thin (around 0.060 in. thick), this type of part is still considered a "thick sheet" application.

The other type of multilayer material that can be used to mimic paint is the co-extruded multilayer sheet. A schematic of the production process for this type of film/sheet is shown in Figure 4. While these materials are constructed with a clear layer, a color layer, and one or more "backing" layers, they are fundamentally different from the dry paint films. These materials are manufactured in a single process by extruding multiple types of resins together through a multilayer extrusion die into a multilayer sheet as shown in Figure 4. Note that while Figure 4 illustrates the process for thick sheet manufacture, a film can also be produced. In that case, the film could be wound on a roll rather than cut into sheets.

As with dry paint films, the use of a multilayer system overcomes many of the limitations of in-color injection molding. While the chemistry of the clear layer varies greatly, the apparent gloss of these materials is very high, in some cases surpassing that of paint. The color layer is a pigmented polymer that is compatible with the clear layer. In some constructions, the backing layer(s) is compatible with the color layer. Other constructions are similar to dry paint films in that an adhesive layer must be added to get sufficient adhesion between the polymer of the color layer and that of the backing layer. The material used in the backing layer(s) varies by manufacturer. Backing layer resins used in co-extruded films in the past include polypropylene (PP), polycarbonate (PC), ABS, PC/ABS, and acrylic styrene acrylonitrile (ASA). The thickness of each layer depends on the particular manufacturer and, in some cases, the overall sheet thickness.

Co-extruded materials can be extruded in just about any thickness and therefore can be used in either an IMF process or a thick sheet thermoforming process. These materials have also been used in structural and semi-structural applications in a modified IMF process that applies a thermosetting polyurethane composite behind the film instead of an injection molded plastic. That process, which is referred to as PU/LFI, has been used in Europe for manufacturing roof modules.

Use of co-extruded film laminates has been slow to expand in North America to date because of limitations in surface impact properties, weatherability, surface appearance, color availability and/or cost. In addition, because these materials are extruded, many of the pigments used to manufacture paint and/or dry paint film cannot be used in co-extruded film laminates because they cannot survive the temperatures at which the polymers are extruded. This does not necessarily restrict the color space available with these materials, but it does make color matching to paint more difficult.

Figure 2. Schematic of the in-mold decorating process using thin films.

Present - Dry Paint Films

By far, the most commonly used film in North America today is the Fluorex film from Soliant. A similar material, Avloy®, is available from Avery, although its use is limited to IMF applications. While Avery and Soliant have been the predominant suppliers in North America, other suppliers around the world have also developed dry-paint-type films for use in other markets. These suppliers are now offering their materials for IMF applications in North America as well.

Figure 3. Schematic of the thick sheet thermoforming process.

Soliant Fluorex

This material is used in both IMF and thick sheet thermoforming processes, as well as in an extrusion/lamination process in Europe. IMF processes are the primary processes used by suppliers to Honda and Toyota, while the thick sheet thermoforming process is the primary process used by suppliers to GM and DaimlerChrysler. Approximately 30 2006MY North American vehicle programs have parts made using this material.The Fluorex film, as well as the Avloy® film from Avery, uses a polyvinylidiene-difluoride (PVDF)/acrylic blend for the clear layer. The color layer can be applied using one of several methods, including gravure printing and slot-die coating. An adhesive layer must be applied to the color layer to achieve adhesion to the backing layer. The type of adhesive is specific to the type of backing layer that will be applied. Compatible backing layers are ABS and TPO.

The current clear layer chemistry requires minimizing the length of time that the material is exposed to high temperatures during thermoforming. If the paint film layers get too hot during thermoforming, the material can lose its glossiness. Consequently, most processors quench the material with chilled air as soon as it is formed to ensure a consistently high level of gloss. In addition, most Tier I suppliers also use a construction that includes a thermoformable mask. The mask is laminated to the paint film foil when the substrate layer is laminated to the foil. The mask serves as additional insurance for a consistently high gloss level after processing. Incorporation of a thermoformable mask appears to be more of a necessity in thick sheet processes than in thin sheet processes.

Since this material has been used in the industry for nearly 20 years, its performance is fairly well understood. Its appearance does not degrade after exposure to exterior solvents, cleaning agents, or environmental exposures. It has scratch and stone pecking performance similar to flexible paints, and it maintains acceptable appearance and adhesion to the substrate after extended UV exposure.

While this material has gained acceptance in the automotive market, Soliant is working on an "improved" version of the film with higher gloss and improved scratch and mar performance. Validation of this new product is pending more general availability of sample material.

The Fluorex film from Soliant is the only dry paint film that has

been used in the thick sheet thermoforming process. Photo

courtesy of Soliant.

Kurz IMD Foil

Kurz is a German-based film/foil supplier that provides a number of film/foil variants for IMF processes; however, only its black IMD foil is suitable for exterior use. This foil is manufactured using a polyester carrier film to which an acrylic-based topcoat layer(s) is applied using a proprietary coating process. Modified black polyacrylate decorative layers are then applied using a gravure printing process. Finally, an acrylic-based hot melt adhesive layer is applied to provide adhesion between the color layer and the injection molded substrate. The finished foil, not including the polyester carrier film, is only 10-50 microns thick.The part production process for this foil is different from that used for the Soliant and Avery films. Because the foil is extremely thin, it is not thermoformed prior to being "inserted" into the injection mold. Instead, the foil is left on the carrier film in roll form, and the film is indexed in front of the injection mold. The mold is then closed and the substrate is injected behind the film. The heat and pressure of the molding process transfers the adhesive, color and clear layers to the part, leaving behind the polyester carrier film. The "decorated" part is removed, the film is indexed, and the process is repeated. A schematic of this process is shown in Figure 5.

While this process is very economical for manufacturing components, it can only be used to manufacture components with a limited amount of curvature. Since the foil is not thermoformed prior to injection molding, the film cannot conform to complex shapes. Consequently, use of this film is limited to relatively flat parts. Nevertheless, for certain parts, such as high-gloss pillar appliqués, this process can be less expensive than other manufacturing processes used to make similar parts.

One other limitation of this foil is that it is only available in solid colors due to the gravure printing process used to manufacture it. The printing process can cause orientation of metal flakes, especially when high metal pigment loadings are used, and create an objectionable appearance relative to the adjacent painted exterior body components.

This material has been used on Opel pillar appliqués and Daimler exterior trim parts in Europe for more than 13 years; consequently, its performance in automotive applications is well understood. The only potential concern for the adoption of this material in North America is weathering resistance. The amount of UV exposure per year in Europe is about one-third of that in Florida. Testing of the Opel film to the Ford specification, however, has shown that the Opel formulation meets North American weathering requirements as well. Development of other colors that can meet NA weathering requirements is still ongoing.

Figure 4. Schematic of the co-extruded film manufacturing process .

DNP America

DNP America, the North American subsidiary of the Dai Nippon Printing Co., supplies dry paint films for IMF in Japan. The exterior film that the company is looking to market in North America consists of a clear acrylic layer onto which the color layer is printed. An adhesive layer is necessary to achieve adequate adhesion between the color layer and a thin extruded backing layer to which the film is laminated. The backing layer may PP, TPO, or ABS. The total film construction thickness is between 125-350 µm. Although this film is available in all colors, solid colors are more difficult to produce than metallic colors. This film does not require the use of a thermoformable mask during processing.While DNP films are used primarily in interior applications, the company's exterior grade film has been used to manufacture a fascia appliqué using the IMF process. The fascia appliqué is used to create a two-tone appearance on the 2006 Toyota HiLux front fascia. (The HiLux is a truck built in Japan for export to the Middle East.) This is the only production application of this material to date.

This material appears to meet fluid and solvent resistance requirements. Testing of scratch, mar, and chip resistance to Ford testing protocols is not yet complete. Since this material has not yet been qualified in North America, the weathering resistance is not well understood. The film passed the Japanese weathering requirement; however, the "sunshine" test used by Japanese automakers includes substantial amounts of wavelengths of light that are not present in sunlight. Consequently, this test can result in both "false positive" and "false negative" results and therefore does not guarantee adequate field performance. Testing to the Ford requirement is currently underway.

Figure 5. Schematic of the film insert molding process using the Kurz foil.

Present - Extruded Films

Extruded films are a more recent entry to the North American market. Similar materials have long been used in the marine, agricultural, and hot tub industries; however, these materials cannot meet the weathering and fluid/solvent resistance requirements of the automotive industry. Several suppliers have tried to fill this gap by developing materials specifically for the automotive market.The variation in materials used in extruded films is far greater than that in paint films. Consequently, the variation in material properties is much greater as well. While films made by co-extrusion are generally grouped into a single "class" of materials, they are unique materials and the properties of one should not be extrapolated to another material in the class.

DNP's exterior film has beed employed to manufacture a fascia appliqué that is used to create a

two-tone appearance on the 2006 Toyota HiLux front fascia. Photo courtesy of DNP America.

GE Lexan SLX

This material was developed by GE primarily to enable expanded use of plastic body panels. As mentioned earlier, there are many limitations to injection molding in-color. One specific example is the molded-in-color panels used for most of the body panels on the original MCC smart car program. In addition to having to grain the panels to hide flow lines, the panels had to be clear coated because the resin could not meet weathering and scratch resistance requirements without the additional protection.1 To overcome these problems, GE developed Lexan SLX.This copolyester-based material is probably the most unique of the film laminates. The clear layer is a modified polycarbonate that GE refers to as "ITR." This resin creates its own ultraviolet (UV) stabilizers as it weathers, giving it outstanding weatherability. In addition, the gloss of the film is far higher than any paint available today. The color layer is a pigmented PC-based resin. Lexan SLX is available in three constructions; a monolithic clear film, a two layer film, and a three layer film. The third layer in the three-layer version is typically a tie-layer to provide adequate adhesion to substrates outside the PC family.

There are three hurdles that have restricted the use of this material in North American automotive applications. First, as with all film laminates, the color matching process is time consuming and expensive. While Lexan SLX can theoretically be matched to most colors, GE currently provides it in six "standard" colors. Since each automaker has its own palette of colors, use of "standard" colors is acceptable only in limited circumstances. As a result, the majority of Lexan SLX produced to date for automotive use has been black. Second, this material is susceptible to microscratches -fine, light scratches that would not be a concern if there were only a few, but become a concern when many are present. Although deep scratches are less visible on this material than they are on paint, the ease with which fine, light scratches are made and the relatively high visibility of these defects has been a deterrent to the use of this material, even though these defects are repairable. Finally, because of the exotic nature of the clear layer, this film is more expensive than other films on the market.

While Lexan SLX is used outside the automotive industry in North America, its only automotive uses to date are in Europe. The film is used to provide the Class "A" appearance of black roof modules for the Opel Zafira and several smart car derivatives. The roof modules are made using the PU/LFI process mentioned earlier. In this process the thermoformed and trimmed film is placed in a tool, the PU/LFI is sprayed onto the back of the film, the compression molding tool is closed, the part is cured, and the finished module is removed and trimmed. The completed module is then typically ready for assembly to the vehicle.

The roof modules of the Opel Zafira feature GE's Lexan SLX film.

Photo courtesy of GE.

Senoplast Senotop/Senosan/"Paintbase"

The Senotop and Senosan materials available from Senoplast are both acrylic/ABS-based sheets. Senotop is the thinner version of Senoplast's film/sheet that is suitable for IMF processes and is a three-layer film. The clear layer and color layers are acrylates, while the backing layer is generally ASA, although blends of ABS or ASA polymers can also be used. The total film thickness varies between 0.040 and 0.080 in. Senosan is the thicker material suitable for thick sheet thermoforming and is a five layer sheet. Again, the clear and color layers are acrylic-based, while the backing layers for this material are ABS or PC/ABS blends. The Senosan sheet is available in thicknesses between 0.080 and 0.400 in.The Senotop sheet was used to manufacture the early versions of roof modules for the MCC smart car in Europe. Subsequently, Mercedes determined that roof temperatures could reach 105°C. As a result, the Senotop film was replaced with Lexan SLX to meet this higher temperature resistance requirement. The author is not aware of any subsequent uses of Senotop in the automotive market. However, the VW Toureg, which is manufactured in Europe and imported to NA, has a lower fascia extension made using Senosan. Senosan is also used to manufacture some aftermarket trim components for the European market.

Since these materials are acrylic-based, the primary concerns with them revolve around impact resistance. These materials are not recommended for use in areas where stone impingement is a concern. The solvent and fluid resistance of these materials has been found to meet automotive requirements. These materials retain their gloss even after 10,000 hours of accelerated weathering; however, some colors have been found to shift color significantly even after as little as 3000 hours of accelerated exposure or 12 months in Florida.

Senoplast is also involved in the paint film development work being done in Europe. The company provides a multilayer sheet that it refers to as "Paintbase" film to other suppliers involved in the consortium. The Paintbase film is a three-layer co-extrusion consisting of ABS/PC, PC, and ABS/PC. This material is provided to other suppliers that can apply paint to the film before or after thermoforming, depending on the component manufacturing process and the paint materials involved. DaimlerChrysler has led the consortium that developed this material system and will launch it on a roof module this year. In that process, the paint is applied to the Paintbase film by linecoating. The film is then thermoformed, UV-treated to complete the curing of the paint, and trimmed. The film blank is then used in the PU/LFI process mentioned earlier to manufacture a roof module. The author has not had the opportunity to work with this film at this time, so cannot comment on its properties.

Black IMD foil from Kurz adorns this exterior cover for a rear windshield wiper housing. Photo

courtesy of Kurz.

Mayco Ionomer Film

The ionomer film that had been produced by Mayco Plastics was originally a joint development between DaimlerChrysler, ExxonMobil and Mayco. The film was designed for use in IMF processes and consisted of four layers - a 0.005-in. thick clear ionomer, a 0.009-in. thick pigmented ionomer, a 0.0025-in. thick adhesive "tie," and a 0.015-in. thick backing of PP.This film maintained its appearance after exposure to exterior solvents and cleaning agents. One of the primary issues with early versions of this film was the adhesion of the color layer to the backing layer. The strength of that bond was found to vary with extrusion conditions, injection molding process conditions and environmental exposure. In some early specimens, delamination of the film could be initiated using a fingernail. The film could then easily be pulled apart by hand. Since this film was used to make rear fascias in a limited production run at the end of the life of the Chrysler Neon program, one would assume that this issue was addressed. The author did not receive later samples of this material and therefore is not able to confirm this. Two years of weathering exposure in Florida was completed on this material, and it was shown to maintain acceptable appearance after exposure. To the author's knowledge, adhesion testing after Florida exposure was not completed.

As mentioned earlier, this film was used to produce rear bumper fascias for the 2005 Dodge/Chrysler Neon in a limited number of colors. Mayco experienced surface quality issues during production of the film and molding of the fascias, resulting in a higher than expected scrap rate. The high scrap rate may have been what ultimately led to the end of this program. When Neon production ended, so did production of this material at Mayco.

Soliant's Fluorex film exhibits scratch and stone pecking performance similar to flexible paints,

and it maintains acceptable appearance and adhesion to the substrate after extended UV exposure.

Photo courtesy of Soliant.

Future Potential

Further use of film laminates in the automotive industry will require that the film chosen has at least the same level of performance as a painted system and that the part's variable cost is lower than that of a painted part. Alternatively, OEMs might be willing to pay a premium for materials that provide a substantially higher level of performance than current materials, but only if the performance improvement addresses an existing warranty concern.While there have been predictions of a transformation of the auto industry away from painting, this has so far failed to occur. One likely reason for this is that even though the target - paint - is an "old" technology, is not a stationary target. While the properties of film laminates have improved in recent years, so have the properties of paint. When TPOs were first used in automotive exteriors, paint adhesion was a significant problem. Since that time, however, improved paint systems have eliminated many of the early concerns. Furthermore, while paint is generally considered to be an expensive process, improvements in the painting process have reduced the cost of injection molding and painting exterior components in the past few years.

There are several possible scenarios that could result in the expanded use of film laminates. In the short term, thin sheet film laminate appliqués are likely to replace two-tone paint applications. Two-tone painting is expensive because of the incremental labor and facilities costs. While very few two-tone components are used on passenger cars today, this appearance is still used widely on SUVs and trucks. It is difficult to predict whether the shift away from traditional SUVs to "crossover" vehicles will also result in a change in use of two-tone appearances. Nonetheless, it is likely that some two-tone appearances will continue to be used. These applications appear to be "low hanging fruit" for conversion to film laminate applications.

The other short term applications for which film laminates may hold an advantage over injection molding and painting are ground effects packages and other similar aftermarket body kits. While film laminates can be expensive in small volumes, the tooling cost associated with thick sheet thermoforming is attractive for low volume applications such as body kits. As OEMs consider offering more of these types of products, the aggregation of several low volume programs with overlapping color palates could increase the volume of film used enough to make both the use of these materials and the body kit programs themselves financially viable.

In the mid-term, one potential development that could spur expanded use of film laminates is development of a true chrome replacement film. While chrome is a highly desirable appearance in today's automotive market, the chroming process is both expensive and environmentally undesirable. Consequently, there is great interest throughout the automotive industry in a film that could mimic the appearance of chrome. While many suppliers have attempted to develop such a material, duplicating chrome in a material that is also thermoformable has been difficult. The films that exist today have poor formability, surface appearance or durability. Soliant and other material suppliers continue to work toward creating a chrome film that will meet all automotive OEM expectations. Once a material with the requisite performance and processing characteristics becomes available, it is likely to see significant use across the industry, provided that it is an affordable material.

Another potential development that could occur in the mid-term is the adoption of roof modules in North America. The use of roof modules requires a change in body construction and assembly processes. This body construction has not yet been used widely outside of Europe. Since the PU/LFI process, the predominant manufacturing process for these modules, does not produce a surface that is suitable for painting, the use of film laminates is required to achieve an automotive quality surface appearance. As a result, the use of film laminates will increase if roof modules become more widely used.

In the long term, end of life regulations could result in more widespread use of film laminates in thick sheet thermoformed applications. Since the thick substrate can be extruded as a multilayer sheet, manufacturing parts via thick sheet thermoforming could allow use of regrind from recovered TPO fascias. The sheet would be extruded with a virgin "cap" layer to protect the "A" surface from the defects that would normally be caused by contaminants in the backing material. The "B" layer would then contain an as-of-yet undetermined amount of regrind. Theoretically, not even the paint would need to be removed from a recovered fascia to reuse the TPO in this process. Unfortunately, very little work has been done in this area to determine the viability of this proposal. More stringent regulations mandating more reuse of recovered automotive materials could drive additional research in this area.

The other potential regulatory change that could influence the use of film laminates in the long term is government mandated reductions in VOC emissions. Currently, paint companies are working on paint systems that will achieve these goals as well. Nevertheless, if new paint materials and painting processes cannot achieve the necessary reductions, then Tier I suppliers and OEMs could be forced to consider alternative technologies such as film laminates for meeting emission regulations.

Another potential long-term development would be the implementation of a "paintless" assembly plant. Some film suppliers have proposed that the use of film could eliminate the need for a paint shop in the assembly plant; however, implementation of such a strategy would require a wide range of changes to vehicle design, manufacture and assembly not associated with the use of film laminates. For instance, while paint provides the appearance of the vehicle, it also protects the metal structure from corrosion. Consequently, to eliminate the need to e-coat and paint vehicles, some other strategy for protecting (or eliminating) the metal would have to be implemented. A vehicle could be bonded together using pre-coated assemblies or built entirely from composites. Both of these strategies, however, are likely to significantly increase the cost of manufacturing a vehicle. Given the economics of the automotive industry, this strategy seems to be appropriate in only very limited circumstances - for instance, in cases where a manufacturer is not interested in maximizing the volume of vehicles sold but does want to produce a vehicle locally in a developing market. Nevertheless, it is believed that some OEMs are still exploring this concept.

Finally, as alluded to earlier, suppliers are continuing to develop new film laminate materials. The film laminates that are currently available are cost effective in only certain circumstances today. If at any time a material and process combination is developed that is cost effective compared to injection molding and painting, there are now many suppliers with enough experience in using film laminates that use of such a material and process could increase quickly.

While there are a number of scenarios that could result in increased use of film laminates, improvements in paint materials and processes could also reduce their use. Although paint is currently considered to be an environmentally unfriendly process, technologies such as powder coating, E-beam curing, and surface modification could provide the same reduction in environmental impact as the use of film laminates. Which technology will be used will ultimately depend on the fully accounted cost to manufacture a given part.

Report Abusive Comment