LANXESS Inorganic Pigments (IPG) held its second Pigments Symposium in Shanghai November 18-19, in conjunction with the inauguration of its new iron oxide plant in Ningbo, China. The goal of the symposium was to discuss the global pigments industry in transition, particularly in China, and to examine how to turn challenges into sustainable value creation, particularly by combining economic and ecological targets. I was honored to have been invited to both the symposium and the inauguration, which gave all attendees an opportunity to learn about the current developments in the China pigment market, the latest government regulations and the newest developments in iron oxide production.

The Pigments Market

Rafael Suchan, Vice President for Asia-Pacific at LANXESS IPG, provided valuable information on the global pigments market, as well as the inorganic pigment market specifically. Suchan noted that the pigment industry totals roughly 7 million tons globally, with 95% of pigments being inorganic. 75% of global pigment demand is represented by TiO2 and carbon black pigments. Of the remaining 25%, iron oxides are the main color pigment. Suchan explained that pigments are differentiated into organic and inorganic categories. Organic pigments have a complex chemical structure, feature bright colors with rather low stability, and have few big western players – primarily BASF and Clariant. (The majority of organic pigment producers are Chinese or Indian.) Inorganic pigments have a mineralogical structure, have warm earth tones with high stability, and are experiencing ongoing consolidation globally. Inorganic pigments are dominated by TiO2 and carbon black, with Chemours, Tronox, Huntsman, Kronos, Cabot and Orion as the major players. The two primary global suppliers in the iron oxide market are LANXESS and Huntsman.

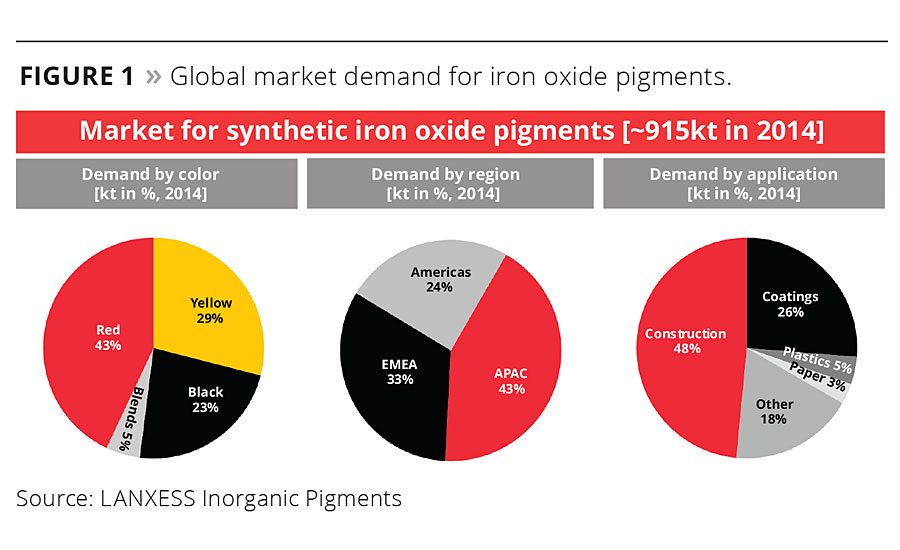

Suchan stated that global demand for iron oxide pigments in 2014 was around 915,000 tons, with the market driven by demand from the construction industry and Asia Pacific. Figure 1 shows the global demand by color, market and application.

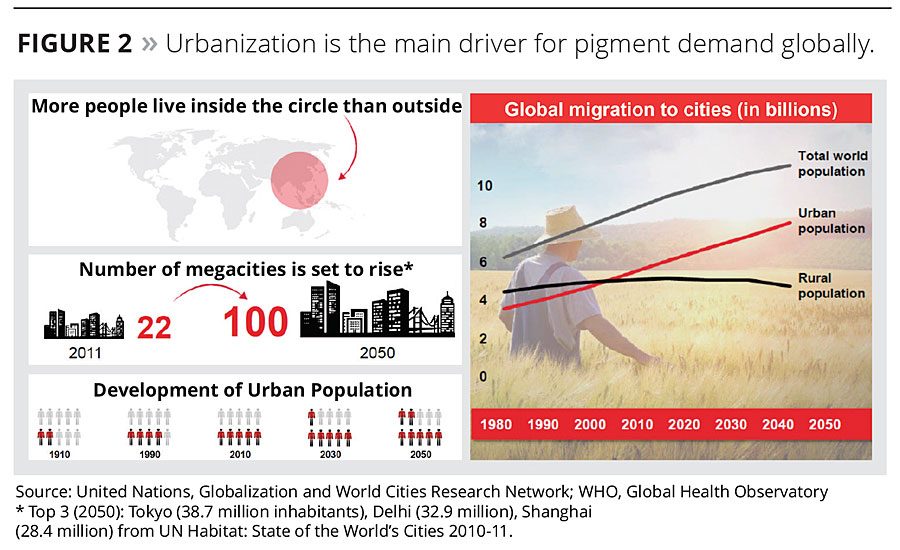

From 1970-2000, the global iron oxide pigment market saw growth of approximately 3.5% per year. In the 1990s, many Chinese producers entered the market, providing low-quality but inexpensive iron oxide pigments. This resulted in higher demand for these pigments, and an annual growth rate of 5.5% from 2000-2006. In 2006-2007, demand for iron oxide pigments reached a peak, at almost 1.1 million tons. Since then, demand has gone down, due to the financial crisis in 2009, as well as technological changes on the customer side designed to save costs. While the iron oxide market bottomed out in 2013, demand started to recover in 2014. LANXESS forecasts that demand will grow at 3% per year in the next five to 10 years, driven mainly by the urbanization megatrend. Suchan stated that as more people move from rural areas into cities, the number of megacities will increase from 22 to 100 between 2011 and 2050 (Figure 2). The growth of urban cities fuels the construction industry, thus increasing demand for iron oxide pigments, which are used in both construction products and coatings.

Manufacturing in China

China is clearly on a path to more environmentally sound manufacturing practices. Two of the speakers at the symposium were government officials who discussed the latest regulations and efforts that the government has put forward. Wenchao Zang, Deputy Chief Engineer and Senior Engineer of the Solid Waste & Chemicals Management Center for the Ministry of Environmental Protection of China, discussed China’s 13th Five-Year Plan, the central government’s strategy for China’s long-term social and economic policies. She stated that the process of building an ecological civilization is deepening. According to Zang, major objectives of the plan include increasing medium- and high-speed economic growth, improving manufacturing standards, improving the quality of the social civilization and the overall improvement of the ecological environment.

Xianhui Zhou, Deputy Secretary-General of CPCIF and Secretary-General of CCIEPA, discussed sustainability and a new mindset for corporate social responsibility. She discussed how China is cracking down on manufacturers that do not comply with the new environmental regulations, via heavy fines and other punishments. The government has also established a hotline, where citizens in the community can call in to report polluting and other violations.

China is the largest producer of iron oxide pigments, and the enforcement of environmental regulations is a major driver for rapid changes in the iron oxide industry. In addition to emissions regulations, investment in new iron oxide facilities in China is now only possible in recognized chemical parks with appropriate energy supply and waste treatment facilities. As a result of these environmental protection measures, approximately 20 iron oxide plants in China have closed down since 2012. New environmental protection laws and the 13th Five Year Plan will put additional pressure on existing producers, further decreasing capacity and the number of producers in the coming years. Joerg Hellwig, Head of LANXESS IPG, stated in his opening speech at the symposium, “In our opinion, this government activity is absolutely the right move to make.”

Hellwig discussed how resource efficiency and pollution prevention are crucial to further sustain industry, both economically and ecologically, particularly in regions of the world with lower environmental standards. Leading chemical companies are asked to contribute their technical knowledge and expertise to help implement environmentally sound methods. He noted that as globalization continues, the chemical industry in China and the Asia-Pacific region will grow strongly, with an expected 46% sales growth contribution by China from 2013-2030. This indicates an increasing demand for chemical products, many required for infrastructure development. “Satisfying this demand can only be realized by implementing sustainable production methods and new, innovative technologies. Sustainability has to be understood as an investment to safeguard the future of our industry and to realize optimal growth potential,” Hellwig stated.

A New Industry Mindset of Sustainability

Unfortunately, sustainability has been interpreted in so many different ways, that Hellwig fears the word is in danger of losing its practical reputation. There is disagreement among managers regarding the meaning of and motivation for enterprise-level sustainability. Added value creation often remains unclear, especially for mid-sized market companies. And a “price before value” attitude often impedes the implementation of sustainability as an integral element of a future-oriented business model.

Hellwig commented that while sustainability is an indispensable element of the business concept at LANXESS, in his opinion a new industry mindset of sustainability and its economic contribution is essential for the coatings industry as a whole. While all companies want to deliver the highest possible value for their stakeholders, Hellwig noted that economic growth without consideration for ecological and social responsibility is not sufficient to retain a long-term growth strategy. “Companies have to meet the legitimate expectations of all stakeholders – society, employees, customers and shareholders,” he stated.

Dr. Norbert Mahr, Director Global Procurement Inorganics at BASF SE, also spoke at the symposium and reiterated the need for a new industry mindset regarding sustainability. He noted that the issue of global population growth brings with it change and a variety of challenges, including our food and water supply, a finite amount of resources, infrastructure within rapidly growing cities, and transportation issues. Another global trend, especially in China, is the growth of the middle class, which brings with it demand for higher-quality products. Mahr stated, “Sustainability and innovation will be significant drivers as we deal with these challenges.” He noted that it is important for companies to accept change, to focus on adapting their behavior, to respond to change and to thrive through change.

When it comes to procurement, BASF is responding to this change with procurement sustainability goals and a risk management process. “By offering sustainable products and solutions, we will enhance our long-term success as well as the success of our customers,” Mahr stated. One of BASF’s sustainability goals in procuring products includes improving sourcing practices by looking beyond price, quality and delivery time to also incorporate environmental and social aspects. BASF participates with the Together for Sustainability (TfS) Initiative, a chemical industry initiative founded in 2011 aimed at improving sustainability practices within its supply chains. TfS aims at developing and implementing a global supplier engagement program that assesses and improves sustainability sourcing practices, including ecological and social aspects. Within the TfS audit process the supplier’s sustainability performance is verified against a defined set of audit criteria on management, environment, health and safety, labor and human rights, and governance issues.1 Mahr stated that such audits help develop suppliers to be more responsible, and to realize that price is no longer the first priority.

New, Sustainable Iron Oxide Production Process

In its efforts to move sustainability forward, LANXESS IPG has set new milestones for sustainable production processes around the world, including incorporating waste-recycling processes, plant automation, using renewable feedstock, independence from external energy resources, waste-water treatment and reduced emissions. The latest example of how the company’s commitment to sustainability is put into practice is its new production plant in Ningbo, China. In 2013, LANXESS announced it would build the world’s most advanced plant for the production of inorganic pigments in Ningbo. The company invested roughly €60 million and created 200 new jobs to develop this new facility with an annual capacity of 25,000 tons of iron oxide red production and 70,000 tons of mixing and milling.

Four processes in particular are used worldwide for the industrial production of iron oxide red pigments. All four processes pose specific challenges when it comes to achieving sustainable, resource-friendly production. In addition, all the processes have their strengths and weaknesses regarding the target color space.2 The Penniman process has exceptional strengths in producing particularly yellowish red pigments with high chromaticity. LANXESS recognized a market need for this particular color, and thus, a need for the Penniman process. However, this process is the most polluting process for red iron oxide production due to untreated release of toxic nitrogen oxides (NO/NO2), laughing gas (N2O, which has an environmental impact 300-times greater than CO2), and wastewater containing dissolved ammonium nitrate (NH4NO3). LANXESS initially ruled out this process as its method of production, but when the market demand for the red color could not be ignored, LANXESS decided that it would optimize the process to make it more environmentally friendly.

LANXESS chose China to build its new facility because it offers optimal conditions to execute a growth strategy based on leadership in sustainable technologies. With the Chinese government’s efforts in pushing forward economic reform, Hellwig noted that LANXESS is in a position to help accompany China on its way to a restructured, advanced economy. In cooperation with the Chinese government, LANXESS took on the challenge to build a plant that solves the problems normally associated with the Penniman process, and bring the standard of iron oxide red production to the next level.

During its efforts to modify the Penniman process and reduce emissions, LANXESS chemists and engineers invented a completely new technology that not only provides for the environmentally sound, safe production of high-quality iron oxide pigments, but also opens up a new red color space with an unmatched hue. These brighter and more yellowish red pigments have significantly higher L*a*b* color space values on the red axis (a*) as well as on the yellow axis (b*). Because this new process has nothing in common with the old Penniman process (other than the basic raw materials used), LANXESS has decided to give the process a new name – the Ningbo process. The name underlines the significance of the pigments industry in China and expresses the company’s gratitude to the Chinese government and the Ningbo Chemical Park Management for their support. For its part, the government is very happy with the new name, as it helps them with their message as well.

With the Ningbo process, 100% of wastewater is treated with biological denitrification and reverse osmosis. All process water will be completely purified so that more than 80% of it can be directly reused in the plant. In addition, almost 100% of waste gasses will be decomposed, which means that 98% less laughing gas, 99.9% less nitric oxide waste gas emissions and 88% less CO2 equivalents will leak out into the environment.

On November 20, LANXESS celebrated the completion of the plant’s construction, which is expected to be on-stream and producing pigments in the first quarter of 2016. Initially, the plant will produce high-quality yellowish red iron oxide pigments, which are likely to be of particular interest in the paint and coatings industry. Unlike many existing products in the market today, these new pigments will come with the ‘green stamp’ of environmentally friendly production. In the near future, LANXESS will also expand its product portfolio further by introducing new and unique high-chromaticity red pigments. These products, which have evolved in the Ningbo process development labs of LANXESS, are not currently available in today’s pigment market.

The Ningbo facility is an example of moving forward in sustainability by creating permanent high value for all stakeholders. Waste and industrial pollution are reduced, a safe and healthy working environment has been created, key future markets in China and Asia-Pacific are being developed, global product availability and delivery reliability are secured, and innovative new products will be produced. We can expect to hear and see the latest news about these products at the American Coating Show in April 2016.

References

1 http://www.tfs-initiative.com

2 Czaplik, W. A New Development in Penniman Red Production. Paint & Coatings Industry (2015), January, p. 40-43.

Report Abusive Comment