The Rise of Water-Based Coatings

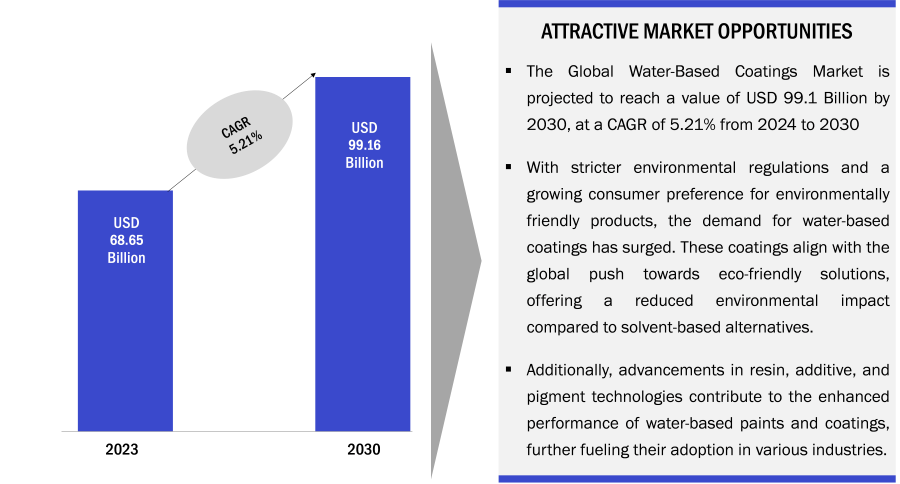

The global water-based coatings market is projected to experience a steady compound annual growth rate in the coming decade. According to Verified Market Research, the global water-based coatings market size was valued at USD 68.65 billion in 2023 and is projected to reach USD 99.16 billion by 2030, growing at a CAGR of 5.21% during the forecast period 2024-2030. A key driving force behind this growth is the increasing emphasis on sustainability, reflected in stricter environmental regulations and rising consumer demand for environmentally friendly products. The evolution of resin, additive, and pigment technologies further propels the adoption of water-based paint and coatings.

The movement towards sustainability is not confined to specific regions; it has evolved into a global initiative affecting various applications. Stricter regulations in China exemplify this trend, but the overarching motivation is a universal desire to enhance human health and air quality by reducing emissions. Industry experts stress the responsibility to create safer and more sustainable products, with a focus on continuous innovation.

Consumers' heightened awareness of the environmental impact of products has prompted the coatings industry to develop more sustainable options, utilizing bio-based and renewable raw materials. The finite supply of traditional resources and the associated environmental footprint are driving the industry towards finding alternative sources and embracing a circular economy.

Water-based coatings offer benefits beyond environmental considerations, creating incentives for transitioning from solvent-based systems. In industrial applications, the reduction of explosion risks and lower insurance fees are notable advantages, while in architectural settings, the lower odor levels of water-based paints address concerns about solvent odors.

Additionally, advances in the performance of water-based coatings contribute to their expanding applications. Formulators are improving performance in areas traditionally dominated by solvent-based coatings, such as direct-to-metal coatings and applications requiring specific properties like high gloss. These enhancements result from advancements in resin chemistry and the development of additives tailored for water-based formulations.

The consensus within the coatings industry affirms that current water-based coating technologies surpass or match the performance of their solvent-based counterparts across various applications. Contrary to the general perception, water-based coatings are demonstrating competitive or superior performance in lighter-duty applications. While challenges are more significant for heavy-duty protection, advancements in resin technology, particularly in increasing hydrophobicity, are paving the way for achieving robust performance in water-based systems. This transformation challenges the misconception that water-based coatings are incapable of meeting rigorous performance requirements.

High-performance, water-based solutions are exemplified by two-component (2K) water-based polyurethane floor coatings and water-based epoxy products formulated to meet stringent application and performance requirements. These innovations offer comparable or even superior performance to solvent-based systems when applied to properly prepared substrates. Water-based architectural coatings, especially interior latex paints, are favored for their enhanced performance, ease of use, appealing appearance, low odor, and non-yellowing properties.

Despite these advancements, certain sectors such as automotive exterior clearcoats and high-corrosion-resistant coatings predominantly rely on solvent-based options. Manufacturers cite the need for high chemical and weather resistance, aspects not yet fully achieved by water-based coatings. Challenges persist in water-based automotive interiors, and exceptions include marine coatings for underwater protection, coatings applied in low-temperature environments, and those used in confined spaces like oil pipelines and tank interiors. High-quality water-based alkyds are making inroads into wood and metal markets, excelling in applications requiring high gloss and adhesion to diverse substrates. In the absence of strict regulations, the transition to water-based coatings must be cost-neutral with performance parity. Even with regulations, a significant imbalance would not be sustainable for the industry in the long term.

Advancements in water-based coatings performance are attributed to significant progress in resin technologies, incorporating novel morphologies, and crosslinking mechanisms effective at ambient temperature. New dispersing technologies, minimizing hydrophilic modifications, contribute to water dispersibility and stability, making water-based binders well-suited for one-component (1K) applications in the absence of low solids and high VOCs.

In the architectural market, where water-based coatings dominate, there's a continuous demand for water-based resins producing consistently high-gloss films and adhering to various substrates without extensive surface preparation. Recent developments in water-based alkyds, exemplified by Arkema's SYNAQUA® 4804 alkyd emulsion, showcase advancements in achieving the look and feel of high-gloss, solvent-based architectural alkyds with reduced VOC and odor.

Improvements in vinyl and acrylic emulsion polymer systems enhance water-resistant binders, low-odor, and aldehyde abatement. Hexion's branched vinyl ester monomers modify these polymers, resulting in increased alkali resistance and superior water repellence, making them suitable for various applications. Water-based epoxy binder systems, like Hexion's AQUAREOUS™ Epoxy Dispersions, offer ultra-low VOC levels, matching solvent-based counterparts in corrosion-resistant primers and epoxy floor coatings.

The development of 1K water-based polyurethane coatings with properties akin to traditional two-component (2K) coatings is notable. Covestro's Bayhydrol® UH 2874 and Bayhydrol A 2846 XP cater to wood-floor coatings, while formulations like Bayhydrol UH XP 2592 and Impranil® DL 2077 provide high-performance 1K-PU concrete sealers for concrete floors and brick pavers, offering protection against staining and chemical attacks.

Lubrizol introduced Aptalon™ polyamide polyurethane technology, showcasing high-performance 1K water-based coatings with excellent clarity, hardness, and chemical resistance, competing with solvent-based coatings. Water-based acrylic emulsions show potential in protective field-applied coatings, such as direct-to-metal (DTM) binders, with VOC levels below 50 g/L and competitive field performance.

Water-based 2K coatings with improved performance are emerging, such as Dow's MAINCOTE AEH acrylic-epoxy hybrid technology and Hexion's method for producing resins for 2K-PU water-based topcoats. Evonik introduced water-based silicone-polyester binders for eco-friendly bakeware coatings, and a new concept for water-based, zinc-rich primers, meeting regulatory demands globally.

The progress in water-based coatings is significantly indebted to advancements in additive technologies, addressing challenges posed by the high surface tension of water. Achieving optimal coating production involves using correct pigments, stabilizing the system, and actively addressing issues like defoaming, flow and leveling, hiding, and mar- and block-resistance. Additives play a crucial role in overcoming these challenges.

Recent breakthroughs enable formulators to surpass surface-tension barriers and macro/micro foam, achieving performance levels comparable to solvent-based systems. Multifunctional additives, combining the roles of several additives at a low-use rate, continue to play a pivotal role in enhancing water-based coatings. Troy Corporation's Z-line of performance additives, especially the Troysperse™ ZWD series of multifunctional dispersants, contributes to improved performance without VOC, APE, or HAPs. Lubrizol's Solsperse™ W-Series Hyperdispersants and innovative replacements for APEO/NPEO surfactants from Clariant also highlight advancements in dispersant technologies.

Rheology modifiers have undergone key developments, moving away from cellulosic thickener-based paints to coatings with one-coat application, scuff resistance, smooth finish, and uniform appearance. Soybean and linseed oil-derived modifiers with zero VOCs and high renewable content offer environmentally friendly alternatives. Surfactants based on epoxide chemistry enhance water-based coatings' early water resistance, adhesion, and durability. Novel surface modifiers, notably the replacement of APEO/NPEO surfactants, improve ease of use and performance in leaching and open time.

Hexion's VeoPox™ hybrid polymer adhesion promotor additives leverage VeoVa™ vinyl ester monomer, providing improved adhesion on diverse substrates and corrosion protection in direct-to-metal (DTM) applications. As the industry looks forward, exciting prospects include the exploration of nanomaterials and graphene in water-based coating systems, opening avenues for further performance enhancements.

Despite the increasing interest in water-based paints and coatings, formulators and ingredient suppliers face several challenges that hinder seamless adoption and optimal performance. Water-based systems often incur higher costs due to the necessity of specialty additives, pigments, fillers, and modifiers, which are comparatively more expensive than their solvent-based counterparts.

Certain applications demand more energy for water release than solvent evaporation, raising concerns about the overall cost of coating formulations and environmental impacts. There is a need to reduce energy consumption and enhance the sustainability of raw materials. Water-based coatings present formulation challenges, including careful attention to raw material addition, pH control, and blending at high speeds. Developing educational resources and experience for companies aiming to work with water-based coatings can accelerate technological advancements.

Achieving optimal performance with water-based coatings requires addressing challenges in application and curing processes. For instance, in the automotive OEM sector, substantial investments in spray equipment, booths, and ovens are often necessary, making the application and curing of water-based paints more complex. Applicators require high-level training to fully achieve the expected performance in water-based formulations. The short open time can pose difficulties for non-professionals, leading to challenges in completing paint jobs before solidification occurs.

Water-based coatings can cause flash rust on metallic substrates, grain raising on wood, and pose challenges related to air entrapment, foaming, and lower sag resistance. Issues like microorganism growth in aqueous formulations and the need for effective wet-state preservatives further complicate the environmental considerations. Achieving leaching resistance is crucial for longer-lasting coatings protection, demanding continuous improvement in binders and preservatives to minimize environmental impact. Water-based coatings can be more challenging to repair, potentially leading to higher scrap rates and greater waste during manufacturing compared to solvent-based systems.

To address these challenges, ongoing efforts focus on improving robustness in water-based binders, optimizing formulation for varied environmental conditions, enhancing binders' storage stability and shelf life, and developing hybrid water-based binders that offer superior performance across diverse applications. Additionally, advancements in additive technologies, including anti-adhesion additives and co-binders, aim to overcome specific issues such as dirt pickup, anti-fingerprint performance, and ice resistance in various applications.

Despite the environmental advantages of water-based coatings over solvent-based systems, challenges related to specific additives have emerged. One concern involves alkyl phenol ethoxylate (APEO) surfactants, which are prohibited in Europe. In response, Arkema's EnVia® brand certification program ensures products with the EnVia tradename are free of APEO surfactants, formaldehyde, formaldehyde donors, intentionally added carcinogens, reproductive toxins, or ozone-depleting compounds. This program aims to assist formulators in making informed decisions aligned with regulatory requirements and sustainability goals.

Another issue involves the use of biocides in water-based coatings for preservation.

Regulatory changes, particularly in the EU, have limited the available chemistries for formulators. The elimination of certain biocides, like isothiazolinones, due to toxicity concerns complicates the protection of water-based coatings against microbial activity. Evonik is working on a biocide-free preservation mechanism, while some companies explore alternative solutions, such as formulating binders at high pH or using encapsulated active chemistries. Hexion's VeoCryl technology, applied by Vanora, incorporates water glass and stabilized hydrophobic polymers for alkaline and water resistance, offering a biocide-free emulsion polymer.

Concerns also arise when using dry-film preservatives, particularly regarding the leaching of biocides. Troy addresses this by introducing controlled release (CR) dry-film preservatives, like Polyphase® and Troysan® CR, to enhance resistance to leaching while maintaining effective coatings protection with reduced environmental impact. These developments signify ongoing efforts to address environmental and regulatory challenges in the water-based coatings industry.

Addressing the need for enhanced water-based coating performance is crucial, given that over half of all coatings are water-based, and the segment is expected to continue experiencing above-average growth. However, it's essential to acknowledge various sustainable coating technologies, such as high-solids solvent-based, solvent-free, powder, and UV-curing systems, each with its advantages and challenges. Long-term sustainability also involves accessing eco-friendly feedstocks due to environmental concerns related to petrochemical-based polymers and titanium ore.

Additionally, evaluating the benefits of using water-based systems for industrial applications against the increased carbon footprint for curing these systems is a vital consideration. A significant trend is the global harmonization of product quality and safety standards, driven by consumer preferences for environmentally friendly products that combat air and water pollution, protect resources, and contribute to lowering the carbon footprint. As a result, product development for water-based binders needs a global perspective to align with these international preferences.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!