I caught up with a few industry experts and asked them what trends they see for automotive paint and coatings, and what their company is doing to realize them.

According to Salatin, the automotive industry's requirements driving research and development include the following:

- Higher gloss,

- Increased resistance to UV damage,

- Lower VOC emissions,

- Greater resistance to marring and scratching,

- Color innovation,

- Reduced film thickness,

- Greater film flexibility,

- Improved transfer efficiency,

- Shorter cycle times, and

- More efficient and compact paint operations.

Salatin says, "Among BASF's key goals is developing new product formulations that help customers reduce their overall costs and increase their profitability." He says that one way to reduce the cost of the paint process is to widen application tolerances on coatings. Another is to modify the processes to reduce or eliminate layers while maintaining or improving quality. In addition, enhancing such properties as scratch resistance helps improve the performance and appearance of vehicle finishes. "Finally," Salatin says, "we are committed to environmental compliance, including the reduction of emissions."

Salatin says that BASF is the first company to introduce waterborne automotive coatings in China, with a waterborne basecoat being used in a GM plant in Shanghai. "Previously, only solventborne coatings have been used in the Chinese automotive industry," he says. "The introduction of waterborne basecoat technology in China is a major milestone for BASF Coatings Shanghai, for Shanghai General Motors and for China itself. Waterborne coatings emit significantly fewer volatile organic compounds (VOCs) and require fewer hazardous components than solventborne coatings," he says.

The coatings industry is and will continue to be a vital and high-performing one, according to Salatin, with potential for incremental growth. However, he says, coatings companies have to aggressively pursue innovation and new technologies that will not only sell more coatings, but will also offer efficient and ecologically friendly solutions for their customers. "It is increasingly important for coatings companies to focus even more strongly on the added value of their products. We have to offer innovative technologies and process concepts that help our customers reduce the total costs of the paint process while maintaining and even enhancing quality levels," Salatin says.

Faced with intense global and regional competition, and with greater manufacturing complexities and rising costs, Salatin emphasizes that the car companies are looking to their coatings suppliers to help them reduce costs at all levels of the manufacturing and value chain.

"BASF is able to draw on its global resources and technical expertise to provide state-of-the-art products and service support to its OEM customers," he says. "Among our strategic guidelines is a commitment to helping our customers to be more successful. That commitment manifests itself in several ways. Foremost among them is our drive to help customers attain the ‘lowest total cost' while maintaining and improving the quality of their products. That's an across-the-board endeavor that involves advanced coatings solutions, process innovations and outstanding service levels. It's a unique, integrated and partnership-focused approach that we refer to as ‘zero headaches' for our OEM customers," he says.

Examples of BASF's lower total cost strategy include coatings solutions such as CathoGuard 500 low-VOC electrocoat, SlurryGloss no-solvent clearcoat and ProGloss scratch-resistant clearcoat. Salatin says that other examples involve new combinations of cost-saving products and processes, notably its Integrated Process II. This approach eliminates an entire coating step by combining the functions of a primer and basecoat, and it can be used in existing facilities.

BASF's TotalCARE and ColorCARE are comprehensive color management systems that help OEMs and their Tier 1 parts suppliers achieve outstanding color quality at lower cost.

"Underlying BASF's customer-focused coating and process innovations is another of our corporate commitments, and that is to form the best team in industry - not just in the chemical industry, or even in the coatings industry, but anywhere. Having the best people, working within an efficient and motivated organization, pays off for BASF and helps us deliver lower-cost solutions to our customers," Salatin says.

It provides bell-like performance features including uniform film build and high transfer efficiency but is a powder gun with unique benefits and added system flexibility. With its built-in proprietary engineering, the RPA-1 is designed to produce a bigger spray pattern than any other powder gun. "Plus it delivers twice the coating capacity - coating more square feet per minute than any other gun or bell," according to Lietzke. "The RPA-1 improves productivity due to a simplified design, eliminating rotating parts. It enhances the bottom line by increasing powder line capacity and reducing maintenance costs."

Jon Lawniczak, market manager Americas at Eastman Chemical Co., says a key focus at Eastman is the development of color control and color harmony technologies that help its customers achieve consistent, high quality color performance, while balancing cost reduction pressures, and production efficiency and regulatory issues.

Achieving good color control and color harmony are particularly challenging in metallic paints, according to Lawniczak. "When the metallic flakes in automotive paints do not lay-down on the substrate properly, color inconsistencies and dull finishes can occur. Eastman offers paint formulators technologies that create proper aluminum flake alignment, enhancing color consistency for a brighter, eye-catching finish. Equally important, by ensuring consistent color, Eastman is helping OEMs increase output by achieving first-time quality for tough-to-finish plastic parts such as bumpers and other add-on parts. That translates into significant time-savings for OEMs, where the need to repaint parts can slow plant output," he says.

As metallic colors become more complex and sophisticated, being able to achieve good color match is a challenge for refinishers. Ensuring this consistency across an array of parts and substrates from different suppliers does not help matters, Lawniczak says. "Eastman is helping refinish paint suppliers provide easier, more consistent color match at the basecoat level. Since mixing and matching paints can be a painstaking and wasteful process, the faster refinish shops can do this, the more cars they can refinish in a single day, creating significant cost savings and reduced waste," he says.

As for trends in the development of automotive coatings, Lawniczak reiterates that OEMs and Tier 1s are increasingly looking for enhanced color consistency and color match at faster line speeds across a wide array of interior and exterior parts. "Eastman is helping to address this issue with technologies designed to enhance metallic flake control," he says.

He also mentions that environmental regulations are driving increased use of waterborne refinish base coats and higher solids technologies in waterborne and solventborne systems. "In Europe, where EU Paint Products Directive for 2007 will further restrict the amount of solvents that can be emitted by refinishers, they are increasingly turning to waterborne coatings," he says. The challenge for waterborne paint makers, according to Lawniczak, is that these systems dry more slowly than do solventborne systems, reducing output for the shops, and tend to have inconsistent color. In addition, because waterborne systems dry more slowly, they require drying equipment with more direct airflow. Lawniczak says that Eastman's technologies are focused on helping its customers, the paint makers, make enhancements to their waterborne technologies that speed drying time and eliminate the need for high-tech drying systems. "We expect to be announcing new products to the marketplace in this area in early 2006," he says.

On the refinish side, Lawniczak says that Eastman's rheology technologies are helping refinishers achieve better control in high-solids solventborne refinish clear coats, reducing sag and eliminating flow and leveling problems. "Eastman is also helping the refinish paint maker achieve higher productivity while moving to lower VOC refinish paint systems," he says.

When asked what technologies are in demand, Lawniczak says, "At Eastman, we're seeing strong demand for our adhesion promoter technologies. As the automotive industry moves toward plastic parts, ensuring coatings adhere to multiple, difficult-to-adhere substrates is a huge challenge for paint makers. Eastman's proprietary adhesion promoter technologies are helping paint makers and OEMs get the performance they need from their paints, whatever the substrate."

In regard to application technologies, Lawniczak says that OEMs and Tier 1 suppliers are developing new paint application and drying technologies to maximize efficiency and productivity. "This presents paint formulators with an opportunity to help OEMs increase efficiency and ultimately, help the OEMs achieve manufacturing goals. However, they create challenges for paint makers. With all the new spray technologies on the market, OEMs are finding it difficult to get good color consistency across a wide array of spray technologies and types of paint. Suppliers like Eastman are offering formulators the opportunity to bring back color consistency through the use of formulation additives," he says.

Mark Kingsley, general manager, global marketing, GE Advanced Materials, Automotive, says that he also sees a trend in the growth of plastics. His reasons include:

- Mass out efforts and a lower center of gravity for the vehicle.

- Broad adoption of pedestrian impact friendly design driving a fit for thermoplastic fascias, fenders and hoods.

- More niche vehicles with sub 100M build that fit the sweet spot of injection molding economics.

- More aggressive exterior styling and curves to differentiate OEM product lines.

- High heat conductive thermoplastics as a substrate for powder coated interior parts.

- Highly weatherable, harder and impact resistance powder coats.

- Exterior plastic panels: conductive, CTEs of metal and paintable.

When asked about any new application technologies that require a particular paint or coating formulation, Kingsley says there is a focus on glazing. Specifically, GE Advanced Materials, Automotive, working in collaboration with Exatec, offers design options for large three-dimensional (3-D) glazing panels for rear and roof window applications and other 3-D parts by combining high-performance Lexan GLX resin with coating technologies from Exatec.

According to Kingsley, the GE-Exatec collaboration aims, in part, to help address and lead the auto industry's move toward larger, automotive backlite and roof glazing panels, as well as deluxe panoramic roofs.

The Exatec 900 coating system includes an optimized wet coat tailored to the specific requirements of the automotive glazing environment. Kingsley says this advanced wet coat improves the adhesion to the final (PECVD) protective layers (plasma coating), and offers a wider processing window than competitive materials for higher yields at potentially lower cost. Exatec glazing systems feature coatings that meet the 10-year weathering and abrasion resistance required by OEMs globally. The solvent-free, water-based primer in the Exatec 900 coating system is less prone to molded-in stresses, minimizing the risk of micro cracks and delamination.

PPG Industries' Lisa Merlo says that PPG has developed Powercron 8000SL, a high edge coverage cationic epoxy electrocoat product optimized for anti-friction properties. It was designed as a single-coat finish for applications that require a low coefficient of friction. This electrocoat has a coefficient of friction in the range of 0.10-0.15. This compares with a coefficient of friction of 0.30-0.35 for typical cationic epoxy electrocoat technology.

According to Merlo, the new e-coating demonstrates excellent corrosion resistance and low volatile emissions compared to other finishing processes. "It provides superior corrosion resistance without using lead or chrome in the formulation. The e-coat was engineered to provide excellent edge coverage, particularly on sharp edges, by the development of a unique polymer that controls the flow characteristics of the coating," she says. Additionally, its total VOC content is less than 0.3 pounds per gallon and is formulated with HAPs-free solvents.

Merlo says that possible applications include seat tracks, hood latches, trigger mechanisms, window rails or other applications requiring lubricity properties.

Overall, environmental regulations, color consistency and a high quality end result at a lower production cost continue to drive the market.

Sidebar: Just for Fun-What your car cooler says about you

Your car may be talking about you behind your back. Based on the DuPont Automotive rankings of most popular automotive colors in North America, here's what Color Answer Book author Leatrice Eiseman says vehicles are revealing about their owners' personalities:Silver: Elegant, loves futuristic looks, cool

White: Fastidious

Vibrant Red: Sexy, speedy, high-energy and dynamic

Deep Blue-Red: Some of the same qualities as red, but far less obvious about it

Light to Mid-Blue: Cool, calm, faithful, quiet

Dark Blue: Credible, confident, dependable

Taupe/Light Brown: Timeless, basic and simple tastes

Black: Empowered, not easily manipulated, loves elegance, appreciates classics

Neutral Gray: Sober, corporate, practical, pragmatic

Dark Green: Traditional, trustworthy, well-balanced

Bright Yellow-Green: Trendy, whimsical, lively

Yellow Gold: Intelligent, warm, loves comfort and will pay for it

Sunshine Yellow: Sunny disposition, joyful and young at heart

Deep Brown: Down-to-earth, no-nonsense

Orange: Fun loving, talkative, fickle and trendy

Deep Purple: Creative, individualistic, original

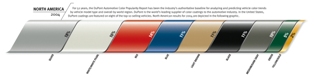

For 52 years, the DuPont Automotive Color Popularity Report has been the industry's authoritative baseline for analyzing and predicting vehicle color trends by vehicle model type and overall by world region. DuPont is the world's leading supplier of color coatings to the automotive industry. In the United States, DuPont coatings are features on eight of the top 10 selling vehicles. North American results for 2004 are depicted in the graphic above.

For 52 years, the DuPont Automotive Color Popularity Report has been the industry's authoritative baseline for analyzing and predicting vehicle color trends by vehicle model type and overall by world region. DuPont is the world's leading supplier of color coatings to the automotive industry. In the United States, DuPont coatings are features on eight of the top 10 selling vehicles. North American results for 2004 are depicted in the graphic above.Sidebar: Automotive Color Trends

In its 52nd year, the DuPont Automotive report, which was released in December last year, is a baseline for analyzing and predicting vehicle color trends by vehicle model type and overall by world region. DuPont says that in the United States, its coatings are featured on eight of the top 10 selling vehicles.Karen Surcina, color programs manager for DuPont Automotive Systems, the automotive OEM unit of DuPont Performance Coatings, works with a DuPont designer in Europe to help automakers stay ahead of the color curve.

"We see the desire for color mirrored in the worlds of fashion and home furnishings," says Surcina. "Yet, our research in small focus groups indicates what people prefer isn't always what they buy when it comes to cars and trucks. Some buyers may rein in their expressive side and choose mainstream colors based on their perceived impact upon vehicle resale," she says. "In others, we see more of a ‘notice me' effect in the choice of brighter colors- people are becoming more optimistic, they're proud of their new car and want to be seen," Surcina says.

Not surprisingly, yellow appeals to the high-visibility contingent. "Yellow has moved into the Top 10 in North America for the first time since 1992," Surcina says. "Yellow really works for the smaller SUV classes as well as for compact cars and certain sports cars."

Don't pin the "color conservative" tag exclusively on big-ticket buyers, however. In the North American luxury car segment, which has lost a bit of market share to SUVs since 2003, light brown metallic grew dramatically in popularity over the past year - from 4 percent in 2003 to 11 percent, while both red and blue doubled in popularity. Silver and gray have begun to decline as the leading colors, but various shades of white, including dramatic, pearlescent tri-coat finishes, remain strong.

This is doubly significant because the luxury segment often presages trends across all vehicle segments. Red has already started to grow in popularity in the intermediate/full-size market segment.

Fleet buyers particularly tend to look at the business case, and data from automotive analysts at the Power Information Network (formerly a J. D. Power company) indicate the right color choices can improve a car's resale value.

Trucks have long been dominated by plain white coatings, in part because of the impact of commercial fleet and construction buyers. But here, too, color is making remarkable inroads, particularly in the brown and blue families.

In the light truck, van and SUV category, light brown metallic gained four percentage points of market share, to 9 percent, while blue climbed three points to hold 12 percent of the market. White lost a couple of points, but still leads at 20 percent, with silver also slipping slightly in second, at 16 percent.

The big jump in the American luxury market is light metallic brown. Silver and gray have lost some of their ground as the leaders to reds and blues that have doubled in popularity from a year ago, each now at the 9 percent level.

In the North American truck, SUV and mini-van segment, which is stealing overall share from the luxury car market as people move into "loaded" trucks and upscale sport utilities from Lincoln, Cadillac, Lexus, Mercedes and Porsche; elegant blues, nature-oriented light browns and clean reds are winning at the expense of silver and gray.

After its dramatic rise last year, silver has slipped slightly in the U.S. compact/ sport market. Yellow has almost doubled in popularity but 4 percent remains a niche color best suited to specific vehicles.

The "play it safe" strategy of selecting a vehicle color based on reliably popular colors such as silver and white may not always be the safe approach at all when it comes to resale value, according to recent analysis by Power Information Network. Used vehicle prices follow the laws of supply and demand. Even the most popular color will depress resale price if it is oversupplied.

Report Abusive Comment