A Review of Global Supply and Demand for Titanium Dioxide

Source: CEIC database owned by ISI Emerging Markets

Source: CEIC database owned by ISI Emerging Markets

Titanium dioxide is never more than two or three feet away from you at any given time. The ubiquity of its application means that global demand trends run closely with gross world economic product. This should mean that producers can rely on a fairly predictable set of metrics by which to forecast their market. However, the last 10 years have been anything but predictable. We have witnessed the departure of synchronicity between feedstock mining and pigment production, exacerbated by the global financial crisis and the explosion of Chinese capacity, which saw that country turn from a key net importer to an exporting behemoth in a few short years.

Shortages in 2010 and 2011 led to a price spike and super profits before both collapsed under a mountain of inventories in 2012. Buyers today have more choices and enjoy more influence than they have in recent years. But there is a myriad of options on the market. While the world’s high-end producers are finding their once rarefied atmosphere a little thinner these days, buyers are also being duped into paying for worthless pigment.

Definitions

First, a definitional note - TiO2 is a crystalline powder whose high refractive index has made it the white pigment and opacifier of choice for coatings formulators. Along with carbon back it is a non-colour pigment that is used in all chromatic paint. Titanium dioxide accounts for at least half of all pigment sales in the world according to BASF. Other compounds, organic and inorganic, are used with TiO2 to impart different tints.

Titanium dioxide has been commercially produced since 1916, although widespread production did not occur until the 1960s. TiO2 pigment is produced either via sulfuric acid digestion and calcination, known as the sulfate process, or by chlorination of a high-purity feedstock to produce titanium tetrachloride, which is then oxidized at high temperature. This is known as the chloride process.

Current processing technology is a function of the feedstocks that are available. Sulfate processing lends itself to ilmenite, a mineral consisting of a roughly equal mixture of iron and titanium, while chloride processing, which demands a higher purity of feedstock, draws on natural rutile and beneficiated products like slag, which are created from ilmenite.

Supply Side View

Titanium dioxide feedstock markets, having faced tough conditions in 2012 and 2013, are gradually recovering: global import volumes in the first quarter of 2014 increased by 4% from the previous quarter and 10% from the first quarter of 2013. Approximately half of this volume was for sulfate feedstocks, comprised largely of ilmenite. China’s imports of approximately half a million tonnes, while making up a large part of global demand, have declined in recent years. The reason for this is the prodigious rate at which Chinese miners are producing ilmenite. Much of the mineral is sourced from Sichuan province where it is found together with magnetite. The high iron ore prices that prevailed when the magnitude of China’s construction boom took everyone by surprise have allowed some of the larger Chinese miners to produce very low-cost ilmenite. Current factory gate prices of around US $100 are a symptom of the massive stockpiles that have accrued.

Low feedstock prices and unabated TiO2 capacity expansion in China have kept pigment prices supressed long past the market’s volume recovery in 2013, bottoming only in April 2014. This has had a profound impact on the rest of the world. Chinese pigment exports have spread rapidly across the world, displacing conventional supply in established markets and winning the lion’s share in new markets.

The speed at which Chinese pigment was brought to the world’s markets is matched by the speed by which it has become accepted by formulators. Both phenomena have taken China’s international competitors by surprise. In part, the pigment shortages of three to four years ago caused this acceleration. Formulators that were marginalized when supplies ran dry turned to Chinese suppliers and have helped them develop higher-quality pigment. Even the global formulators like AkzoNobel and Nippon who had more stable supplies have increased their offtake share of Chinese pigment as a part of a diversification strategy.

Much of China’s TiO2 is variable in terms of quality. But the large export-oriented producers like Lomon, Pangang and Billions have worked on product development and now produce widely respected general-purpose grades. It is not clear how much of this has crossed over into powder coatings, which have more exacting surface treatment and particle size distribution requirements; anecdotally, customers are blending the two. The bottom line is that Chinese pigment is good value in a market where margins are tight.

Globally, operating rates remain lower than the level at which suppliers can dictate prices. This is true for almost everyone today and ranges from sub 50% levels of the moribund low-end Chinese producers to the tightly managed multinational concerns. Looking ahead, some rationalisation is expected in Europe and China, as well as some consolidation in both pigment and feedstock parts of the value chain. The past 12 months can be summed up as: things aren’t great, but they aren’t getting any worse. Market participants are predicting a long bottom and slow recovery into 2016.

Demand Side View

The TiO2 market is still swinging back from a demand wobble in 2012. This was caused by pricing volatilities that triggered thrifting, substitution and a build-up of stocks across each of the major centres in Europe, East Asia and North America. Global growth, estimated at 3.6% for the year by the IMF, has accelerated from 3% in 2013 and is expected to remain at a stable trajectory, barring any major disruptive events.

North America’s recovery continues, with major powder coatings producers such as PPG, Sherwin Williams and AkzoNobel all reporting improved sales. The United States remains the world’s most dynamic economy, and this is being exemplified in its pioneering of shale gas, which allows lower energy costs (a critical need for powder coatings applicators), the restructuring of the automobile industry and the most widespread distribution of civilian high-tech industries in the world. By the time this is published, the Federal Reserve will be ending its quantitative easing program with the expectation that strengthening demand will be able to carry GDP.

Europe remains a bigger question. 2014 marked the centenary of the First World War, a time when major powers that had enjoyed over a century of industrial pre-eminence turned against each other. That their economic and quasi political union remains intact perhaps speaks less of the strength of their relationship than the barbs of their embrace. No EU member has exited (yet) because an acceptable mix of austerity and investment was agreed upon in the face of the abyss. Over 2013, a resurgent equities market took the pressure off Eurozone debt. But 2014 saw a reversal of these gains, and the demand outlook has weakened over the year.

In Asia, China continues its shift from an export- and investment-centric economy where household wealth is disproportionally a function of property prices, to a greater consumption-based makeup. Alternative wealth management schemes have proven successful, and a slow correction in prices is returning the country back to normality.

In the short term however, there will be a tough market for powder coatings. TZMI tracks white goods production in China. Figure 1 shows a composite of refrigerators, air conditioners, microwaves, washing machines and water heaters. June 2014 production stood at around 39.7 million units with around 19% decline compared to May and a 27% decrease compared to the same period in 2013.

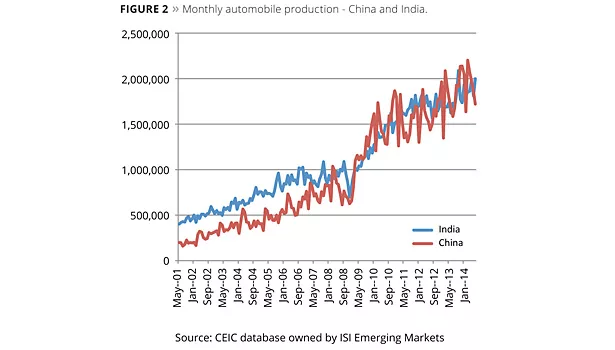

Meanwhile, automobile production continues to grow in China, where car ownership is highly desirable. By comparison, India produces a comparable number of vehicles – both countries manufactured an average of 1.9 million vehicles per month in the first six months of 2014 (Figure 2). The major difference is that while in China around three-quarters of such vehicles are passenger cars (translating into a greater intensity of powder coatings and TiO2), in India the proportion is just 13%. India’s coatings market is also about a quarter of the size of China’s and, while it will undoubtedly see an increase in per capita consumption, the country lacks the control that China has over its economic planning and growth will be slower, if not more equitable.

Conclusion

In summary, we see a stabilizing of TiO2 supply, which will most likely lead to very modest price growth. Plentiful feedstocks and an expansion of supply from China will be prominent features of the market, going forward. TiO2 remains a buyer’s market for the time being. However, before rushing to negotiate a long-term offtake contract, readers may wish to consider the market’s downstream vulnerabilities. The United States’ resurgence is a positive piece of news, but the topping out of China’s growth and continued Eurozone crisis are contributing to growing uncertainties for the industry.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!