The TiO2 industry, like the rest of the world, finds itself coping with the coronavirus epidemic in China. Any unfortunate economic news impacting China is not good for the global economy. Yet, disrupted Chinese production is welcomed by other global producers.

Transportation and logistics are a nightmare. Getting any supply chain to function properly is very difficult. TiO2 feedstock producers are mostly located in Sichuan, while TiO2 and coatings production is focused on the east coast. Products and workers are limited in travel.

Chinese production comes into question. Estimates are that industrial production in China is currently in the 50-60% range. In 2019, China was a net exporter of TiO2 of 775ktonnes. Chinese producers account for approximately 2.4Mtonnes of the estimated 6Mtonnes sold in 2019. The net impact appears favorable for producers outside China.

TiPMC estimates that 2020 feedstock imports into China will be reduced by nearly 700ktonnes vs. 2018, an approximate 30% reduction, as production from mines is declining. Assuming Chinese plants can operate, procuring local feedstock will be extremely difficult, and anything that is available will be priced at a premium.

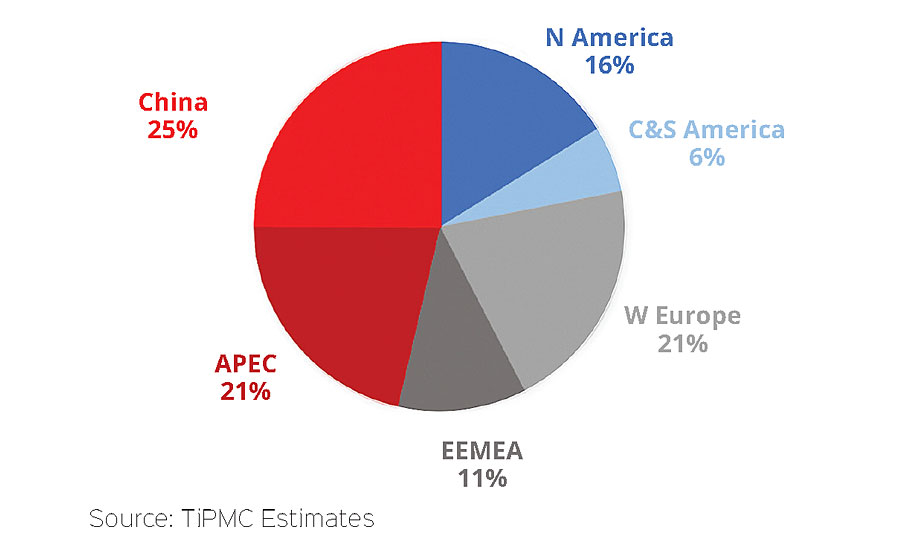

Global demand is still driven from Asia (Figure 1). The impact of the coronavirus is really going to test the dependency on Asian and European economies on China. Slower economies mean slower TiO2 demand. The U.S. is much more insulated, as housing in the U.S. is strong. Germany, for example, will feel a stronger economic impact from decreased Chinese economic activity as they rely on exports of high-end equipment and auto sales to the Chinese market to help drive their economy.

Regarding the Chinese housing market, according to Bloomberg, Chinese real estate is on course to experience a bigger drop than during the 2003 SARS pandemic. Shenzhen has reportedly banned all forms of home sales over the rise of infections in the sub-provincial city.

As housing is critical to stimulate overall economic activity in China, most observers believe the central government will move to stimulate housing as the crisis subsides, in order to stimulate economic activity in order to restart economic growth.

What Does This Mean?

TiPMC sees potential for a variable impact relative to time – positive, some negative mixed in, but a net positive over time.

TiPMC also projects TiO2 growth in APEC to be in the 5-6% annual growth rate over the next five years. Given its large current share, volume increases are significant over this period of time.

What’s Next?

TiPMC believes this scenario sets up the TiO2 industry for a roller coaster impact throughout the next several months. The implications of a weaker Chinese economy will be involved in a balancing act with reduced Chinese production and increasing Chinese production costs.

TiPMC believes the United States and to some degree Latin America will be more insulated, but as this accounts for about 25% of TiO2 demand, the impact of the virus will still impact global demand.

The counter to the economic downturn is the likely action by the Chinese government as the impact of the coronavirus subsides. Demand for key raw materials for housing and infrastructure, such as TiO2, should experience rapid demand growth. The traditional Chinese “golden season” of September and October may prove to be especially strong this year.

Most observers believe the short-term impact of the coronavirus will not extend beyond early summer. The Chinese TiO2 industry may lose some weaker participants as some balance sheets may not be able to recover.

How will the Chinese industry impact the rest of the world post-coronavirus? TiPMC looks at the impact of China on the TiO2 market.

How Will China Impact the TiO2 Industry in the New Decade?

Over the last 20 years, China has greatly impacted to TiO2 industry. Consumption within the country has grown from 50ktpa to approximately 1600ktpa, while TiO2 suppliers grow to nearly 2.4Mt of production, from a near-zero base. It is unlikely this type of growth will continue, but what is the role of China in the new reality of the TiO2 world?

TiPMC offers these thoughts:

• Chloride technology development is a focus in China. 2019 saw a step change in chloride production, with growth of nearly 35%, reported as slightly greater than 200ktpa.

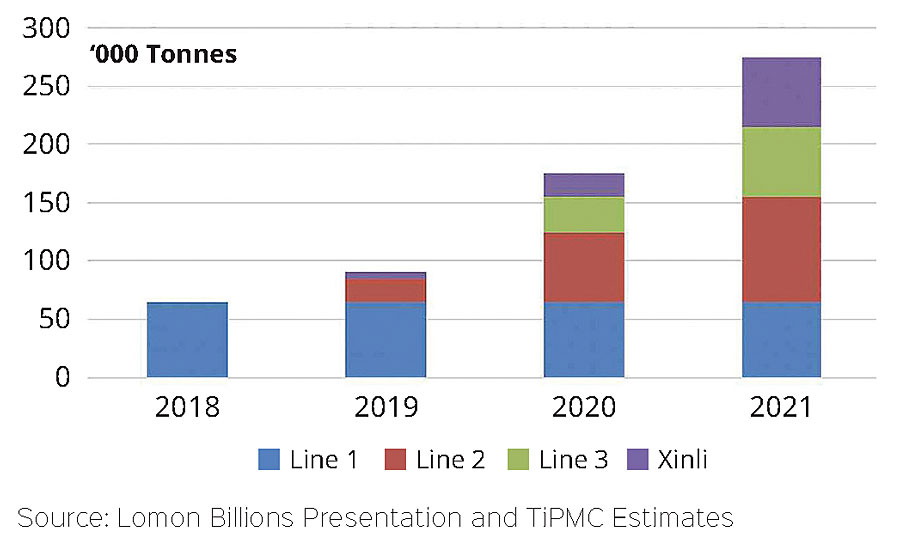

• Lomon Billions is progressing faster in chloride production than Chinese competitors. Their first line began production in 2016, reaching about 60% of the nameplate 100ktpa. Another 100ktpa line began operation in 2019, with a third scheduled for this year. The Xinli plant, a 60ktpa facility that was never operated successfully, was recently purchased by Lomon Billions, along with upstream chloride slag and titanium metal facilities (Figure 2).

• Sulfate expansion has slowed, but not stopped. The largest portion of growth has come from increased “available capacity” of sulfate operations in China, measured as actual capacity vs. nameplate that is not achievable.

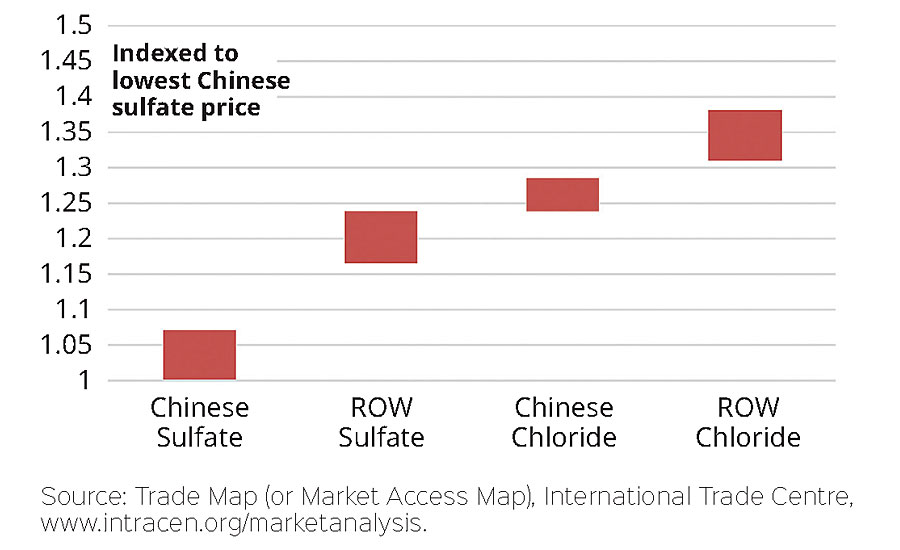

How is this affecting the global marketplace for TiO2? Recent price increase announcements outside of China were largely differentiated between sulfate and chloride product. In the export market, Chinese chloride is reportedly being positioned at higher pricing levels than non-Chinese chloride and below multi-national producer chloride levels. Customers are trialing material, and pricing will be based on performance vs. available alternatives (Figure 3).

India serves as an interesting example. Over the past 10 years, India has shown the largest growth in TiO2 imports vs. anywhere else in the world. Yet, the Chinese share of imports peaked in 2015.

How are multi-national producers (MNPs) responding? This is yet to be seen, but there are some early indications. As part of the Tronox acquisition of Cristal, Tronox is now the second largest, vertically integrated global producer. As part of the acquisition, they now operate a sulfate TiO2 plant in China, in Fuzhou, with reported capacity of 45ktpa. Tronox has stated its intention to expand from this base in China. The impact on local producers, particularly those less competitive, will be closely watched. Recent rapid increases in sulfate feedstock costs for these producers have stressed earnings, with no relief in sight.

As Chinese chloride grows, sulfate producers outside China, particularly those in Europe, are likely to come under intense pressure. Reports of potential assets being closed are prevalent, while the competitiveness of several assets come into question. TiPMC estimates that nearly 210ktpa was closed in the last decade outside of China. This trend is likely to continue through the 2020s.

The timing of Chinese chloride growth seems to be more in question than if it will occur. The rate of growth will likely mirror the experiences of the MNPs, over 30 years ago. Lomon Billions is without question the most progressed chloride producer, with the progress of others still in question. What is certain is that Chinese chloride growth will be a major focus of the industry, its suppliers, and customers, in the coming decade.

Report Abusive Comment