More than Trucks and Warehouses

Distributors’ Value-Added Services are a Critical Part of the CASE Supply Chain

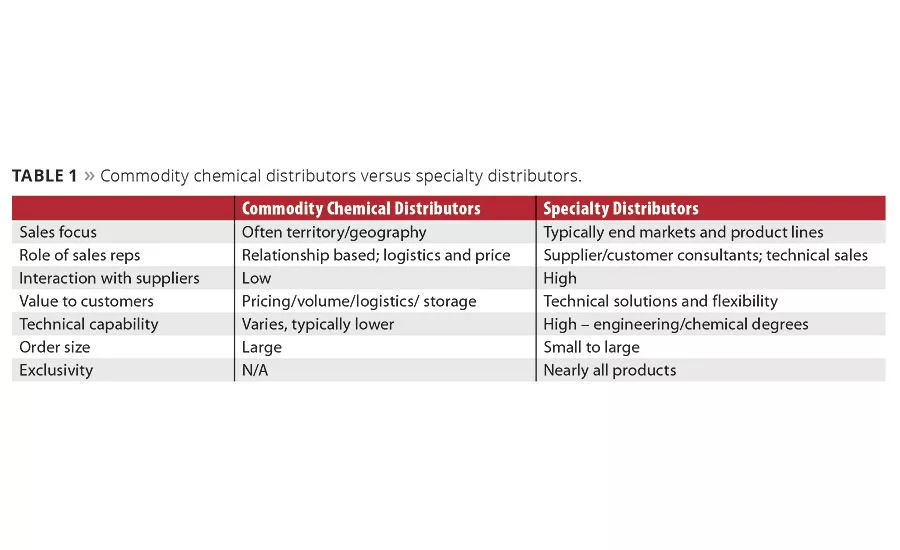

Table 1

Historically, distributors that supply raw materials to coatings, adhesives, sealants and elastomers (CASE) formulators, including manufacturers of paints and coatings, could be distinguished by the average volumes of their shipments. “Large” distributors were accustomed to serving large customers that required tank cars or truck loads of raw materials, and they competed on pricing, logistical efficiency (cost and delivery) and warehousing. “Small” distributors offered the same products and services as the large distributors, but on a smaller scale, either regionally or by market focus. In the past, a small distributor’s primary asset was its customer relationships, which often were held by the owner. Because relationships can be difficult to transfer to a new owner in the sale of a business, valuations for small distributors were generally low. That dynamic has changed dramatically, as we will discuss in this article.

As the paint and coatings industry consolidated, many of the large end markets became extremely concentrated, with perhaps four or five national or multinational companies holding the majority of the market share. In architectural coatings for example, fewer than 10 players have come to control about 90% of the North American market, and in many other markets the level of concentration is at least 75%. The minority shares of the coatings markets were divided between many – sometimes hundreds – of niche players or regional firms. They competed by focusing on specific applications and/or markets, but they had a disadvantage relative to the majors in purchasing, because they didn’t have the clout that comes from purchasing huge volumes.

As the industry has evolved, so have the business models for distributors. Some raw material producers found that selling certain high-commodity products directly to the large coatings manufacturers was more efficient and profitable than going through distributors. Of course, it has always made sense to market and distribute some commodity raw materials in bulk – for example, latex resins or titanium dioxide – but even for more specialized materials, manufacturers developed key account go-to-market approaches, selling direct to some major accounts, but pushing sales for small- and medium-size customers to distributors. Some large distributors adapted by transitioning to become either logistics-only firms that could deliver large quantities of commodity raw materials without taking ownership, or trading firms that did take ownership but that had limited product lines and offered little in the way of services. Others adapted by becoming small distributors themselves, serving mainly small- and medium-sized customers (Table 1).

Today, the key to capturing margin and creating a defensible business model comes from winning and retaining symbiotic supplier relationships. The most successful small and mid-sized distributors are effectively the de facto outsourced technical service/sales engineering organizations for the raw material manufacturers.

This market structure actually worked to the advantage of smaller distributors, which were able to reach and serve the small customers. Not only did they get premium pricing on small orders, but being closer to their customers, they increasingly began to offer something the large distributor could not: comprehensive product offerings and value-added services. Smaller distributors have evolved into today’s specialty distributors – offering all the services traditionally associated with distribution, but also extras like blending, quality control, application development and even regulatory compliance. As you might expect, customers were willing to pay up for these extra services, and the small distributor began to have something else the large distributor did not have: high margins.

Characteristics of Specialty Distribution

A trend toward outsourcing, on the part of both upstream manufacturers (makers of basic and intermediate raw materials) and downstream customers (formulators of coatings and other chemicals), has supported the development of service offerings by distributors. Large raw materials suppliers are good at making “stuff,” but may lack the infrastructure and processes to support small- and medium-sized customers downstream. Those customers may be competent at blending and marketing their end-market products, but sourcing and purchasing intermediate raw materials and managing other upstream complexities may be beyond their expertise. For each, outsourcing certain functions to distribution allows them to focus on their core competitive advantages and maximize their operational efficiencies.

Today, the scope of value-added services provided by distributors to coatings formulators and other CASE manufacturers is extremely broad. Some of the “traditional” and newer “value-added” functions provided by distributors may include any of the following:

Traditional Distribution:

- Product Diversity: Distributors can provide complete access to all the products a manufacturing customer needs, and can be especially useful in sourcing infrequently used or rare raw materials. They also provide scale for suppliers that may be too small to support a broad, internal distribution network.

- Repackaging: Distributors can buy in bulk and repackage in smaller quantities that customers require.

- Warehousing: Distributors will stock products for both suppliers and customers to save on their holding costs.

Value-Added Services:

- Quality Control: Distributors will provide quality testing for incoming materials from suppliers, ensuring that customers consistently receive in-spec materials.

- Blending: Coatings formulators blend their own end products, but they may prefer that certain additives and special resin blends be handled by their suppliers.

- Inventory Management: More than just holding inventory, distributors may provide inventory management services that include networked restocking and flexible delivery options.

- Regulatory Compliance: Increasing government regulation is a burden for both smaller raw material producers and formulator customers. Distributors can provide regulatory support services, including product registrations, labelling, preparation of MSDSs and technical data sheets, and help with import/export controls.

- Risk Management: Although distributors typically are successful in passing through increases in the costs of raw materials, holding inventory and purchasing opportunistically allows them to smooth out the cost curve for customers and, to an extent, protect them from the volatility in raw material prices that has been so common in recent years.

Today, the line between the large and small is increasingly blurred. There are small distributors that specialize in certain industry niches, such as those providing smaller volumes of additives, catalysts, pigments and other raw materials to coatings manufacturers. Other larger organizations provide broader product lines across many chemical industries. But increasingly, you will find both types within the same firm under the umbrella of a large national or multinational distributor. Partly because of higher margins generated by the smaller, more service-oriented distributors, large distributors have been actively acquiring the smaller companies. These distributors themselves are conglomerations of many smaller companies that have been acquired over the years. And typically, they keep and expand the service footprint of the businesses they acquire, often by establishing specialized industry “verticals” within the larger organization. This appears to be where the distribution business model is headed, in that it combines the best of both worlds: the network density, economies of scale and geographic reach of the large firm, and the localized, high-touch services of the smaller firm.

It stands to reason that mergers and acquisitions are the primary methods to build this new model. Chemical distribution is still a fragmented industry with the largest companies – including Brenntag, Univar, IMCD, Azelis, Nexeo Solutions, and a few others – having a combined market share of less than 40% in mature markets, and much less than that in emerging economies. With the exception of Azelis, all of the companies just mentioned have gone public since 2010, and have used part of their IPO proceeds to fund active acquisition programs. IPOs are becoming a logical and common option for large distributors to raise cash for debt reduction and to provide liquidity to fund acquisitions.

Attracted by the reasonably steady cash flows and breadth of end markets served by distributors, private equity groups have also gotten in on the act, and are executing “roll-up” strategies in chemical distribution. Azelis, one of the remaining major independents, was sold to Apax Partners in March 2015. Azelis itself, having recently acquired Koda Distribution, may be setting up for an IPO within a few years. Another example of roll-up strategy, especially relevant to the CASE markets, is CI Capital Partners and Maroon Group, a specialty distributor of additives, pigments and resins acquired by CI in 2014. In less than two years, CI and Maroon Group have built a strong portfolio of national distributors for the CASE markets with the acquisitions of Addipel (2014), D.B. Becker Co., Inc. (2015), CNX Distribution (2016) and U.S. Chemical (2016).

Conclusion

It is clear that distributors have come a long way from their origins as providers of simple repackaging, delivery and temporary storage services. Modern distribution is not just about trucks, tank cars and warehouses, but technical support, regulatory assistance and other services that allow both suppliers and customers to focus on what they are really good at. Success for distributors is about reconciling two seemingly opposing goals: creating a customized approach to the market while simultaneously achieving the advantages of economies of scale.

By John Beagle, Managing Director and Co-Founder, and Andy Hinz, Managing Director, Grace Matthews, Milwaukee, WI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!