Emerging Opportunities in Smart Coatings

Over the years, smart coatings have been tacitly defined as the most functional of functional coatings. Of course, functionality of coatings and other materials has changed. A coating that might have been thought of as smart in the past may not be considered as such now. Over time, one generation of smart coatings becomes merely functional, and a new generation of coatings takes over in the smart coatings category.

n-tech Research believes that this is what is happening right now. Smart coatings are about to take a great leap forward in “intelligence” that will lead to new smart coating products and product classes. In turn, this represents new opportunities for materials firms (including substrate firms), coatings machine makers and even OEMs. Table 1 shows how we think smart coatings will evolve over time with regard to intelligence. Many relevant R&D programs now appear to be reaching a point where they are just a year or two away from leading to viable commercial products with a level of intelligence that has not been seen before.

The Next Big Thing?

All of this suggests that smart coatings (and smart materials more generally) will be a substantial business opportunity going forward, and we expect to see large firms make substantial investments in this area; some have already. These firms will include not just coatings companies, but also the large glass firms, and other companies higher up the supply chain.

Smart coatings is already a vibrant enough topic to have spawned dozens of R&D projects all over the world, not to mention several conferences. In the near future we think that smart coatings will create protectable intellectual property (IP), avoid commoditization of coatings products and lead to a stream of new products over a sustained period of time.

These trends will have important consequences. The trend towards a better IP environment will attract new attention for the smart coatings business from venture and angel capitalists. This is important in a sector of the coatings business that has often seemed characterized by small, struggling companies with mediocre supply chains.

The other two factors listed above suggest that players in the smart coatings space can expect healthy margins that should be sustainable over a lengthy period, and reasons why large specialty chemicals firms should be taking a serious look at the smart coatings space right now. Figure 1 shows the forecast for the smart coatings market from 2015-2022.

This article takes a look at some of the major markets for smart coatings, and offers our opinions on the potential opportunities available in these sectors.

Self-Healing, Assembling and Cleaning

Although coatings in each of these three categories have been available for some time, we think they are about to reach lifetimes and performance levels that they have not attained before. The latest generation of self-healing, self-assembling and self-cleaning coatings will all address large markets and have an attractive technology pipeline with a low chance of commoditization.

Self-Healing Coatings

The big technological leap forward that n-tech expects in the area of self-healing coatings is an improvement in terms of the type and size of damage that they can self-heal. While we are not buying the hype on smart coatings someday being able to repair major damage to an aircraft fuselage, there is plenty of room for improvement in today’s self-healing coatings, which are often little more than anti-scratch coatings. However, competition in this space will not be just on what size of hole or scratch a coating can repair, but also on (1) how long the repair takes (some self-healing coatings today can take many hours), and (2) the longevity of the coatings.

Self-Assembling Coatings

Self-assembling coatings can already demonstrate some impressive advantages, and n-tech Research believes these will only increase as new generations of self-assembling coatings come onto the market. In particular, we think that advanced self-assembling coatings can provide reduction in the cost and ease of manufacturing processes. For example, self-stratifying coatings can already provide a way to eliminate the need for multiple coats. But it seems likely that as self-assembling coatings (and self-assembling materials more generally) evolve, they will become an important part of advanced manufacturing techniques.

Self-Cleaning Coatings

Self-cleaning ovens are ubiquitous, but other self-cleaning coatings and self-cleaning surface opportunities have yet to be exploited because of the absence of suitable coatings, especially coatings with adequate lifetimes. For example, self-cleaning windows have been available on the market since 2001, but they tend not to last long, which is the reason they have never made it out of the single-family residential sector.

An incentive for developing such coatings is obviously that they provide low maintenance, reduced cleaning time and reduced cost. To best exploit these opportunities, new hydrophilic, hydrophobic, oleophobic, amphiphobic and multifunctional coatings are being developed. Some of the technological trends that n-tech sees as having reasonable potential in the area of self-cleaning coatings are: (1) nano-technological approaches to textured hydrophobic surfaces; and (2) super-hydrophobic coatings.

Hydrophilic surfaces are not as widely used as hydrophobic surfaces for self-cleaning coatings. These coatings typically use a photo-catalysis process with TiO2 as the main material. But there remain many challenges that need to be overcome by nanocrystalline TiO2, especially its robustness and optical transparency in glazing industries. A number of other approaches are under investigation, such as doping. There have also been various attempts to add materials to TiO2. And hydrophilic coatings are effective but have their limitations; inorganic dirt is not removed.

Although not exactly self-cleaning, coatings that provide antifouling and antimicrobial functionality are closely related. In the antifouling sector, we are seeing opportunities for moving away from the traditional copper-based and metallic materials more generally. Biocide-free antifouling coating solutions are also being investigated, as are layered polymer antifouling coatings. Smart antimicrobials have tended to mean just that there is a time-release mechanism built in. However, we are seeing a shift towards the use of self-assembly and hydrophilic technology for smart antimicrobial coatings.

Glass and Color-Shifting

Self-dimming glass is often celebrated as one of the successes of smart coatings. Electrochromic (EC) automotive mirrors are already a billion dollar business. Self-dimming windows are a solid, albeit niche business. And while there are several ways to make smart windows aside from electrochromic coatings, we do not consider them significant alternatives to EC at the present time.

Somewhat related to self-dimming coatings are color-shifting coatings; both change the shade of the substrate onto which they are coated and they use related technologies, but have different applications. Color-shifting coatings, which are often used on cars and buildings, have lately found application in packaging to help consumers avoid counterfeit drugs and other fake merchandise.

Many of these color-shifting paints are high cost and the final effect can be somewhat uncertain. So there is room for improvement here. However, unlike the other smart coatings opportunities we have reviewed, the addressable market for color-shifting coatings seems somewhat constrained.

Electronics

n-tech Research is a strong believer in the commercial potential for smart electronics coatings, which ties into the emergence of the Internet of Things (IoT) and continued growth in mobile and wearable electronics.

Smart Coatings and the IoT

The idea behind the IoT is that -using embedded sensors and processors -buildings, appliances, machines and objects will become more responsive to human needs in both personal and professional environments, and provide increased functionality and enhanced data collection capabilities.

While smart materials are not being prominently mentioned in current IoT literature, n-tech sees a perfect fit. Ideas include: coatings that clean and repair themselves either automatically or in response to external cues; sensors embedded into coatings and surfaces that collect data and react as needed; and a smart coating that functions as a sensor that serves as a more cost-effective way to create a wide-area sensing panel than a large array of sensing devices. The possibilities in this regard are significant.

Self-Cleaning Coatings for Smartphones and Tablets

n-tech Research believes that protective smart coatings for smartphones and other mobile devices will be commercially significant. These will protect devices from yellowing and chemical effects, as well as the buildup of dirt, microbes and smudges.

The recent unsuccessful attempt by Apple to coat phones with sapphire at least demonstrates how important this kind of coating might be eventually and the markets that are opening up for protective coatings in this space.

Self-healing coatings are also a class of smart coatings that will generate revenues in the electronics sector. Waterborne polyurethane dispersions have already been shown to conveniently realign themselves to fill in scratches. We also expect that there is a niche market here for smart antimicrobials.

In any case, the smartphone/tablet market is so huge - about two billion units shipped annually - that it seems inevitable that smart coatings makers will be incentivized to design coatings especially for this market segment.

Energy and Construction

Much of the market emphasis in the smart coatings space during the past decade has been on the building products sector, with green initiatives being an important driver. However in 2015, the decline in oil prices has not only taken the steam out the energy efficiency story but threatens to curb the resurgent green building sector where self-healing and self-cleaning coatings seemed to have viable applications.

n-tech Research believes that market opportunities for smart coatings are going to be more limited in the oil and gas sector, compared to how we saw things turning out in our previous smart coatings market analyses. In particular, we expect that the smart protective coatings that in the past have been sold to gas and oil firms looking for new wells and deposits will see a decline, as many shale oil firms have radically cut back on their capital expenditures, for example.

However, n-tech Research does not believe that the decline in the energy sector will last forever, and once energy prices start trending upward in some sustainable way we expect the market for energy-related smart coatings to revive.

In the meantime, R&D into new energy technologies continues, and smart coatings may find a role there -in the development of fuel cells, for example. In addition, smart coatings are being developed for use as oil-filtering materials that can completely separate oil and water in an economical manner. And given the regulatory support for eco-friendly oil spill removal solutions, new products based on smart coatings are still likely to be commercially popular.

Also, n-tech Research is seeing a lot of activity in the self-healing concrete sector, which is in no way dependent on energy prices. We believe that active smart coatings will remain restricted to new construction activities, because retrofitting applications will remain prohibitively expensive for the majority of consumers.

Military and Healthcare

Worldwide, the U.S. military is both the leading supporter of research on smart coatings and the largest military end user of smart coating technology. The majority of research projects in this space are undertaken directly by the U.S. military or jointly with other research institutes, sometimes through funding and sometimes through collaboration.

The military seems likely to continue to be an attractive market (and funding source) for smart coatings. As n-tech Research sees it, the military is especially interested in anti-corrosion coatings. What stands out in this regard are new smart coatings designed to protect galvanized steel and aluminum surfaces. In this context, we anticipate that military markets will be examining closely the ability of such smart coatings to extend the service life, reduce operational costs, and improve the chemical resistance of metal structures relevant to military applications. This will lead to the adoption of these materials for other related military applications in the medium term.

The active involvement of the U.S. Navy’s Office of Naval Research (ONR) in the development of antifouling solutions through the “Antifouling/Fouling Release Coatings Program” leads n-tech Research to believe that more innovative commercial solutions, including non-metallic and biocide-free coatings, will be commercialized in the near to medium term of the forecasting period of this report.

The development of a smart coating with a self-signaling feature that can effectively camouflage military personnel and equipment, such as tanks, helicopters and trucks, has been proposed. Another possibility is the use of natural materials such as reflectin -a protein used by squid to change color and reflect light -to provide infrared invisibility.

In the healthcare field, smart antimicrobial coatings have already been established. Smart coatings for use as antimicrobial agents are extending beyond medical uses to the food, textile and residential segments. As a result, n-tech Research sees the addressable market for smart antimicrobial coatings as growing.

There is also a need for innovative drug delivery agents. The majority of smart coatings that are meant to trigger automatic drug release based on an external stimulus are still in the research phase, and there is uncertainty over the commercial release of such advanced drug delivery systems in the immediate future. Since such coatings will have to pass through many more tests than other types of smart coatings, there is also additional business risk in this market segment.

That said, there are some interesting developments in this space, and new coatings of this type can plug into the demand from aging populations in the developed countries. Among the developments we see in this area that appear to meet a real need are bio-adhesive coatings that offer controlled drug release for the prevention of drug overdoses in critical situations.

Transportation

Smart coatings provide numerous benefits for the transportation industry, such as improved asset life, limited corrosion damage, and reduced maintenance and overall cost of ownership. These benefits extend across all of the major verticals in this sector, including land vehicles, aircraft, trains and marine vessels.

Marine Coatings

Apart from energy conservation via self-dimming window coating solutions, anti-fouling coating solutions have long been in demand from the global marine industry. In order to address the growing concern over biofouling, new smart anti-fouling coatings are being developed.

Airline Coatings

Corrosion of aircraft parts and disintegration of the protective paint are some of the key areas of concern for the airline industry. Currently, research is being undertaken to develop optical fiber sensors with fluorescent coatings that can indicate paint degradation and prevent microbiologically influenced corrosion. Experimentation is also in progress with polymer coatings that have the potential to prevent metal corrosion by forming a barrier to water and oxygen.

De-icing is a second major issue for the industry, and leading airlines and research institutes are jointly developing novel coatings that can lead to frost-free aircraft body surfaces.

Automotive Coatings

Labor and material costs involved in the application of a second coating on automobiles have been an issue in the industry for some time. As a result, self-stratifying coatings that are able to form multilayer films from a single coating system are gaining prominence in the automobile industry.

A number of additional smart coatings developments are taking place in the automotive sector. A few prominent examples include: coatings that improve the effectiveness of braking and suspension systems, smart coatings with embedded sensors for tires that signal the driver when the tires begin to lose traction, and smart lubricant coatings that can either enhance the performance and effectiveness of automotive oils or eliminate the use of automotive oils entirely.

Other Markets

There are segments of the smart coatings market that represent smaller opportunities either because the addressable markets are limited or because the technology development work that still remains to be done is at a relatively early stage.

Corrosion/Wear Resistance

There is a significant opportunity in this area to develop new kinds of coatings that avoid the chromium VI that has commonly been used in these coatings. Approaches that are based on pH changes seem to be especially popular, and here the changes may be detected either using fluorescent molecules, quantum dots or by some other method.

Pressure-Sensitive Smart Coatings

Pressure-responsive paints (PSP) are used for carrying out aerodynamic testing in wind tunnels, where the PSPs serve to measure the airflow. This application is common to both the automotive and aerospace industries. Scientists at Pennsylvania State University have, however, developed a luminescent pressure-sensitive coating that is claimed to be better than PSPs. So this suggests that there may be opportunities for pressure-sensitive smart coatings beyond the more conventional PSPs.

Future Opportunities

n-tech Research believes that the immediate opportunities for smart coatings lay mostly in market-expanding improvements of existing materials. However, there are also a few instances of entirely novel materials platforms being used for new kinds of smart coatings, but with largely longer-term opportunities. One example would be the use of metamaterials in smart optical coatings. Another is the small research program designed to create new kinds of self-healing products.

Particularly exciting are multilayer coatings, which we see as an important commercialization direction since it is the simplest way to develop coatings that are multifunctional. As an example of truly smart coatings, one might imagine a smart coating that provides photovoltaic energy generation with inherent self-repair and self-cleaning capabilities. Whatever the functionality of multilayer coatings, cost will be a factor holding back the development and use of these sophisticated smart coatings.

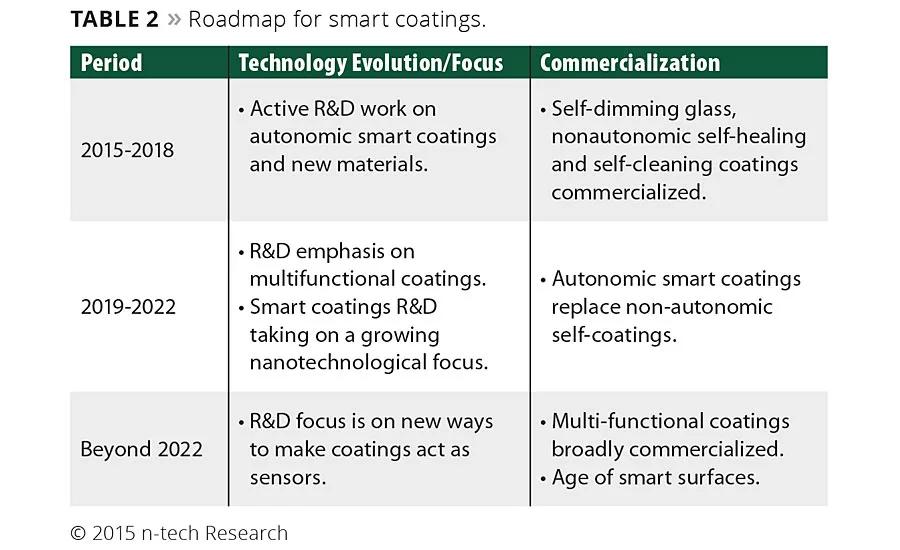

Table 2 shows a roadmap for smart coatings development into the future.

Barriers to Growth

Despite the strong potential of smart coatings in various industrial applications, there are certain gray areas that need to be effectively addressed in order to expand the scope of the global smart coatings market beyond traditional consumer segments. Some of the key areas of concern that require a rational solution from the smart coatings community include: the premium pricing structure, technological gaps, unfavorable environmental regulations, and disinclination of end users towards particular products.

Potential Opportunity

There are several large specialty chemical companies that seem well positioned to supply smart coatings into the market in that they already supply one or two “semi-smart” coatings. But we have yet to see any of the giant specialty chemical firms really focusing on smart coatings. Which large specialty chemical firms are likely to take this direction is hard to say. It is possible - indeed likely - that some large firms will devote significant amounts of resources to smart coatings, but will limit their activities to certain market segments that fit with the central business objectives and product ranges.

Given the overall lack of commitment to smart coatings as a class of materials, we see investment in or acquisitions of innovative smaller firms that are specifically smart coatings focused as an entry point for companies looking the pursue these markets.

This is a potentially significant opportunity for investors, innovators and inventors to consider. While materials players are not going to produce the massive returns on investment that electronics, software and content firms will potentially offer, they do provide reasonable return potential. University groups, small start-ups and the like can attract reasonable funding from larger firms or boutique investment groups if the IP is right and the applications targeted make sense.

For more information, e-mail info@ntechresearch.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!