Green Chemistry: The Tug o’ War Between Headwinds and Tailwinds

A vast array of both consumer and industrial products, from plastics to fuels; from paints and coatings to lubricants; from personal care products to household, industrial and institutional cleaners (“HI&I”), and many others, have historically been based on starting materials that are derived from fossil fuels such as petroleum, natural gas, shale oil, oil sands, bitumen, coal, etc. Over the past couple of decades, there has been a lot of discussion, R&D, marketing and sales efforts aimed at converting as many products that are based upon fossil fuel-derived specialty chemicals to “green” (biosourced) analogs, as possible. The drivers for this movement are varied, but some of the more important considerations include the sustainable nature of bio-sourced materials vis-à-vis finite fossil fuels; potentially lower carbon footprints of certain bio-sourced materials; and consumer “pull” for materials that are low-odor, with benign label warnings. The quest is most urgently felt in the areas of plastics, fuels, and paints and coatings, where varying degrees of progress have been made developing products derived from starting components that are grown and harvested, such as corn, soybeans and perennial grasses. This makes eminently good sense, because fossil-derived, and especially petroleum-based, chemistries will eventually require alternatives - untapped oil reserves are finite, whereas crops are renewable.

At least for now, however, the world seems to find new oil reserves on a routine basis, and - as the COVID-19 pandemic has dramatically reduced demand for oil - there is currently an overabundance of oil, which has had a dramatic effect on its price. Green chemistry development continues, but to what degree does it affect the various segments of the coatings industry? These chemistries from novel, non-petroleum sources are often more expensive than their petroleum-based analogs. With prolonged low crude oil prices, can these new chemistries make a sufficiently sizable entrée into the various paint and coatings segments and regional markets for them to acquire and maintain a solid, commercially viable foothold? COVID-19 and its effect on demand for oil, coupled with the pre-COVID oversupply of oil and ongoing food supply disruptions, are economic forces that will put a damper on significant near-term growth in certain segments of petrochemical-sourced, as well as bio-sourced, paints and coatings. Nonetheless, the price and availability of crude oil are only two, albeit extremely important, factors in determining how the global and regional paint and coatings industry will perform at any given time.

What the effect of the price of oil will have on green/sustainable/bio-sourced materials, in general, cannot be known for certain, but it is reasonable to posit that the dynamics driving the use of bio-sourced materials are in some ways similar, but in other ways somewhat different, than those driving the use of petrochemical-based analogs, including regulatory fiat, health and safety concerns, environmental issues, consumer preferences, et al. There is, therefore, no reason to believe that the price of crude oil will have any greater effect on interest in, and use of, green paints and coatings, in the post-COVID world than it did in the pre-COVID world. It may, however, have a somewhat different effect.

Green Chemistry: The Future for Paints and Coatings?

Bio-sourced chemicals are sometimes referred to as “renewable chemistry,” and a now-familiar term that is not strictly defined, but that is easy to use, is employed on a global basis, and conveys the general concept, is “green chemistry.” Regardless of nomenclature, it is chemistry that converts living organic feedstock through a variety of chemical processes to produce useful chemicals that can serve as finished product components or as reactants to produce a broad range of specialty chemicals, including oligomers and polymers.

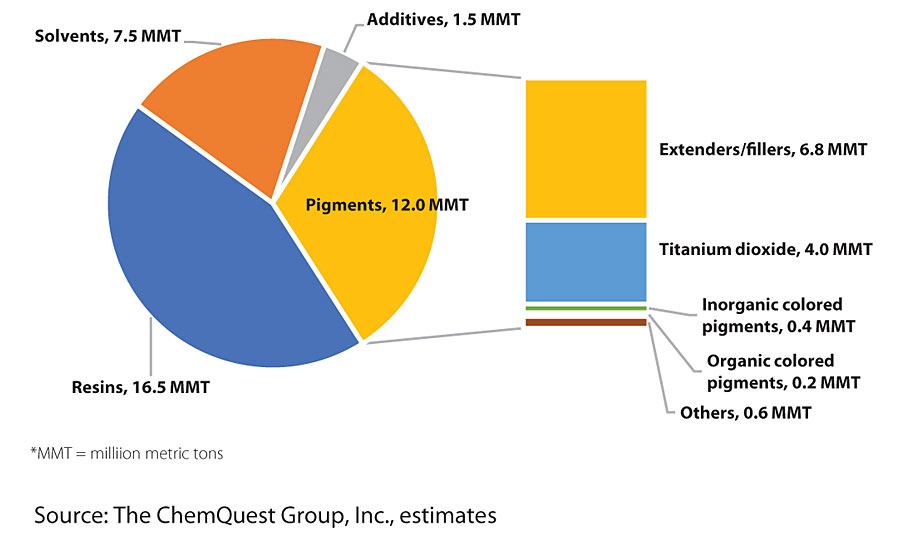

The breakdown on all components (from any source, petrochemical or biomaterials) used in paint and coatings production in the global coatings market gives us a very high-level view of the types of raw materials that might be viably explored for “green” chemistry use (Figure 1).

In pre-COVID 2019, 37.5 MMT of chemicals in the form of pigments, resins, solvents, and additives were forecast to be used in the global production of paints and coatings. A large category (12 MMT) is comprised of pigments, and it is safe to say that inorganic pigments, such as titanium dioxide, fillers, and other inorganic colored pigments can never be sourced from biomaterials. Some organic pigments may be able to use “green” precursor chemistry, but, as the fig. shows, colored organic pigments represent only a small sliver (0.2 MMT) by volume of total pigment consumption. Producers of these materials, however, constantly strive to reduce the energy needed to manufacture the pigments, minimize the waste, and maximize the yield. In this regard, pigment manufacturers certainly have a “sustainability” mentality.

Green Solvents

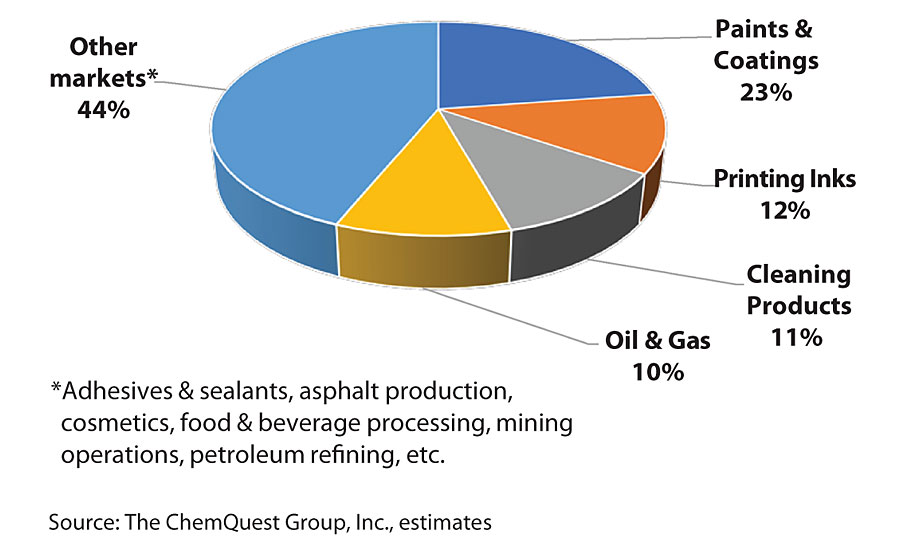

The largest category of paint and coatings raw materials is represented by solvents, which offers, at least at first blush, quite a few opportunities for bio-based (“green”) products. Since the paint and coatings industry represents, on a global basis, the largest usage category for solvents, this is a natural area in which to concentrate research, both for raw material suppliers and paint and coatings formulators (Figure 2).

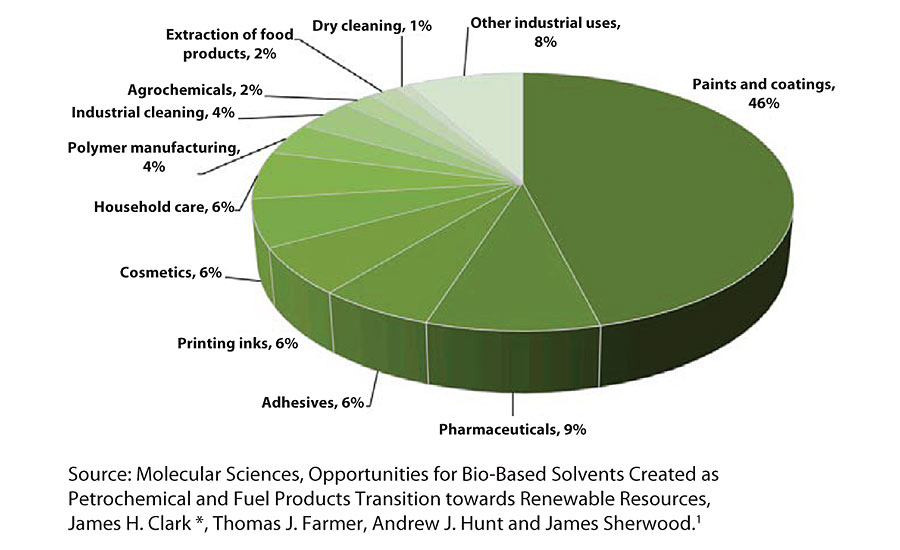

In pre-COVID 2020, the worldwide market for bio-based solvents used in all applications (inks; coatings; adhesives; household care; others) was estimated to be $3-5 billion, and the total global solvent market was estimated to be $35-$40 billion (Figure 3).

While the growth in solvent usage in coatings is only about 1-2% CAGR (2014-2019), green solvents’ growth in coatings shows a faster growth rate - approximately 4-6% CAGR, driven by green coatings’ growth of >6% 2 - as they make headway in replacing petroleum-based, conventional solvents. Growth will certainly continue into the post-COVID foreseeable future, given the environmental and regulatory pressures, and a desire to reduce the dependence on petrochemical solvents in the major paint-producing global regions - North America, Europe, and Asia-Pacific.

Green solvents can include a variety of products, such as bio-based ethanol from corn; methyl soyate from soybean oil; ethyl lactate, n-butanol, and acetone from various types of biomass; and d-Limonene, derived from citrus rinds. These, and many others, are either used - or have the potential for use - in paints and coatings.

All global regions are considering, or are already using, green solvents. Nonetheless, petroleum-based solvents are low-cost, readily available, with a well-established infrastructure, and - by and large - an extremely low carbon footprint as a result of process efficiency, all of which offer significant headwinds for green solvents with their associated higher feedstock costs, more complex manufacturing processes, and (potentially) higher carbon footprints. These, in turn, affect the cost of green materials. Manufacturers of green chemistry, however, continue their research into ways to make green solvents more commercially available and economically viable, aided by crop disruptions following COVID-19 that are driving lower soybean and corn pricing perhaps through 2021. Weak ethanol demand as the result of lower oil prices is another factor that contributes to the tailwinds for favoring the development and use of green solvents.

Green Polymers

An additional opportunity for green chemistry to enter the paints and coatings marketplace is through the production of bio-based monomers that are used to make polymers. Alkyd resins, typically containing a significant level of bio-based content, have, of course, been used for several centuries, although their imminent demise has been predicted for the past six decades. (When I joined Sherwin-Williams in 1970, I was not taught how to cook alkyds, because their use was expected to drop to essentially zero within 7-10 years.) Nonetheless, this technology continues to grow with GDP in the U.S., slightly less than GDP in Europe, and faster than GDP in Asia Pacific - in China and Southeast Asia, for example, alkyds (all types - traditional solventborne; waterborne; and high solids) represent 15-18% of all coatings. Work on alkyd resins and coatings is still on-going, and increased use of alkyds is being encouraged by work in both resin and coatings laboratories, such as OPC Polymers in Columbus, Ohio, and at universities and research institutes, such as The University of Akron’s Polymer Engineering Department (Prof. Mark D. Soucek, Ph.D., Chair) 3 and the ChemQuest Technology Institute (Douglas Corrigan, Ph.D., Director). This type of work has already produced bio-based routes to monomers such as bio-adipic acid, bio-itaconic acid, and bio-furan dicarboxylic acid, among others, and more will be emerging. Many of these new biomolecules either are, or might be, suitable for creating biopolymers for use by paints and coatings producers.

Beyond the “Bio Buzz”

It is important to know what suppliers, distributors, and formulators actually think about bio-sourced materials. A recent global survey conducted by the European Coatings Journal 4 indicates that all three have greater interest in bio-sourced materials now than in the past, but it really comes down to a common hurdle that all new raw materials face in the paints and coatings arena: a cost/performance ratio (Figure 4).

If a new material is more expensive, it must provide one or more positive attributes that justify the higher price. One of these attributes might very well be “greenness,” which will satisfy a variety of national and local regulatory mandates, and be of compelling interest to a certain percentage of both businesses and consumers for whom “greenness” adds value to a product, and justifies its value-added pricing. BOTTOM LINE: For the majority of users of paints and coatings, however, the tipping point where “value-added” pricing meets the “cost/performance” requirements of the industry is going to be a minimum of 5-7 years into the future.

References

1 https://www.ncbi.nlm.nih.gov/pubmed/26225963

2 Global Market Analysis for the Paint and Coatings Industry (2019-2024). World Coatings Council (WCC) and The ChemQuest Group Inc. Chapter 5, “Architectural Coatings,” page 291. https://www.paint.org/programs-publications/publications/market-analyses/

3 Salata, R.R.; Pellegrene, B.; Soucek, M.D. “Visible Light Cure Packages for Improved Drying Kinetics in Alkyd Coatings,” Progress in Organic Coatings, Volume 144, July 2020, Article 105672.

4 “Biobased Coatings Survey,“ European Coatings Journal, 2019 (09-2019). https://www.european-coatings.

com/Markets-companies/Raw-materials-market/Biobased-coatings-survey-Prices-will-go-down/(cpg)/LA0105?utm_source=interner-verweis-redaktion&utm_medium=referral&utm_campaign=Online-Verweise_Redaktion&cpg=LA0105

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!