Survey Results Show the Deepening Effects of COVID-19 on the Manufacturing Industry

BNP Media’s Clear Seas Research division has released the third wave of survey results on how the coronavirus pandemic is affecting the manufacturing industry. This survey was conducted April 16-20 among the readers of BNP’s 12 magazines that focus on manufacturing – PCI being one of them. The survey asks about manufacturing industry areas of concern, business outlook, changes in marketing budgets, whether or not a company has applied for the small business stimulus loan, if the company is classified as an “essential” business, actions being taken to keep employees healthy, anticipated workforce changes within the next three months, how companies are communicating with customers, changes in marketing/advertising, estimated time for business to get back on track, and more.

Below are a few takeaways from the survey as compared to the first two waves of results. You can download the full survey results free of charge here.

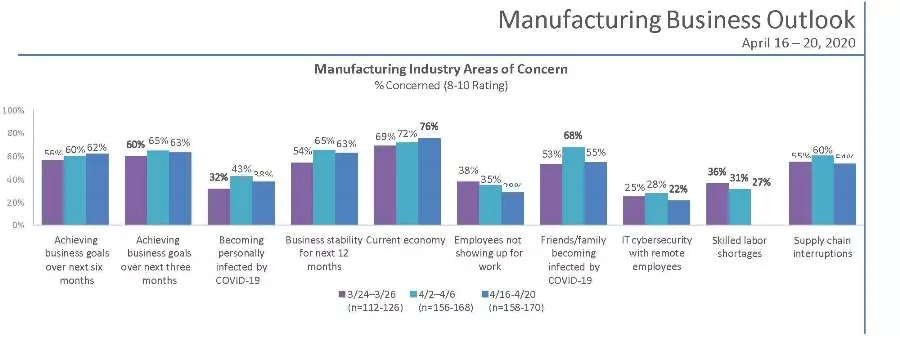

THE PERCENTAGE OF PEOPLE WHO INDICATED A LEVEL OF CONCERN FROM 8-10 (ON A SCALE FROM 1-10) WITH THE FOLLOWING:

Current economy:

March 24-26: 69%

April 2-6: 72%

April 16-20: 76%

Achieving business goals over next three months:

March 24-26: 60%

April 2-6: 65%

April 16-20: 63%

Achieving business goals over next six months:

March 24-26: 56%

April 2-6: 60%

April 16-20: 62%

Supply chain interruptions:

March 24-26: 55%

April 2-6: 60%

April 16-20: 54%

Business stability for next 12 months:

March 24-26: 54%

April 2-6: 65%

April 16-20: 63%

Friends/family becoming infected by COVID-19:

March 24-26: 53%

April 2-6: 68%

April 16-20: 55%

Employees not showing up for work:

March 24-26: 38%

April 2-6: 35%

April 16-20: 28%

Skilled labor shortages:

March 24-26: 36%

April 2-6: 31%

April 16-20: 27%

Becoming personally infected by COVID-19:

March 24-26: 32%

April 2-6: 43%

April 16-20: 38%

IT cybersecurity with remote employees:

March 24-26: 25%

April 2-6: 28%

April 16-20: 22%

THE PERCENTAGE OF ACTIVE BUSINESS THAT IS ON SCHEDULE, DELAYED OR CANCELLED:

On schedule:

March 24-26: 67%

April 2-6: 63%

April 16-20: 56%

Delayed:

March 24-26: 26%

April 2-6: 28%

April 16-20: 33%

Cancelled:

March 24-26: 7%

April 2-6: 9%

April 16-20: 11%

THE PERCENTAGE OF PLANNED BUSINESS THAT IS ON SCHEDULE, DELAYED OR CANCELLED:

On schedule:

March 24-26: 63%

April 2-6: 57%

April 16-20: 50%

Delayed:

March 24-26: 31%

April 2-6: 34%

April 16-20: 41%

Cancelled:

March 24-26: 6%

April 2-6: 9%

April 16-20: 9%

RELATIVE TO ONE YEAR AGO, HOW IS NEW BUSINESS DEVELOPMENT ACTIVITY BEING IMPACTED?

Increase:

March 24-26: 16%

April 2-6: 17%

April 16-20: 13%

No Change:

March 24-26: 20%

April 2-6: 17%

April 16-20: 13%

Decline:

March 24-26: 64%

April 2-6: 66%

April 16-20: 73%

HOW IS PLANNED 2020 BUSINESS SPENDING ON EQUIPMENT, PRODUCTS, TECHNOLOGY, SERVICES, ETC. BEING IMPACTED?

Increase:

March 24-26: 8%

April 2-6: 9%

April 16-20: 5%

No Change:

March 24-26: 29%

April 2-6: 18%

April 16-20: 20%

Decline:

March 24-26: 63%

April 2-6: 73%

April 16-20: 75%

ANTICIPATED WORKFORCE CHANGES IN NEXT 3 MONTHS

Lay off all employees:

March 24-26: 1%

April 2-6: 0%

April 16-20: 2%

Lay off some employees:

March 24-26: 24%

April 2-6: 26%

April 16-20: 27%

Temporarily suspend employees with pay:

March 24-26: 22%

April 2-6: 14%

April 16-20: 15%

Temporarily suspend employees without pay:

March 24-26: 21%

April 2-6: 19%

April 16-20: 18%

Rehire previously suspended/laid off employees:

March 24-26: 13%

April 2-6: 10%

April 16-20: 14%

Hire new employees:

March 24-26: 11%

April 2-6: 15%

April 16-20: 9%

No change:

March 24-26: 33%

April 2-6: 32%

April 16-20: 33%

Don’t know:

March 24-26: 17%

April 2-6: 14%

April 16-20: 14%

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!