TiO2 Industry: Destocking, Slowing Economies, and Supplier Response

The second half of 2022 proved a difficult period for the global TiO2 industry. Following a very strong first half of 2022, sales decreased dramatically. As underlying demand weakened, customer destocking spread throughout the world, beginning in Europe and Asia and spreading across to the Americas by the end of the year. How are producers across the world responding? The answer is very different for emerging producers in China versus established multi-national producers (MNPs). TiPMC expects this dynamic to continue as the market recovers, lasting well into the foreseeable future.

TiPMC expects demand outside of China in 4Q22 to be 20-25% lower than the same quarter, one year earlier. Sales in the first half of 2023 are expected to improve, relative to the second half of 2022. Destocking among consumers appears to be ending. Key leading indicators point to reduced sales in the first half of 2023, potentially 10-15% below 2022.

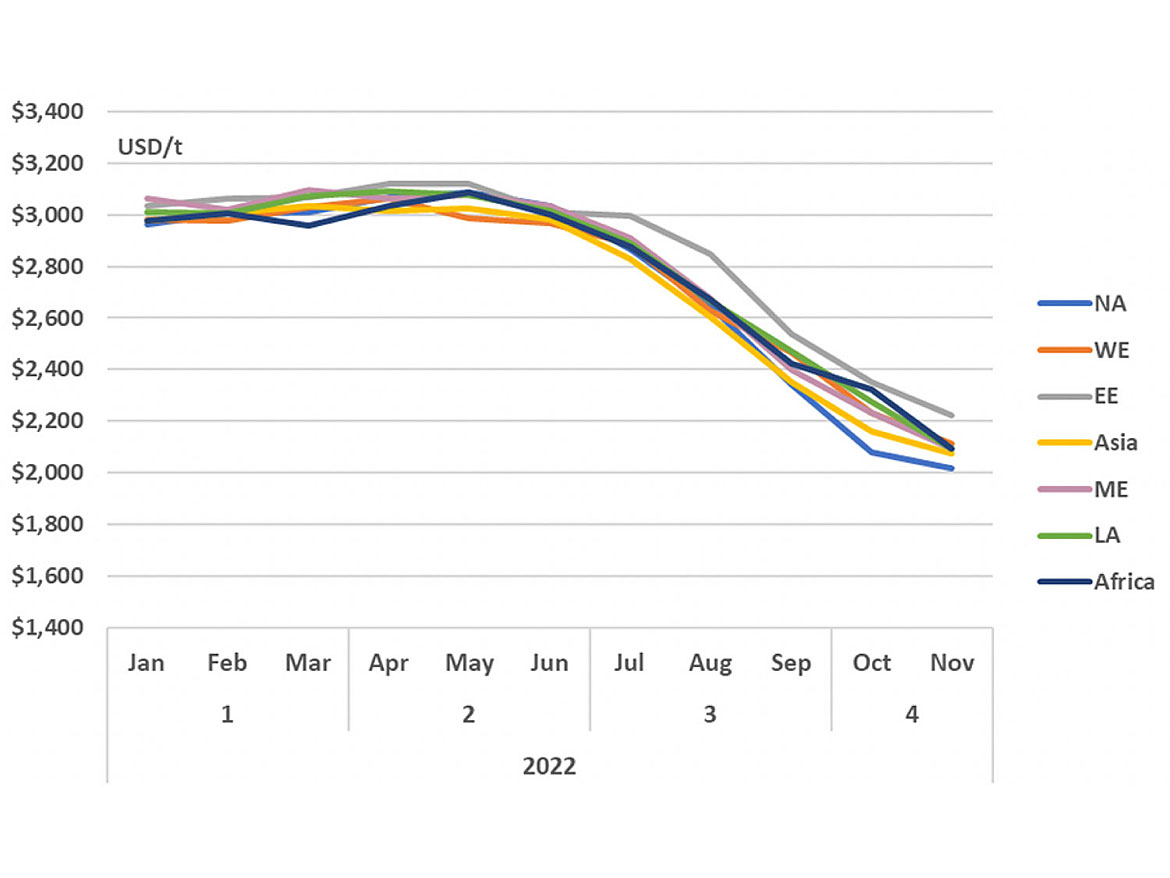

MNPs continue to seek price stability, dramatically reducing production rates across the world to manage inventories. TiPMC believes their decisive response to reduced demand has shortened the period of destocking among consumers. Key raw material inflation persists. A warmer winter, and government support in Europe, have lower natural gas prices, but future uncertainty persists. Margin and cash preservation appear to be the dominant strategy.

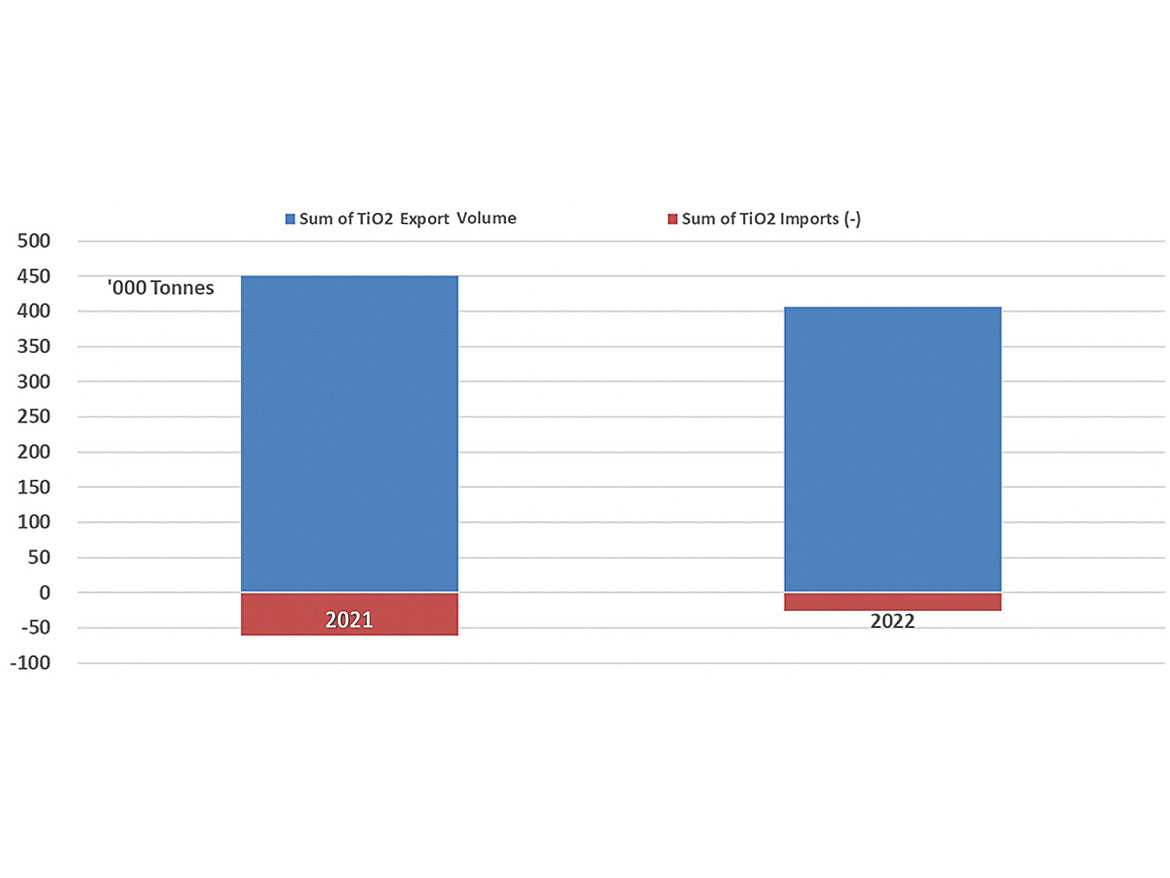

Chinese producers have favored lowering price and maximizing volume. Export prices from China have declined nearly 30% from their high point in the spring. Compared to 2021, exports reduced from August through November by 43kt, or about 9.5%, relatively small as compared with MNP-reduced sales. Imports into China are down 57% through November as compared to 2021, with significant reduction since September.

Despite difficult business conditions, Chinese producers have aggressive expansion plans, led by LB Group. The former Lomon Billions has announced its intention to increase both chloride and sulfate capacity by nearly 600ktpa by mid-decade, positioning them as the largest TiO2 producer in the world.

Others continue to build new capacity as well. TiPMC estimates available capacity in China to have increased by 425-475kpta since the beginning of 2021. Over 2M tonnes more capacity is announced by multiple producers, both chloride and sulfate.

What Does This Mean for TiO2 Consumers, and What Can Be Expected in the Future?

TiPMC believes Chinese prices will increase in 2023, as current levels are not sustainable relative to most producers’ costs. A number of new projects will be delayed, while high-cost plants remain idle until demand and increasing prices warrant continual operations. The extent of addressable market outside of China, due to product consistency and available grades, will limit Chinese exports.

TiPMC believes global demand in 2022 was down nearly 500ktpa, nearly 8% from 2021. The rapid increase in demand following the world’s emergence from COVID-19 and the flood of global government stimulus supported the volatile market seen in 2021 and early 2022.

Longer term, TiPMC believes demand will return closer to its long-term trend growth in 2024 and 2025, increasing utilization rates among all producers.

TiO2 consumers will be faced with multiple choices and decisions. MNPs are responding with improved offerings to support the needs of customers for products supporting their sustainability goals and minimizing climate impact. Chinese producers are focused on volume and low-price offerings. Consumers will continue to weigh choices well into the future.

For more insights into the TiO2 and Mineral Sands markets, visit TiPMCconsulting.com, or see our ad in this issue for more details. For more information about the impact price stabilization on the TiO2 industry, ask to see our latest issues.

1 Global Trade Tracker

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!