TiO2 Industry: Where is the Light at the End of the Tunnel?

The TiO2 industry continues to experience difficult times. Multi-national producer (MNP) volume in 1Q23 was 31% lower than 1Q22, while net exports from China increased 22%. This followed a fourth quarter that was down 35% compared to the previous year. Raw material inflation remains in place. Venator, the world’s number five producer in 2022, filed for Chapter 11 bankruptcy protection in May. The spring coatings season for 2023 was extremely weak. Expectations for a second-half recovery in 2023 are not promising. Is there a light at the end of the tunnel, and if so, how long is the tunnel?

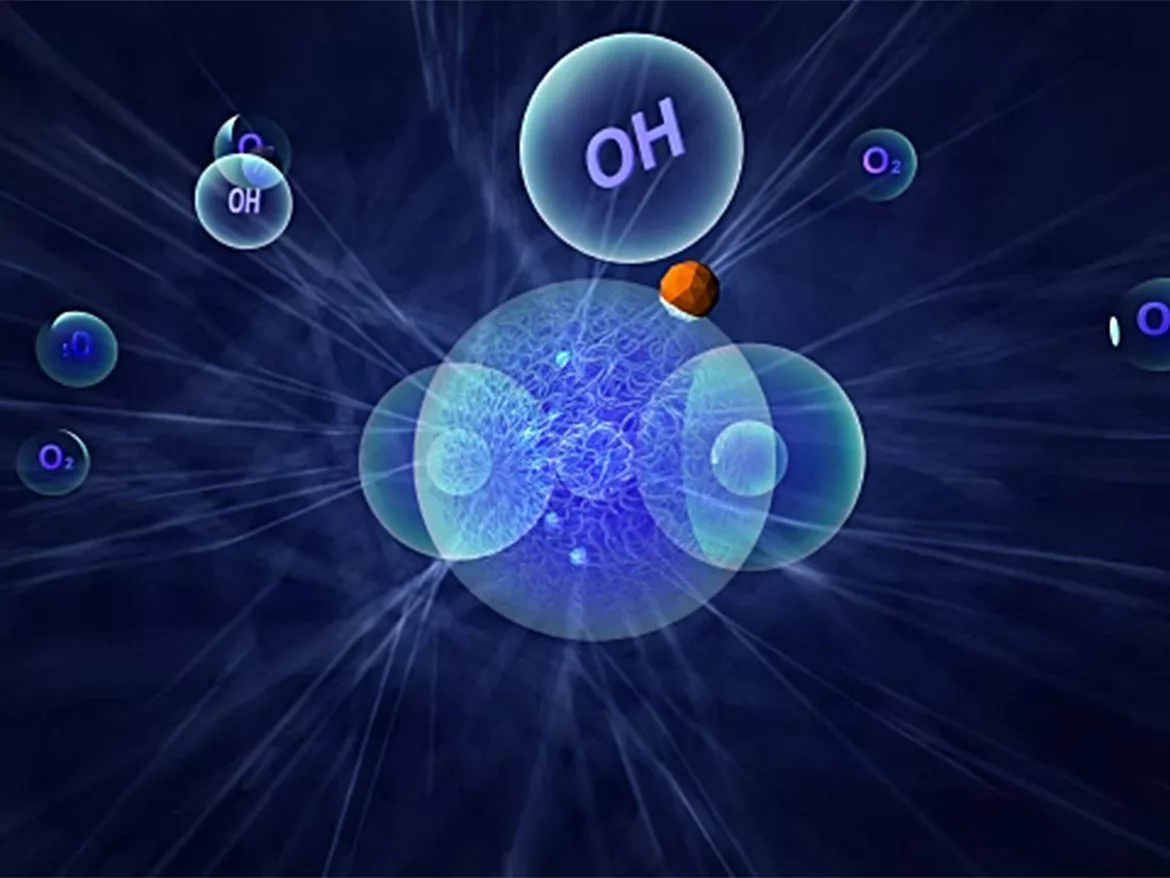

To understand the nature of the recovery, it is best to review the nature of the downturn. The United States housing market has always been a key component of TiO2 demand. In the case of MNPs, their dependency on the North American market continues to grow. TiPMC’s analysis indicates that the four major global TiO2 producers are becoming increasingly dependent on the North American market. This market presents unique barriers to developing producers such as the Chinese producers. Chloride TiO2 is generally specified for most applications in North America. Most coatings applications, particularly architectural coatings, require TiO2 to be delivered in the form of a slurry, as many consumers converted their operations to allow the TiO2 producer to create and sell slurry product, vs. mixing dry product themselves. Third, the recent tariffs imposed by the United States on TiO2 products from China have increased protection for domestic producers.

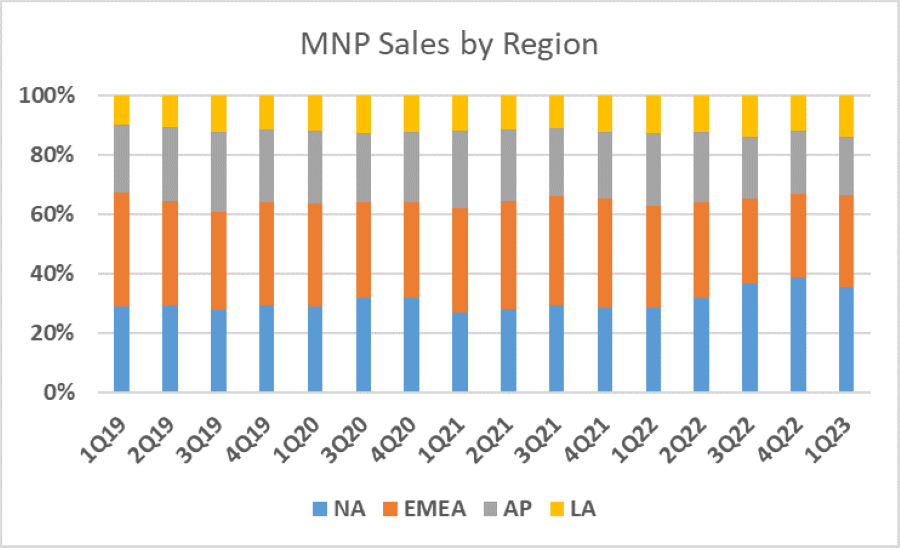

Quality and product requirements, particularly in European plastics applications, present a barrier to entry for Chinese in the European market, although Chinese exports to Europe have penetrated the multi-purpose market. Data for both MNP sales and Chinese exports show the growing dependency of MNPs on their key markets. As the European market has contracted during the recent downturn, North America has recently grown to nearly 40% of the source of MNP revenue. The growth in Chinese export volumes has been highly centered on Asia and the Middle East, while maintaining earlier volume gains in Europe and Latin America, even as these markets have turned downward.

FIGURE 1 ǀ MNP revenue by region. Source:Company 10Qs/TiPMC Estimates

FIGURE 2 ǀ 2022-2023 Chinese TiO2 exports by region. Source: Global Trade Tracker

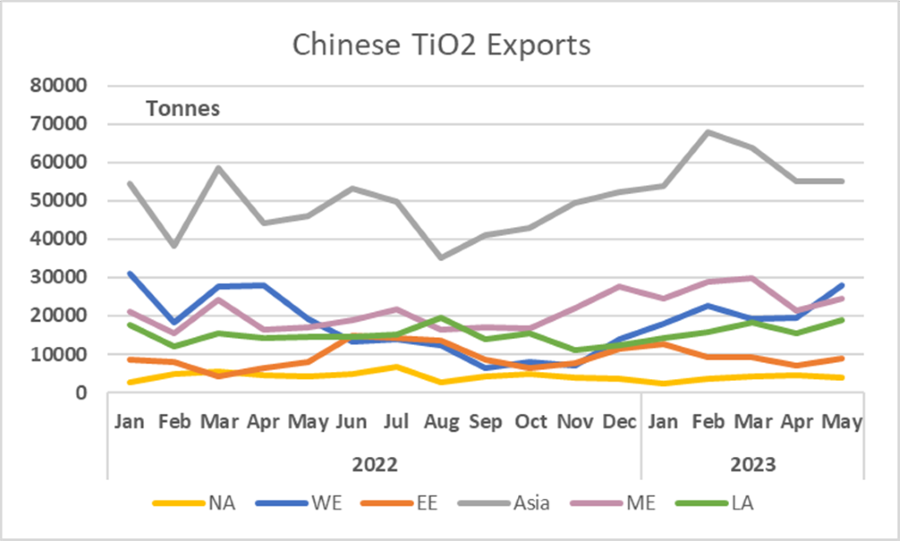

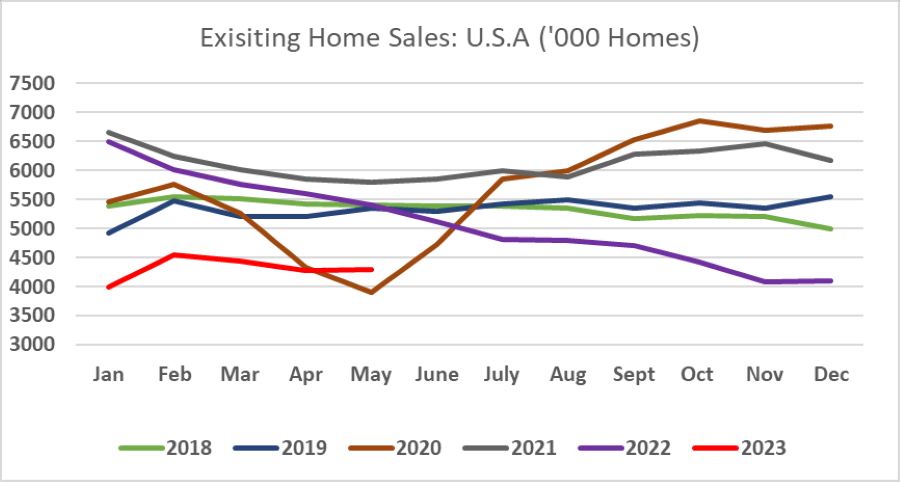

One of the key determinants of demand for architectural coatings and TiO2 in North America is existing home sales. Sellers paint homes to advance marketing of their home, while buyers paint again to meet their own preference for color for each room. Existing home sales this spring are down nearly 25% vs. the high point of the spring of 2021.

FIGURE 3 ǀ NAR data – existing home sales. Source: 2023 National Association of Realtors®. All rights reserved. Reprinted with permission.

MNPs continue to seek price stability, dramatically reducing production rates across the world to manage inventories, while Chinese producers have favored lowering price and maximizing volume. The strategy is creating issues for the Chinese industry. Most Chinese producers, approximated at over 70%, are experiencing negative margins. LB Group, the world’s largest producer, announced plans to curb its expansion, focusing on its chloride growth and abandoning plans for further sulfate expansion.

What Does it Mean for TiO2 Consumers, and What Can be Expected in the Future?

Although very slow, TiPMC believes some signs of a recovery are beginning to appear on the horizon. The U.S. Federal Reserve is tapering interest rate increases. Per the U.S. Census bureau, sales of new single-family houses in the United States unexpectedly jumped 4.1% month-over-month in April, as the reduced costs of building materials, and little competition from home sales has set up an excellent scenario for U.S. home builders. Still, Europe has entered a recession, and China’s recovery is slowing, particularly in the real estate sector.

However, the U.S. housing market decline generally precludes any recession in the United States. The same thought applies for its recovery. This places an upswing, potentially in line with the 2024 coatings season. The state of the war in Ukraine, becoming increasingly unpredictable, can have a positive or negative influence by 2024. The continuing pressure on energy prices is seen as a potential negative. If the conflict is resolved, reconstruction will support both coatings and plastics used in construction.

Although the Chinese housing market is difficult to predict, the current reforms are seen as starting to impact domestic sales at some point in 2024, the timing of which is greatly variable.

For more insights into the TiO2 and Mineral Sands markets, visit TiPMCconsulting.com, or see our ad in this issue for more details.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!