TiO2 Industry: Downturn Impacting Global Operating Footprint

Global TiO2, mineral sands, and coatings producers have reported their first half earnings, and the outlooks for the remainder of 2023. The prolonged slump seems all but certain to continue for the rest of 2023. TiPMC believes 2023 will see a 5-8% drop in overall TiO2 demand as compared to 2022, when the market declined an estimated 8% vs. the previous year. Reports are consistent around low inventories throughout most supply chains, but forward indicators do not show a great need to be concerned about supply reliability. The state of the Chinese real estate market and United States sales of existing homes are pointing to more of an “L-shaped” recovery vs. a “V.”

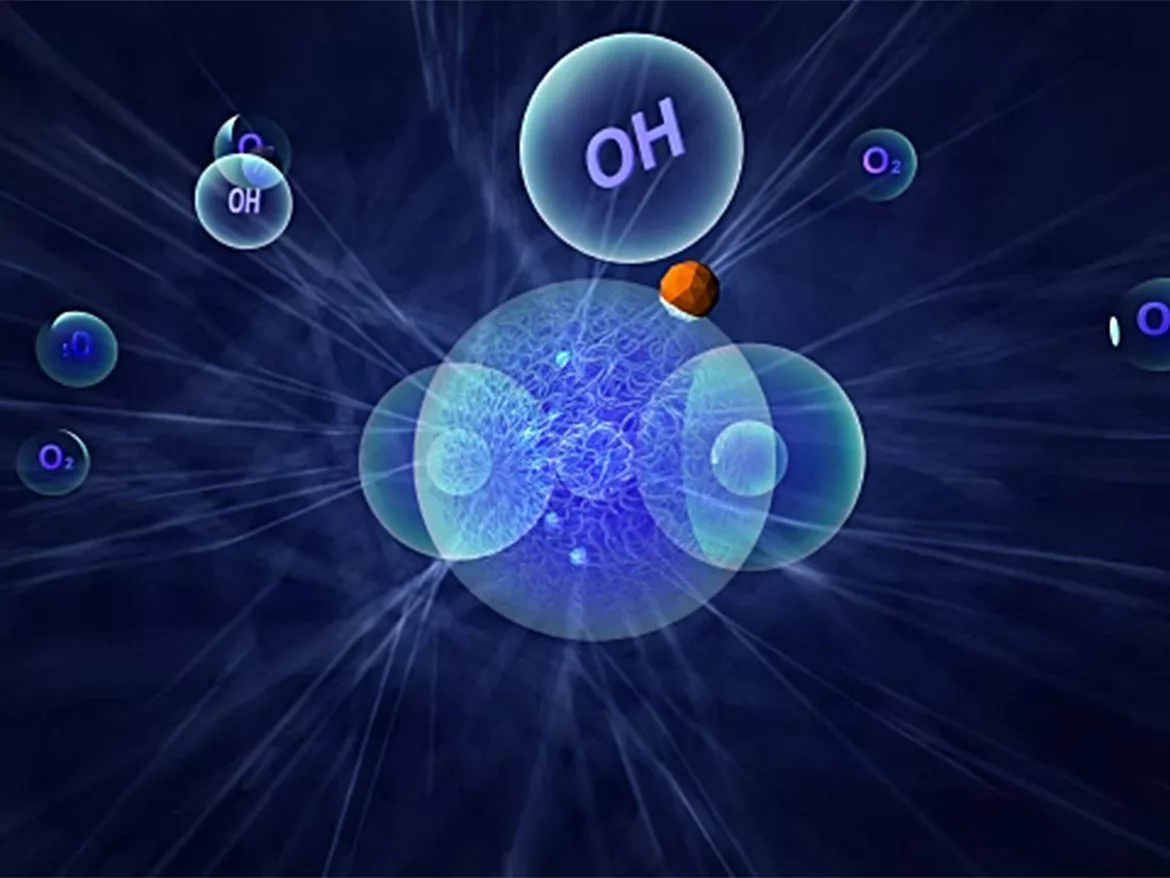

TiO2 producers are responding by reducing their operating footprint. Chemours announced the closing of its Kuan Yin facility in Taiwan (estimated 170 ktpa capacity) effective August 1, 2023. Venator indicated in its Chapter 11 filing that it plans to shut down both its Duisburg and Scarlino TiO2 operations (130 ktpa, combined). As the Ukraine war has progressed, both the Ukrainian TiO2 producer (Sumi) and the Russian producer (Crimea Titan) have had their operations impacted (total of 165 ktpa capacity), as the latter is reported to have the plant mined to release toxic chemicals.

Even LB Group, the new number-one producer in the world, and the fastest growing Chinese producer, announced its plans to curtail its previous expansion plans. The company recently stated its TiO2 capacity as 1,215 ktpa. It also stated that its goal capacity for the next five to 10 years will be 1,550-1,560 Mtpa, significantly less than previously discussed options. They plan to achieve operating rates at 80% utilization rates, with 1125 ktpa as the expected long-term production goal. The current plans to are to only complete current TiO2 projects, and focus on growing their titanium sponge and battery material businesses.

Another element impacting TiO2 in China is structural surplus of lithium iron phosphate (LFP), the primary material for cathodes for electric batteries for EVs. LFP production provided a new consumer of the iron sulfate co-product from TiO2 production plants, providing a new revenue stream. As over capacity has set into the Chinese battery production, prices for iron sulfate have dropped dramatically. As most Chinese TiO2 producers are only marginally profitable, the previously announced rate of expansion, highly based on iron sulfate revenue, will likely be delayed.

Despite the current doldrums, the industry history dictates that global demand will return to the long-term trendline. Expectations are for demand to increase from today’s base by 1.1-1.3 Mtpa later this decade. TiPMC estimates global utilization rates to be near 80% this year, far from the 87-90% level experienced in this industry during profitable periods. The reduced MNP capacity and slower-than-anticipated Chinese expansion could lead to a much tighter market as global economies recover.

What Does it Mean for Tio2 Consumers, and What Can be Expected in the Future?

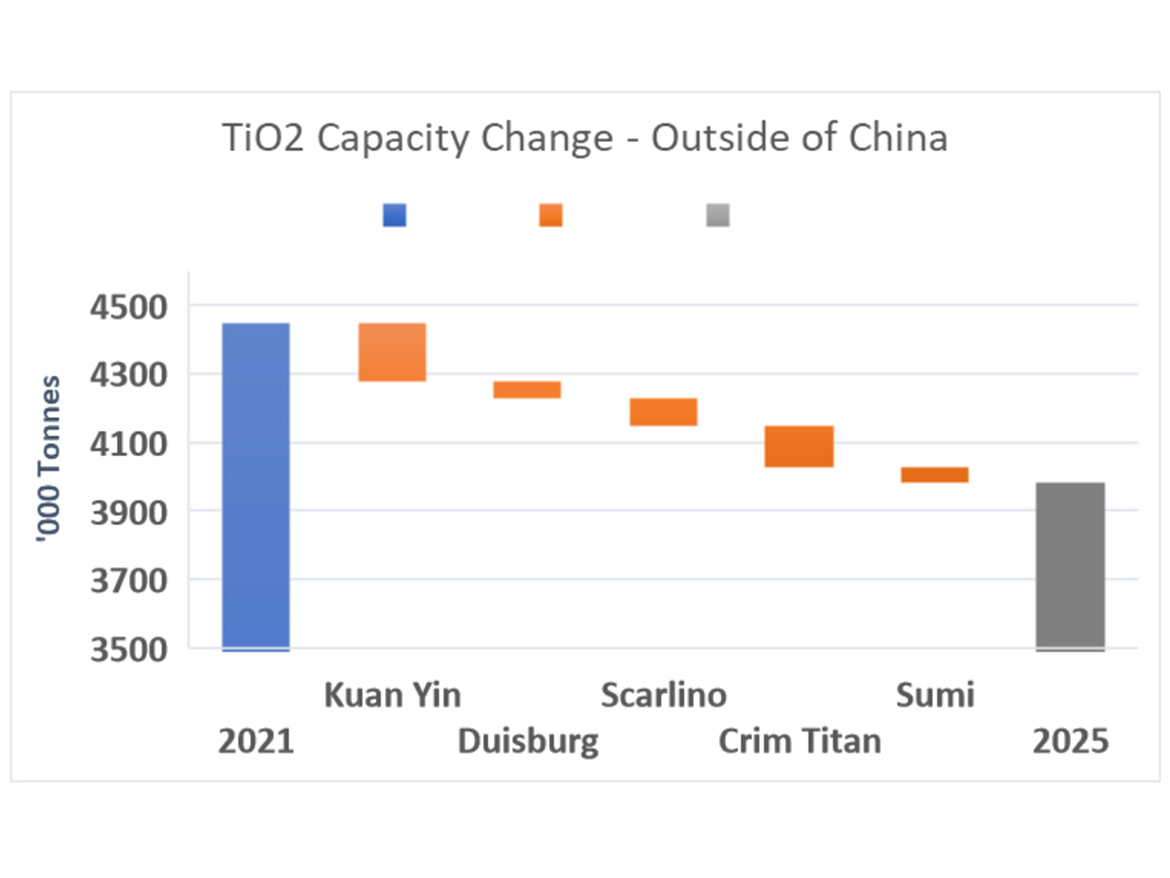

TiO2 consumers have become increasingly aware that differentiation has grown among global MNP producers and emerging Chinese producers. High price differentials in every region of the world between the two groups have become normal for downcycles, while pricing differentials have inverted as supply tightens.

TiPMC does not see significant movement of value-over-volume MNPs any time soon. Inflation, coupled with extremely low price points for Chinese products, does not offer incentive for MNPs to use price to gain share.

Experience shows that the current situation is only a point in time. Chinese costs will increase, and housing fundamentals in developed countries point to much stronger long-term demand fundamentals.

TiO2 buyers need to manage the short-term advantage for long-term gain. At some point, reliability of supply and high-quality customer service cannot be dismissed.

For more insights into the TiO2 and Mineral Sands markets, visit TiPMCconsulting.com, or see our ad in this issue for more details.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!