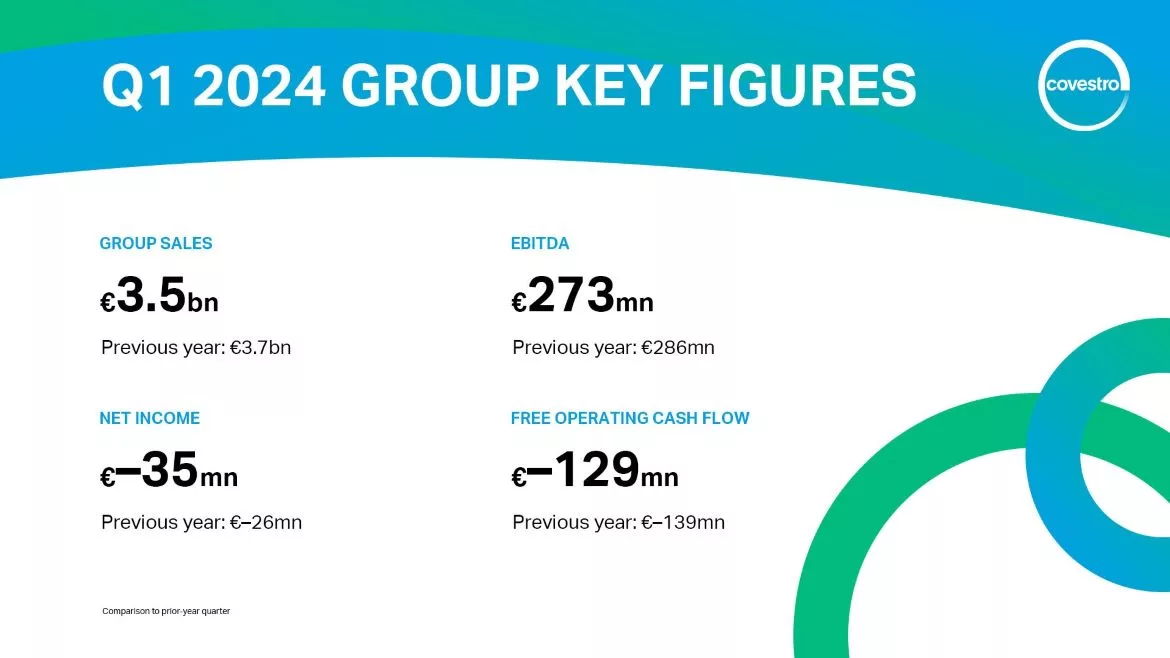

Covestro Releases Q1 Results

Image courtesy of Covestro.

| ||||

| ||||

|

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!

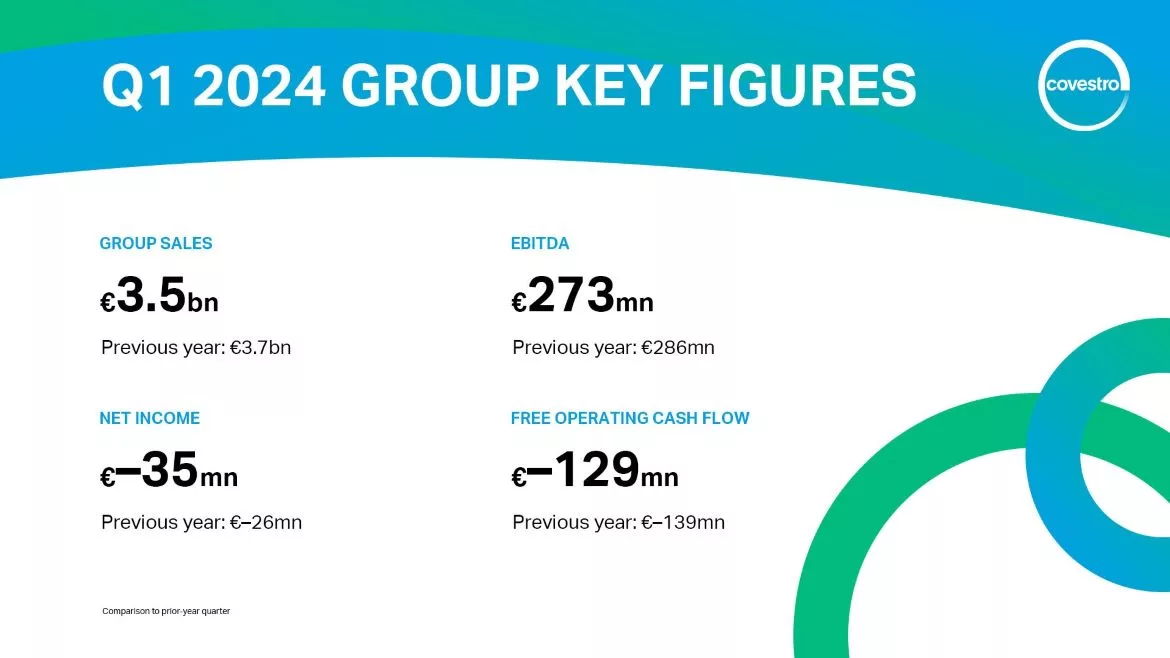

Image courtesy of Covestro.

| ||||

| ||||

|

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!

Copyright ©2026. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing