Sustainability: A Surge in Non-PFAS Releases

Is the Paint and Coatings Industry Ready for the Big Transition?

Credits (left to right, top to bottom): EasyBuy4u / E+ via Getty Images; luza studios / E+ via Getty Images; Rustam Kaberov / iStock via Getty Images Plus; gremlin / E+ via Getty Images; Lemon_tm / iStock via Getty Images Plus; AndreyPopov / iStock via Getty Images Plus; itsjustluck / iStock via Getty Images Plus; Alex Liew / iStock via Getty Images Plus.

PFAS's remarkable qualities have led to their widespread use in the paint and coatings industry, both as an additive and sometimes as a resin. A survey found that approximately 50% of the 94 paint samples contained fluorine traces, an indicator of PFAS. These substances have outstanding water- and oil-repelling properties in addition to their chemical resistance, thermal stability and ability to improve surface smoothness. Although its usage in the industry as an additive is in smaller quantities, the phaseout of these additives has long been called for.

But these key questions remain: Can PFAS actually be replaced in the paint and coatings industry? Can PFAS-free alternatives replicate the performance and properties of PFAS additives?

The PFAS Challenge

PFAS’s unique chemical structure is characterized by a chain of carbon atoms fully saturated with fluorine atoms, resulting in strong fluorine-carbon bonds. Companies are working to develop PFAS-free coatings that mimic the performance of traditional PFAS additives. However, matching properties such as low surface energy and low friction is challenging. These characteristics are highly sought after in industries like automotive and aerospace, where performance demands are stringent.

The push to phase out PFAS whenever feasible is gaining traction, driven by regulations and growing demand for environmentally friendly products. Regulatory agencies are not only restricting PFAS but also working to better understand the risks associated with specific PFAS substances.

Last year, the U.S. Environmental Protection Agency (EPA) issued a new test order under the Toxic Substances Control Act (TSCA), requiring 3M and Wacker Chemical Corp. to test a specific PFAS chemical known as NMeFOSE, which is used in textiles, furniture and coatings. In 2023 Green Seal, a nonprofit that certifies goods and services adhering to environmental standards, declared it would eliminate all PFAS chemicals from its approved products, including paints, coatings, floor care products, adhesives and degreasers.

Strict regulations lead to strict measures. But if not PFAS, what additives are companies using in paint and coatings?

PFAS-Free Alternatives

Many end industries, including textiles, personal protective equipment (PPE), architectural coatings and personal care, use silicone-based additives in place of PFAS additives. These are currently the most reliable replacements, as silicone has comparable properties to PFAS.

For instance, silicones can achieve low surface energy levels (~25 mN/m), similar to PTFE (18 mN/m). This makes them useful for creating surfaces that repel water and prevent other substances from sticking. They can also achieve high water contact angles (around 85-90°), effectively repelling water and making them useful in coatings. While silicones do not repel oils as effectively as PFAS, they can exhibit oleophobic properties in certain applications. These include protective coatings for electronic devices, water-repellent coatings in textiles and applications where oil resistance is desirable.

Actnano, a U.S.-based company specializing in non-PFAS nanocoatings, uses silicone-based materials to create PFAS-free coatings for electronics, mobility and medical applications. Other alternatives include fluorine-free surfactants and bio-based additives such as plant oils, starch and cellulose derivatives and sugar esters. However, these alternatives are not used as extensively as silicone-based additives.

Exploring PFAS Replacements: Where Is This Change Possible?

The elimination of PFAS additives is feasible in cable and wire coatings, as most applications in this sector do not require the high performance that PFAS provides. Textiles are another sector where PFAS can be readily replaced. PFAS are commonly used in durable water-repellent (DWR) treatments, but bio-based alternatives such as waxes or natural oils offer similar properties, eliminating the need for PFAS in textiles.

Replacing PFAS coatings in PPE is more challenging. However, companies are reconsidering material choices as part of sustainability initiatives. Some brands, such as Hatley and Jack Wolfskin, now offer PFC-free (PFAS-free) outdoor gear and protective jackets. Kappler, a U.S.-based PPE manufacturer, offers ProVent, a line of PFAS-free protective fabrics for industries including healthcare and construction.

In the automotive industry, replacing PFAS coatings is significantly more difficult. PFAS-based coatings play a critical role in engine performance, reducing friction, protecting against extreme temperatures and resisting chemical degradation. They are applied to seals, gaskets, bearings and fuel system components to improve efficiency.

PFAS-free coatings in automotive applications frequently fail to deliver the same level of durability, UV resistance and hydrophobic properties as PFAS coatings. They also lack abrasion and corrosion resistance, which are essential for preventing surface damage and rust. Transitioning to PFAS-free alternatives in automotive coatings could reduce performance and shorten component lifespans.

However, ceramic coatings, often used on car exteriors, can be replaced more easily. For example, Italian company #Labocosmetica offers silicone-based, PFAS-free ceramic coatings containing TiO₂, which enhances chemical resistance and self-cleaning properties.

The Semiconductor Industry: The Biggest Challenge

The semiconductor industry presents the greatest challenge in replacing PFAS. PTFE is widely used in semiconductor manufacturing due to its chemical resistance. Anti-reflective coatings (AR coatings) applied to semiconductor surfaces improve optical efficiency, and workers in clean rooms rely on PFAS-based coatings for stain and water resistance.

Industry Response: Demand and Supply

Companies are increasingly replacing PFAS and PTFE with safer alternatives to stay competitive and meet consumer demand for sustainable products. Daikin, a fluoro-based product supplier, has developed Unidyne XF, a durable water-repellent (DWR) treatment composed of more than 50% bio-based material and free of PFCs.

The packaging, architectural paints and cookware industries are also moving toward PFAS-free formulations. AkzoNobel has launched an internal spray coating technology free of PFAS, bisphenols, styrene and formaldehyde for beverage cans.

Archroma has introduced a PFAS-free water-based coating for paper and packaging, while Linx Printing Technologies has released two new PFAS- and CMR-free inks for plastic packaging, architectural paints and medical applications.

Nano-Care Deutschland AG has launched four PFAS-free coatings designed for applications such as oil and dirt repellency for leather, dirt resistance for sanitary ceramics and graffiti removal.

Syensqo’s new product, Rhodoline HBR, eliminates fluorosurfactants from architectural paints. PPG has expanded its Malaysia factory to produce nonstick PFAS-free coatings for kitchenware, industrial applications and low-friction surfaces.

Biocoat Inc. has been granted a U.S. patent for a process that applies hydrophilic coatings to medical devices, including catheters, offering a high-performance and safer alternative.

Unilin Technologies has launched the first PFAS-free formulation for waterproof flooring coatings.

Several major companies are announcing plans to eliminate PFAS from their product portfolios. 3M plans to remove PFAS from all products by the end of 2025. BYK Additives is also ending PFAS additive production by 2025 and aims to help customers transition to environmentally friendly alternatives. The company is upgrading all facilities to PFAS-free firefighting foam.

Apple is considering phasing out PFAS in production, particularly in durability and water-repellent coatings for plastics. This transition will take time, beginning with an evaluation of the phaseout strategy.

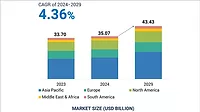

This transition is expected to occur more quickly in regions with stricter regulations, such as Europe and North America. In contrast, the shift may take longer in Asia due to more lenient regulations.

Conclusion

The paint and coatings industry is gradually eliminating PFAS, as evidenced by the shift toward PFAS-free products. However, maintaining performance and managing cost parity will remain significant challenges during this transition.

For more information, visit chembizr.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!