TiO₂ Value Chain Faces New Reality

Overcapacity, Tariffs and Strategic Shifts Reshape Market

The global titanium dioxide (TiO₂) industry is navigating a period of profound transformation, marked by persistent overcapacity, the rise of trade barriers and strategic restructuring across the value chain. Recent developments underscore the challenges and opportunities facing producers, feedstock suppliers and consumers as the market adjusts to a “new reality.”

Overcapacity and Tariffs Redefine Trade Flows

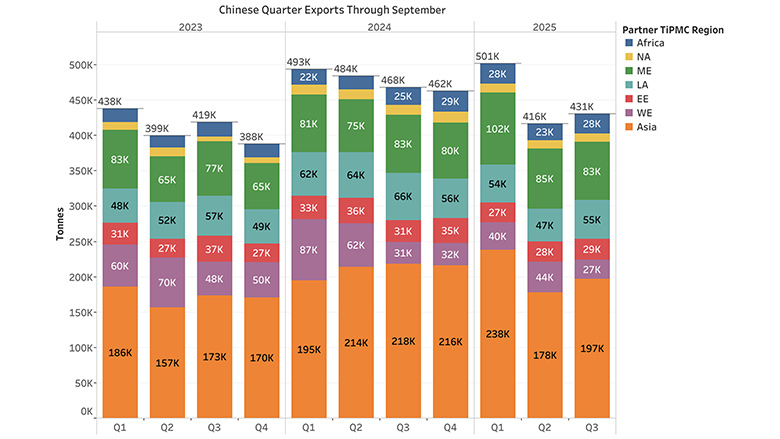

Chinese TiO₂ producers, now accounting for over 55% of global demand, have rapidly expanded capacity, outpacing both domestic and international consumption. This expansion has led to significant overcapacity, with Chinese exports becoming a critical outlet for surplus production. However, a wave of antidumping tariffs — implemented in the European Union, Brazil, the Eurasian Economic Union, India, the United Kingdom and Saudi Arabia — now threatens to restrict nearly 40% of China’s export volume. These measures, ranging from 16% to over 45%, are already impacting trade flows, with Chinese exports to Europe and Latin America declining sharply.

The drivers behind these tariffs are multifaceted: a cooling Chinese real estate market has dampened domestic demand, while state support for Chinese TiO₂ companies has fueled aggressive export pricing, often below the profitability threshold for competitors. As a result, global producers are under pressure to adapt, with some expected to pursue price increases rather than market share gains, even as margins remain tight.

Global producers are also reshaping the operating footprint. Venator, the fifth largest TiO2 producer in the world, has declared insolvency, with none of their 400ktpa of capacity operating. It was recently announced that Venator UK, which includes its Greatham facility, was recently sold to LB group, allowing LB to be the first Chinese TiO2 producer to haver operations outside of China. Part of the move was to allow LB to avoid anti-dumping tariffs, but several strategic moves are possible. The deal is subject to regulatory approval. Still, over 1M tonnes of TiO2 capacity outside of China has been idled during this decade.

Feedstock Market Restructuring and Strategic Uncertainty

The ripple effects of TiO₂ market shifts are acutely felt in the feedstock sector. Major announcements from Rio Tinto, Venator and Iluka signal a period of restructuring, with mining pauses and the review of assets for possible spin-off or sale. The insolvency and asset sales of Venator, for example, have removed significant sulfate feedstock demand from the market, raising questions about the future of sulfate plants in Europe.

Chloride feedstock demand is also evolving. The rise of Tronox as nearly fully back-integrated producer, coupled with increased use of chloride ilmenite, is reshaping supply chains. However, overcapacity in beneficiation and sluggish demand in Europe and China have led to high inventories and price pressures. Producers are responding with temporary shutdowns and strategic reviews, aiming to preserve value and rebalance the market.

Outlook: Transition and Opportunity

Looking ahead, TiPMC anticipates that overcapacity in China will persist, but the combination of tariffs, industry consolidation and disciplined capacity management could gradually restore balance of supply and demand for global producers. Feedstock prices are expected to remain stable at current levels, with potential for recovery as inventories normalize and demand — particularly in North America — shows signs of improvement in 2026.

For industry participants, the path forward will require agility and strategic focus. The interplay of global trade policy, supply chain restructuring and evolving demand patterns will define the next chapter for TiO₂ and its feedstock markets. For consumers, TiPMC believes the bifurcation of the market, between Chinese and global players will continue. The recent moves by LB Group signal the willingness of the Chinese to make moves to begin playing in markets they have not traditional participatedLooking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!