PPG Reports Q4 2025 Results as Aerospace and Packaging Lift Volumes

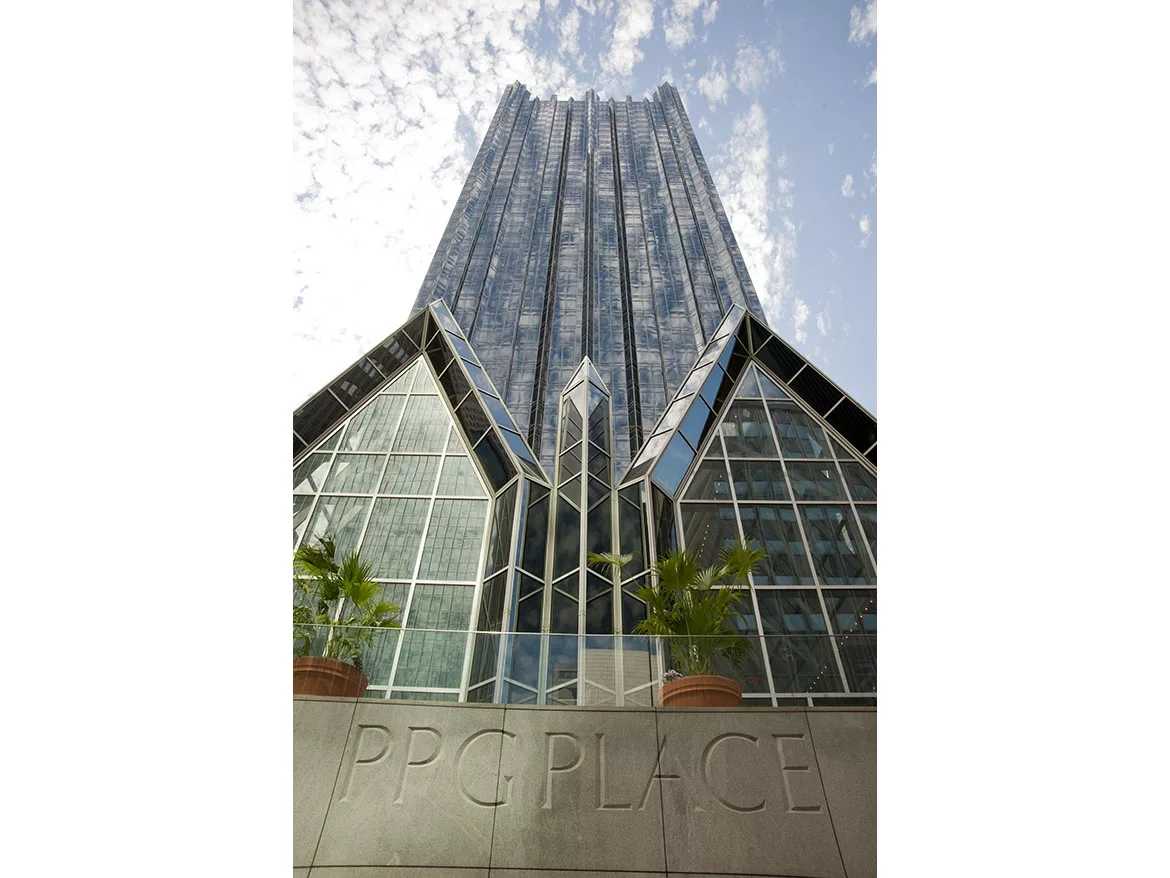

Image courtesy of PPG.

Inside this Article

- PPG reported Q4 2025 net sales of $3.9 billion with 3% organic sales growth driven by higher selling prices and volume growth across regions.

- For full-year 2025, PPG reported net sales of $15.9 billion and operating cash flow of $1.9 billion, up more than $500 million year over year, alongside $1.4 billion returned via share repurchases and dividends.

- PPG guided to 2026 adjusted EPS of $7.70 to $8.10, with growth expected to skew to the second half as aerospace, Mexico architectural demand recovery, and industrial share gains support organic sales.

PPG reported financial results for the fourth quarter and full-year 2025, citing Q4 net sales of $3.9 billion, 3% organic sales growth, reported EPS of $1.34 and adjusted EPS of $1.51. The company reported Q4 share repurchases of about $100 million.

For full-year 2025, PPG reported net sales of $15.9 billion and 2% organic sales growth driven by higher sales volumes and selling prices. Reported EPS was $6.92 and adjusted EPS was $7.58. The company reported a segment margin of 17% and segment EBITDA margin of 19% for the year. PPG also reported operating cash flow of $1.9 billion in 2025, which it said increased by more than $500 million year over year. Share repurchases and dividends totaled $1.4 billion for the year, including $790 million in repurchases, which the company said represented about 3% of outstanding shares.

In management commentary, CEO Tim Knavish said Q4 organic sales growth reflected both volume and pricing, with all regions delivering sales volume growth. He said results in the Global Architectural Coatings segment improved sequentially through 2025, with Q4 organic sales growth of 2% supported by a sequential recovery in Mexico project-related sales and strong retail sales, while demand in Europe remained mixed.

Within Performance Coatings, the company reported 3% organic sales growth in Q4, led by aerospace coatings and protective and marine coatings, partially offset by lower automotive refinish coatings demand that PPG attributed to customer order patterns weighted toward the first half of 2025. PPG said Q4 pricing in the segment improved 4% year over year, which it tied to demand for technology-advantaged products and services. In Industrial Coatings, the company reported 4% organic sales growth in Q4, attributing the increase to share gains. PPG highlighted that it outpaced industry production in automotive OEM coatings and industrial coatings and said packaging coatings delivered double-digit volume growth in the quarter.

By segment in Q4, PPG reported Global Architectural Coatings net sales of $951 million, up 8% year over year, with segment income of $137 million and segment income margin of 14.4%. Performance Coatings net sales were $1.322 billion, up 5%, with segment income of $246 million and segment income margin of 18.6%. Industrial Coatings net sales were $1.641 billion, up 3%, with segment income of $200 million and segment income margin of 12.2%.

PPG also outlined cost and balance sheet items. The company said actions to reduce global structural costs yielded $75 million of benefits in 2025 and it expects incremental restructuring savings of $50 million in 2026 tied to European manufacturing consolidation and other structural cost reductions. PPG reported net debt of $5.1 billion, about $630 million higher year over year, and noted a $700 million debt maturity due in the first quarter of 2026. Corporate expenses were $114 million in Q4, which the company said increased primarily due to higher medical claim expenses and a true-up of incentive-based compensation tied to higher organic growth and strong cash generation in the quarter. Net interest expense was $34 million in Q4. PPG reported an effective tax rate of about 20% in Q4 and an adjusted effective tax rate of about 24%.

Looking to 2026, PPG said it expects demand in Europe and in global industrial end-use markets to remain challenged. The company projected full-year 2026 adjusted EPS of $7.70 to $8.10, and said organic sales are expected to be flat to low single-digit percentage growth for the year. PPG said EPS growth is expected to be weighted toward the second half of 2026, with the first half flat to low single-digit percentage growth and the second half increasing to high single-digit percentage growth.

Follow ongoing developments in Industrial Coatings through PCI’s topic page.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!