Acquisitions Reshape the Face of the Paint Industry

A major reshaping of the paint industry structure has occurred in recent years, due primarily to mergers and acquisitions. Large and mid-sized producers have been acquiring smaller producers to expand their product lines and geographical coverage.

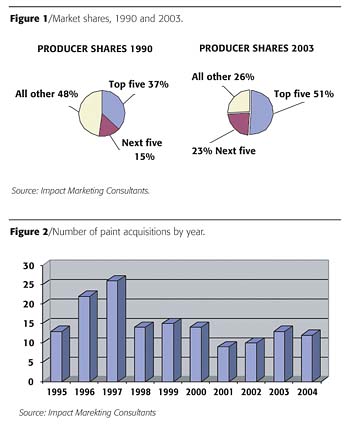

As an example, in 1990 the top five companies controlled only 37% of sales, and the leading 10 held just over half. By 2003, the five largest producers dominated with 51% of industry sales and the 10 largest had almost three-quarters (Figure 1). Gone are some of the old names - DeSoto, Lilly, Guardsman and Grow Group, with their operations now held by others.

What has been spurring this desire to get bigger? First, the industry has long been fragmented. Each of its three major segments, architectural coatings, industrial OEM coatings and special purpose coatings, has supported hundreds of producers. With increasing pressure in recent years to reduce costs, many of the smaller and mid-sized suppliers have decided to sell or merge. Secondly, larger size means lower R&D expenditures, reduced shipping costs, and the ability to negotiate higher prices and terms from customers.

Some major acquisitions in recent years include Sherwin Williams' acquisitions of Pratt & Lambert, United, Krylon, Thompson Minwax and Duron; Akzo Nobel's purchases of Courtalds and Ferro's powder coatings business; RPM's acquisition of Rust Oleum; Valspar's purchase of Lilly; Berkshire Hathaway's acquisition of Benjamin Moore; and Comex' purchase of Professional Paint.

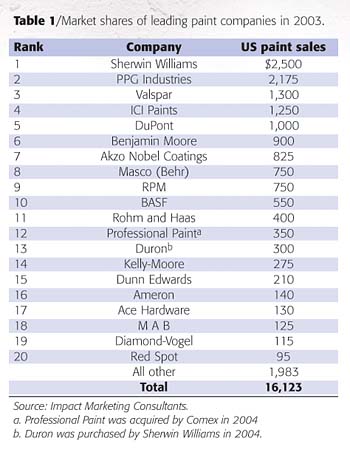

Since 1990, 13 of the leading 40 suppliers have been acquired, or have gone out of business. Although there have been several major mergers and acquisitions over the past several years, the total number of acquisitions has actually declined as fewer of the smaller and middle-sized companies have been acquired. The number of acquisitions peaked in 1997, and has remained at 10-15 annually since that time (Figure 2).

According to the latest Rauch Guide, Sherwin Williams is now the leading supplier of paint in the United States and controls 15% of the business (Table 1). It is active in all segments, and has some 22% of the architectural sector, 5% of OEM coatings and 16% of special purpose coatings. PPG is a close second to Sherwin Williams, having 13% of the industry sales. Other leaders are Valspar (8% market share), ICI Paints (8%), DuPont (6%) and Benjamin Moore (5%).

What does the future hold? The industry supports about 1,200 participants, and some of these will obviously be acquired over the next five years. However, we don't expect as many large deals, as the leading companies already control a large part of the market. When acquisitive, the leading companies will most likely fill in their needs with niche acquisitions where they have geographical or product line needs.

Expansions within market segments are the most likely acquisition strategies. For example, Sherwin Williams and ICI both hold a relatively small position in OEM coatings, and Behr, Professional Paint, Kelly Moore and Dunn Edwards have no products in either OEM or special purpose coatings. Conversely, some leading companies do not market architectural coatings, and might consider diversification. Overall, we expect the number of paint acquisitions to remain at 10 - 15 annually, with most being smaller and mid-sized deals.

About Impact Marketing

Impact Marketing Consultants, Inc. (IMC), founded in 1996, aids clients in the paint, coatings and other process industries by providing market information, planning strategies and developing acquisitions.IMC also publishes the well-known series of Rauch Guides, which have been serving industry for over 20 years. Details for this article come from the sixth edition of the Paint Guide, recently issued. The Guide provides detailed market data for the industry, including market shares and size by segment, government regulations, raw material consumption, and unique profiles of 665 industry suppliers. Users describe the Guides as the best cost-effective source of market information.

For further information, contact Impact Marketing at 802/362.2325, comments@impactmarket.com, or visit www.impactmarket.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!