Identifying and Improving Customer Account Profitability (Part 2)

The coatings market is mature and highly competitive. Understanding profitability sources and cost drivers associated with individual accounts can be a market advantage. This analysis will identify profit-improvement opportunities that will immediately add to your bottom line. You will identify those areas where you are the most successful and therefore develop your strategy from a position of strength. You will identify areas of poor performance that can be addressed, and you can stop wasting resources on unprofitable areas. Our experience has shown that undertaking an account profitability improvement initiative can improve a business' overall profitability as measured by Earnings Before Interest and Taxes, EBIT, by as much as 2% of sales. According to David Sherman, president of Absolute Coatings, a leading wood floor coatings company headquartered in New Rochelle, NY, "This is one of the best things that we have done for our business recently. Using the Orr & Boss approach has enabled us to improve our corporate profitability by a significant amount."

Undertaking an account profitability improvement initiative is a five-step process:

- 1. Costing System - A product costing system that fully and accurately assigns product costs must be implemented.

2. Profitability Modeling - All costs associated with individual accounts are identified and assigned to specific accounts. A four-quadrant analysis is then conducted to segment the high-performing accounts from those with poor profitability.

3. Profit Improvement Planning - Account-specific action plans are prepared and executed for accounts with poor profitability.

4. Strategic Planning - The results of the profitability analysis and the four-quadrant analysis are used to identify those areas where the company should focus its resources.

5. Ongoing Systems - It is important to assure that the account profitability process becomes institutional and not simply a one-time event. This requires an ongoing profitability-monitoring system as well as a new account pricing system.

Product costs are generally the greatest single cost for any account. Therefore, product gross margin, PGM, is the starting point for all profit analysis. This makes having an accurate costing system foundational. A failure to assign product costs properly will result in a fundamentally flawed analysis.

Orr & Boss advocates the use of a costing system that measures the actual cost to produce products and assigns them to the individual products whenever possible. While this type of system is much more difficult to accomplish than other systems, it will provide the means to understand the true product costs.

There are five main steps to develop this type of costing system:

- a) Identify product characteristics that add cost to products;

b) Develop labor standards for each manufacturing process;

c) Identify and apply cost for quality control, and research and development;

d) Identify overhead costs to be applied and the basis for applying these costs;

e) Bring it all together.

Profitability Modeling

With an effective costing system in place, the first task is to identify the components of cost. Outside of product costs, the single largest cost component is generally sales cost. Other costs will typically include items such as technical support, marketing, freight, warehousing and administration. It is important to note that every company is different and these components of costs must be determined on a case-by-case basis. It is important to get input from across the company to assure that all of the costs associated with specific accounts are captured.The second task is to measure the cost components. Sales costs, typically the largest component of cost outside of product costs, include the salary and benefits of salespeople, their expenses as well as customer entertainment expenses. Systems to measure these items must be put in place where they currently are not. This can sometimes seem like a daunting task, but it does not have to be complicated. These costs can be effectively measured with a simple spreadsheet. Oftentimes, the components of costs are already being measured. It is just a matter of bringing the data together.

Task three is to link the costs to specific accounts. As it was illustrated in Part 1 of this article, allocations result in misinformation. Costs must be directly linked to specific customers. This is the only way to determine true profitability. Once costs have been identified and measured, companies often try to simply allocate these costs on a percentage basis. This type of analysis offers little insight and can create delusions of profit where none exists. A customer-profitability analysis based on allocation will dilute the profitability of your best accounts and hide the presence of unprofitable accounts. The need for direct assignment of cost is illustrated in Table 1.

While it is important that specific costs are assigned to specific accounts, it is not always possible. In this case, costs need to be allocated only to the subset of accounts affected. For example, Orr & Boss recently worked with a client that had one product line that required an inordinate amount of advertising and promotion. To properly determine the impact of this expense, the costs were allocated based on percent of sales to only those accounts that purchased the product line in question - in this case, only about one-quarter of their customers. This analysis illustrated that the product line in question had to be sold at a higher margin to support the added marketing expense.

As was the case with product costing, the analysis alone will not change your costs and resultant profitability. It will, however, allow you to clearly identify high-profit and low-profit accounts. The results of this analysis can be quite revealing. As was stated by Brian Kostyk, the national sales manager for Para Paints, "While we had a good idea of what the profitability was for most of our customers, we were surprised at the profitability of a few of our larger accounts."

Having constructed the profitability model and determined the profitability of each account you can begin to manage account profitability. Task four of this step is to separate the good accounts from those that are not as good. This is accomplished using a standard, four-quadrant analysis (Figure 1). The two axes used in the analysis are gross margin dollars and the contribution income percentage. Therefore the ideal accounts, those in Quadrant 1, are those that generate a lot of gross margin dollars and are highly profitable. The most undesired accounts, those in Quadrant 4, are those that only generate a small amount of gross margin dollars and are unprofitable.

The final task of profitability modeling is to analyze the results of the four-quadrant analysis. After segmenting your accounts into the four quadrants, you need to try and identify the similarities and differences that characterize accounts in each quadrant. Characteristics to examine include customer type, product niche, product mix, channels of distribution and geographic location. Understanding what makes an account a winner or loser will form the basis of future tactical and strategic decisions.

As part of this analysis it is important to not only look at each individual account but to also examine the profitability of business segments and sales territories. This can be accomplished by simply rolling up the data for the accounts in a given business segment or sales territory. It is not uncommon to find significant differences in account profitability from salesperson to salesperson, even when all external characteristics would seem to be the same. Quite simply, some salespeople are much better at selling value, while others are only able to sell on price.

Profit-Improvement Planning

Our experience suggests that you should focus on the problem accounts first. This would include Quadrant 3 and Quadrant 4 accounts. The Quadrant 4 will deliver a few quick hits and easy decisions. For this quadrant, you should quickly determine which accounts could be improved. For those that cannot be improved, the customer should be dropped.Quadrant 3 is where most of the work will need to be done and where you stand to make the most impact. There will be some very difficult decisions in this quadrant. By and large these are bigger accounts. Profitability will be more difficult to improve, but it is important that an attempt be made to address each individual account. Where profit cannot be improved, you may not be able to drop these accounts simply because of the large revenues delivered by the customer. For these accounts, long-term plans need to be put in place to replace the customer, reduce overhead or otherwise improve profits.

After the accounts in Quadrants 3 and 4 have been addressed, the Quadrant 2 accounts can be worked on. These are generally small but profitable accounts. The best means of addressing these accounts is to look for ways to make them grow. If this is not possible then a harvest strategy should be adopted.

Quadrant 1 accounts are your best customers. You must take care of these accounts because you cannot afford to lose them. These accounts generally deliver the majority of all of your company's profits.

Having identified the Quadrant 3 and 4 accounts the next task is to develop detailed action plans. As was previously stated, most emphasis should be on Quadrant 3. In the profit-improvement plans you should identify unnecessary or excessive costs and try to develop means of eliminating or defraying them. There is no universal panacea. This must be done on an account-by-account basis. It is also important to remember that price is not your only profit lever.

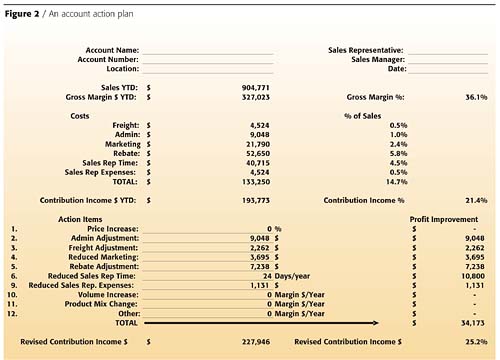

It is very important that sales and marketing are involved in this process. It is equally important that you talk to your customers. This is an opportunity to be creative. By and large, customers understand that you are not running a philanthropic organization. They understand the need to make a profit. One excellent tactic is to talk to your customer about the services that you provide and try to determine those that are truly valued. Ask the customer what services they would be willing to pay for. An example of an account action plan can be seen in Figure 2.

Once the plans have been established they must be executed. This may well be the hardest part of the process. Because it is up to sales to deliver the message, it is important that they be involved throughout the entire process. It is equally important that senior management be committed to the process. You will lose some business. However, the accounts that are lost are almost always extremely unprofitable and should go away if they are not willing to change. When dealing with difficult accounts, it is important to remember that not every component of the profit-improvement plan has to occur at once. You can adopt a progressive approach and work towards small, incremental gains. Every step forward is more profit than you are making today.

Strategic Planning

It has often been said that battles are won or lost based on information. The information gained through account profitability modeling will help you win marketplace battles. You have identified the good accounts and the accounts that need work to make them profitable. You have determined which accounts can be fixed and which can't, and you have also identified what separates winners from losers for your business. This information will allow you to make rapid, informed, tactical business decisions. It will also allow you to craft a business strategy that will deliver sustained profitable growth.Tactically, the customer profitability information can be used in a number of ways. First, the profit model itself can be used to help in pricing new business. Second, the four-quadrant analysis can be used to help in determining resource allocation. If your technical department is faced with limited resources, which accounts get priority? Clearly it must be the Quadrant 1 accounts. In addition, having identified what creates winners and losers, sales efforts can be directed to focus on potential winners and away from potential losers. Ideally, sales and marketing should target potential clones of your Quadrant 1 accounts.

Strategically, the customer profitability initiative will identify the business units, geographies and channels of distribution where you make the most money and where you have the greatest opportunity for success. This information can be used to direct investment. This would include not only investment in property plant and equipment but personnel investment as well. The information will also identify areas for divestiture. In a recent customer profitability initiative, Orr & Boss identified a product line that added significant manufacturing costs to the operation. In addition, the accounts that purchased this product line were not profitable. Our client was able to divest the product line at a premium, while at the same time reducing operating costs and improving customer profitability; a truly winning strategy.

Ongoing Systems

Managing account profitability must become a way of life. The best way to achieve this goal is to institutionalize the systems needed to monitor and report account profitability. As was previously stated, oftentimes the systems are already in place and simply need to be brought together. Where they do not exist, new systems must be put in place that directly link specific costs to specific accounts. While it does vary from company to company, in general, the information that should be linked to customer revenues will include product costs, sales costs, marketing support, technical support and logistics. This information needs to be communicated to sales management on a monthly basis. In addition, profit improvement plans for Quadrant 3 accounts should be reviewed on at least a quarterly basis.

An additional ongoing system that should also be modified is compensation. The company must become profit focused as opposed to revenue focused. To accomplish this goal, a portion of the compensation for the sales force, sales management, marketing and even senior management should be tied to profitability, not just revenue. However, prior to changing the compensation program it is important that you be able to easily and accurately measure account profitability.

Conclusions

In today's market, coatings companies need every advantage they can get. Most companies recognize the need for cost control and have taken steps to improve profitability by reducing costs. These efforts have largely centered on trying to reduce manufacturing costs or corporate overhead. While these efforts are very worthwhile, they generally ignore a significant portion of your company's costs and they fail to address profitability at the source, the customer level.The account profitability initiative will have significant short- and long-term benefits for your company. In the short term, identifying high-profit and low-profit accounts will tell you which customers you must hold on to and which customers require a profit-improvement plan. In the long term, having a fundamental understanding of where and why your business makes money will allow you to make sound tactical and strategic decisions. Most importantly, by eliminating unnecessary costs and focusing on what you do best, your company will reap greater profits both today and in the future.

For more information, contact the authors at 734/453.3033.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!