Driving Innovation by Collaborating With Others

Prefer the magazine experience? Subscribe to our digital issue.

Meeting the technical and product needs of all your customers can be very challenging, especially if R&D resources are constrained or you do not have the right in-house expertise to deliver a timely response. A faster technology solution to some of your needs might be found outside of your company, in a university or Federal laboratory, startup company or research institution. In order to find those solutions, you need a plan that includes scouting the technology, understanding its feasibility and status, and developing a collaborative relationship with the right technology partner. Scouting for opportunities outside your company is a process. It starts by clearly defining your needs in a way that any university or startup, unfamiliar with your business, can understand and offer potential solutions. These needs can be grouped into what I refer to as focus areas.

Focus Areas

The list for all your unmet customer needs can be extensive, but it helps when they are grouped into focus areas. A focus area is a key technical opportunity for commercialization that addresses the strategic needs of individual business units and their respective plans for growth. Defining focus areas is not easy, but it is critical to driving business through innovation. In fact, Einstein said, “If I had 20 days to solve a problem, I would spend 19 days defining it.” Obviously, Einstein had the foresight to know that a lot of homework goes into characterizing problems in order to describe them to others. From the definition above, it is clear that you must understand what is absolutely necessary to drive the business and meet the needs of particular customers in each business unit (BU). Although BU managers may be busy, it is imperative to gather needs from key stakeholders and prioritize the list to at least the top 10 requirements.

Each BU must be able to explain how solving this problem will add to the growth of the company. This usually means numerous customer interviews and internal discussions to validate the choices made. It takes deliberate effort to distill the needs of your customers down to a meaningful list of potential growth opportunities. To make things more complicated, our fast-breaking global economy can shift priorities overnight. Change comes faster now, and focus areas will also need to pivot accordingly.

After gathering the needs from all the BU managers, group them into common focus areas, and describe them using language that anyone can understand and does not restrict creative approaches. For example, instead of needing a new ergonomic paint brush, modify this to needing a new method of applying paint. Doing so leaves the door open for many possible solutions to your problem. In large companies, focus areas from different BUs will likely overlap and can be merged into a common focus area list for the entire company to share with outside potential collaboration partners.

Why is all of this important? Large companies operate very differently from universities and startup companies because they are at opposite ends of the commercialization value chain. Universities have a mandate to educate, publish groundbreaking research and spin technology out into startup companies, while corporations need to sell products to maximize shareholder value. So, in order for corporations to take advantage of external collaboration partners, like universities and startups, they must learn to translate their needs into a common language that can be understood by anyone.

Technology Readiness Levels

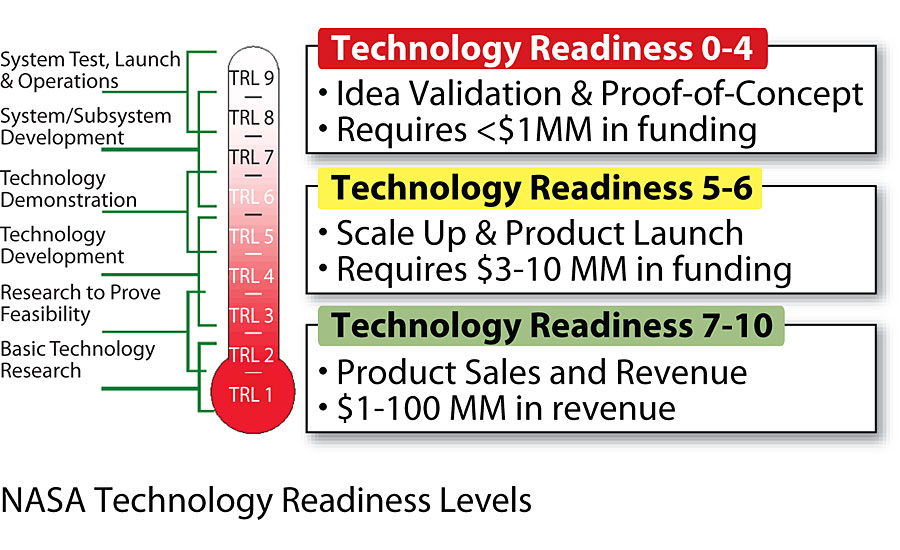

It is a challenge to sift through many potential opportunities to understand which one is right for you. One way to narrow the field is to decide early in the scouting process what Technology Readiness Level (TRL) is acceptable for your organization. TRLs were originally conceived at NASA in 1974 and formally defined in 1989 as a method for defining the maturity of a technology. Early-stage technology has a high risk of failure as it is still in the discovery and proof-of-concept stage. However, the higher the TRL, the lower the associated risk factor, because further development lowers the chance of commercial failure. Each TRL has an associated list of activities and funding needs. Generally, TRL 0-4 describes a technology that has been validated through proof-of-concept work, while TRL 5-6 describes a technology that has been scaled up for small production and is ready for limited product sampling and launch. TRL 7-10 describes a product that has early stage sales and revenue (Figure 1).

If you are risk averse, then avoid technologies that are too early-stage for your needs. However, if there is a technology that has been proven to work, then prepare to pay more for its use. Most scouts like to search for technologies at TRL 5-6 because there is enough data to review and, if the technology meets some of your needs, it may be available at an attractive price. Early-stage funding usually comes from government grants, while funding in the later stages can be a mix of venture capital, grants and sales.

Collaboration with Others

Working with universities and startup companies presents larger corporations with a unique set of challenges. They are fundamentally different in many ways, as they do not speak the same language nor operate under the same timelines. There are some essential questions to ask in order to understand if they have the right tools and expertise to deliver the technology you need.

- Who are they and how are they staffed? It is essential to have a person primarily rooted in the technology, others to do work in the lab and most importantly, a leader who has some business experience. Academic and business backgrounds represent two distinct skill sets, but each must be strong for long-term survival of a small technology company.

- How are they funded and for how long? Typically, receiving National Science Foundation SBIR funding is a good signal that expert government reviewers believe there’s a good team in place to get through to a proof-of-concept. Do they expect money from you? How much? For how long? Are there any obligations to venture capital groups or other funders?

- What is the status of their intellectual property (IP)? Are there other countries covered besides the U.S.? Sometimes universities may hang on to some IP in order to help a startup build capability. Having leverageable IP is essential to meeting your long-term business needs. Know who owns the IP, for how long, and for what technology space/vertical. Understanding their licensing terms is essential.

- Does the IP represent an addition to existing technology, raise the bar to another level or is it truly a breakthrough? None of these excludes the other if there is technology you feel helps your business. But breakthrough technology typically needs a longer ramp up to commercialization with a higher risk of failure.

- How much current IP exists in this technology space? Too much may leave you little room to maneuver, too little could present more risk that needs further long-term research. You will need to do your homework here.

- Where are they in their technology roadmap? Do samples, prototypes and data exist? How much?

- How do others address this technology need? Are there other more viable and simpler options available to your competitors if you introduce this technology? Do not be blindsided by shiny object syndrome and fall in love with the technology.

- Does their culture match yours? Flexibility and trust on both sides helps the relationship grow. If there are difficult stakeholders, this may not be a productive collaboration.

- Will this technology differentiate you from your competition in a way that will disrupt their momentum? A startup will not be able to answer this question for your business.

Vetting the Potential Solution

Once potential technology solutions are found, they must be vetted to determine feasibility. Sometimes the collaboration partner can provide some data, however, it is better to test under conditions that meet your specifications and needs. Vetting new technology can be tricky, as new materials may not behave in conventional ways. They may work at lower or higher levels than expected in your tests. They may need special processing techniques or no processing at all. It may take a little time to prove it delivers the desired solution to your problem or it may work right away. Generally, it takes experienced and observant lab staff to evaluate new technology. It is a skillset that requires a level of curiosity, inventiveness and years of formulating knowledge to determine if your problem can be solved. There is also the need to be able to walk away from a technology if, after trying hard to make it work, it fails. Clear goals, timely vetting and good communication between all collaborators prevents the process from suffering scope creep.

Finding the right collaboration partner, vetting their technology and working to secure a technology solution for your business is a process that requires special expertise. A practiced technology scout serves as a bridge between small technology providers and larger corporations. The relationship can be delicate and requires nurturing on both sides in order to deliver innovations that can be commercialized. Ultimately, driving your innovation process by collaborating with others can deliver new technology and new products for your customers. It starts by describing your focus areas in common language, scouting many potential opportunities, vetting new material technology and establishing a collaborating relationship with a trusted partner.

For more information, contact Dr. Victoria Scarborough at vscarborough@chemquest.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!