Turning Over a New Leaf

Growth, Evolution, Interconnectivity, and Collaboration

realrocking, Creatas Video+, via Getty Images

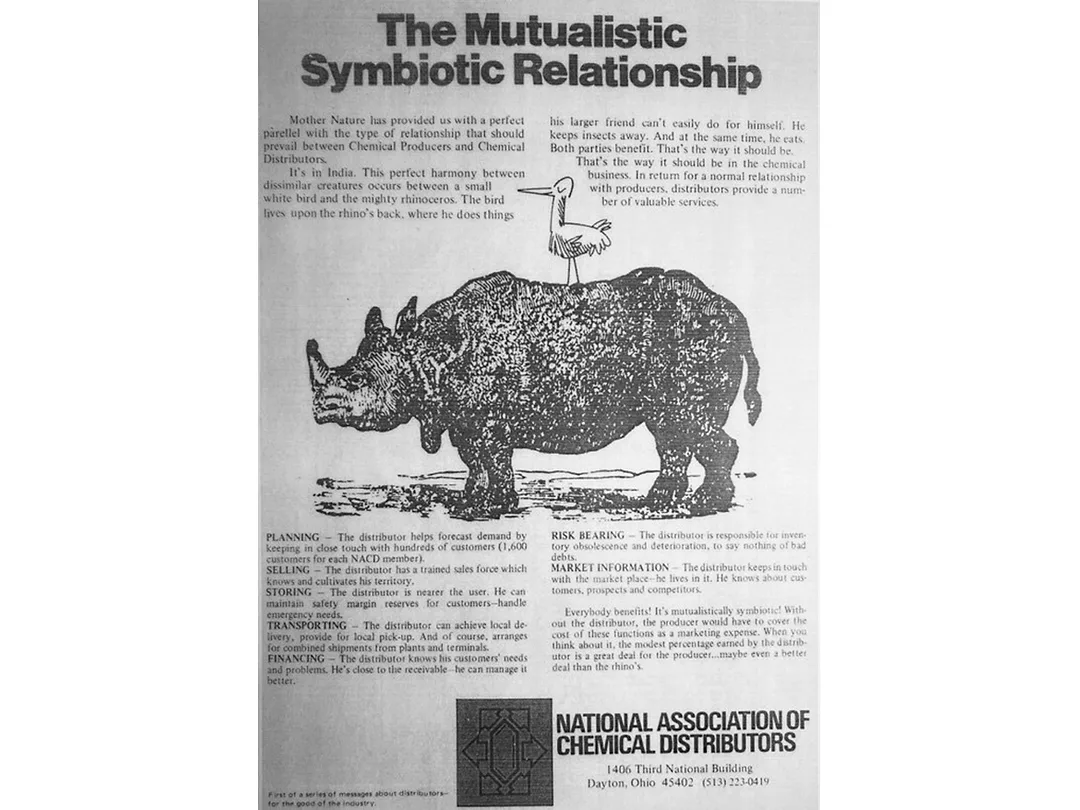

An NACD ad from the early days.

Image courtesy of ACD.

If you’re particularly observant, you may have noticed that our column has a new look and feel, and a new name – Distribution Dive. Sure, the change from Distributor Dive to Distribution Dive may seem subtle, but there’s a lot of thought behind it. In fact, it’s driven by our rebranding in November of last year from the National Association of Chemical Distributors (NACD) to the Alliance for Chemical Distribution (ACD).

What’s In a Name?

Using a road atlas or calling the office from a pay phone sound archaic nowadays, yet both were standard practices when NACD was founded back in 1971. Those original NACD members were predominantly chemical distributors.

And since then, NACD has supported most companies that consider themselves chemical distributors. Our modest, but mighty, organization has developed education and networking opportunities that nurture unparalleled thought leadership and peer-to-peer problem solving in the industry. We have built the industry’s most comprehensive environmental, health, safety, security, and sustainability standard. And, we have used those principles along with our daily advocacy outreach to drive effective policy on the industry’s behalf.

Today, members of the chemical distribution industry are much more diversified. They are not only distributors, but also proprietary blending specialists, tollers, marketers, warehousers, specialty manufacturers, and more. In fact, on average, companies in the chemical distribution industry choose more than three different business functions to describe what they do. As our members diversify and the chemical distribution supply chain evolves, it is imperative that we reflect that diversification and fully support all of the experts who play a role in ensuring the high-quality chemical products essential to our daily lives get where they need to be, when they need to be there.

Hence our new name, Alliance for Chemical Distribution; new tagline, Empowered Performance. Unrivaled Expertise.; and new brand conviction of “backing the experts our world depends on.”

Paint, Coatings, and Chemical Distribution

The paint and coatings industry has an even longer history than that of chemical distribution. Paint in its earliest form was used by cave dwellers tens of thousands of years ago. And there are instances of beeswax and other materials being used as protective coatings more than 5,000 years ago. Of course, the modern paint and coatings industry was born during the Industrial Revolution and has played an invaluable role in just about every innovation since then, from automobiles and space flight, to cell phones and solar panels.

Paint and coatings were early primary customers of chemical distributors. In fact, NACD was “born” at paint and coatings industry events! The “founding father” and first president of NACD, Gerald “Jerry” G. Kraft of Kraft Chemical Company in Melrose Park, Illinois, first started buttonholing chemical distributors and chemical agents at the 1969 Paint Show in Chicago. The formation of an association was first seriously explored at the October 1970 Paint Show in Boston. Meeting participants even considered organizing under the umbrella of the National Paint, Varnish & Lacquer Association (NPVLA), which later became the National Paint & Coatings Association and is now the American Coatings Association.

The close affiliation and collaboration still exist, and both industries have continued to grow and thrive. Today, nearly two-thirds of ACD members work with customers in the paint and coatings industry.

Chemicals and chemical products are used in nearly every U.S. industry and contribute to the improvements in our health, safety, and comfort. From the medicines we take, to the filtration of our drinking water, and even the interior coatings of our steel and aluminum food cans, chemicals are consistently present in our lives, and the chemical industry is a vital component of our economy.

In fact, companies engaging in chemical distribution have a total direct economic impact of more than $27 billion while employing more than 75,000 people with good-paying jobs.

As one of the most dynamic sectors globally, the paint and coatings industry not only serves a wide range of needs for customers, but it is expected to experience tremendous growth over the next few years. The global size of the market in 2022 was valued at $164 billion, with a projected growth of $171.5 billion in 2023, and $241 billion by 2030. In recent decades, the industry has navigated evolving market trends, changing customer demands, new technological advancements, and updates to regulatory compliance.

Over the last few decades, both the chemical distribution and paint and coatings industries have experience transformational changes due to increasingly integrated supply chains, technological advancements, and evolving consumer demands.

Despite these changes, paint and coatings professionals and their supply chain partners, like chemical distribution companies, have remained nimble. As we begin the New Year, we are reflecting on the significant trends in both of these industries and looking into how we can remain competitive in the 21st century global economy.

Advancements in the Paint and Coatings Industry

Since paint and coatings are used in a variety of industries, such as the automotive, construction, and transportation sectors, there has been a significant trend among customers who are looking for more sustainable products and greater transparency throughout all facets of the supply chain, particularly since many of these materials can be hazardous. Today, customers are holding these companies to a higher standard, requiring products that have low volatile organic compounds (VOCs), or water-based and solvent-free coating formulations to minimize air pollution and negative health effects. Suppliers and producers are also requiring greater product life cycles and more transparency on the impact of their products, calling for supply chain processes that minimize waste and use renewable materials.

One way the sector has addressed this growing focus on sustainability is by investing in innovative technologies to bring long-lasting, durable, and sustainable products to market. From harsh weather conditions, to corrosion, and even aesthetics, paint and coatings professionals have prioritized research and development to create cutting-edge products that not only meet the needs of their customers, but also give them the tools to stay competitive and diversify their offerings. For example, formulation technologies within adhesives, coatings, weather resistant, solvent-borne, and nanotechnology have played a central role in enhancing efficiencies and customer loyalty.

The sector must also meet stringent and evolving environmental, safety, and quality standards. As one of the more heavily regulated industries, the chemical sector, including its paint and coatings partners, has adopted new coating technologies to adhere to these environmental regulations, such as powder, water-based, and ultraviolet and low-emitting coatings.

Demands from customers for smarter and more sustainable products will continue to grow. These shifts represent a tremendous opportunity for businesses of all sizes to create value, drive growth, offer products that better align with customers’ needs, increase efficiencies, and mitigate risks in the future.

Chemical Distribution, Then and Now

The chemical distribution industry isn’t new to change either. Moving chemicals requires deep expertise and a steadfast commitment to safety. From manufacturers to producers, blenders, warehousers, transporters, and tollers, our industry links producers and end-users, like paint and coatings professionals, with the products and services they need to keep their businesses running.

Amidst the backdrop a global pandemic, chemical distribution was recognized as an essential industry and workforce in the nation’s crisis response, facing unprecedented supply chain disruptions and challenges to maintain essential industries during this time of need.

After navigating logistical curveballs, market disruptions, and uncertainty over the last few years, the industry has emerged more equipped to tackle challenges. This return to normalcy, however, has brought with it more rigorous regulations. For example, the re-institution of the Superfund Tax has placed additional administrative burdens and costs on companies, particularly small, family owned businesses. The scope of this tax is far reaching and complex, and businesses are still trying to incorporate the impacts of the tax into their business operations while urging the U.S. Internal Revenue Service (IRS) to clarify its guidance to assist with compliance.

The changing regulatory environment is paired with daily challenges that distribution professionals must face. This includes working with the U.S. Federal Maritime Commission (FMC) to hold ocean carriers accountable to their outrageous shipping practices, managing truck driver shortages across the nation, and narrowly avoiding rail and port labor strikes last year, which would have halted the essential transportation of chemical products.

Sustainability has also been top-of-mind for distributors and their end users. By identifying opportunities to increase fuel efficiencies, lower waste, and invest in renewable energy, businesses of all sizes have recognized the importance of these evolving sustainability practices and made it a priority to integrate these initiatives into their business planning.

Despite high labor costs and additional regulatory burdens, chemical distribution companies are managing their supply chains, maintaining their commitment to sustainability practices, and adapting to a new wave of technological advancements to stay competitive in today’s economy.

Conclusion

Both the paint and coatings and chemical distribution industries are undergoing various changes, which have brought new technological advancements and sustainability initiatives to the forefront of their businesses. These changes ensure that companies, end users, partners, and producers remain competitive in an evolving global landscape.

Despite regulatory changes, differing customer demands, and complex supply chain challenges over the last few years, our industries’ businesses have quickly adapted and remained nimble. As we look to improve the efficiency, productivity, and safety across the supply chain, ACD will continue to champion our partners and support their empowered performance and unrivaled expertise for the paint and coatings industry and others into 2024 and beyond.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!