“Green Shoots” Beginning to Appear

Global TiO2 producers unanimously agree that 2023 was a very difficult year. Low sales volume, share loss, and high costs were all issues faced by multi-national producers (MNPs). However, fortunes apparently are beginning to turn. What is behind the improved mood, and is it certain to last? Current data is mixed, but there is very good logic that the worst may be behind it for global TiO2 producers.

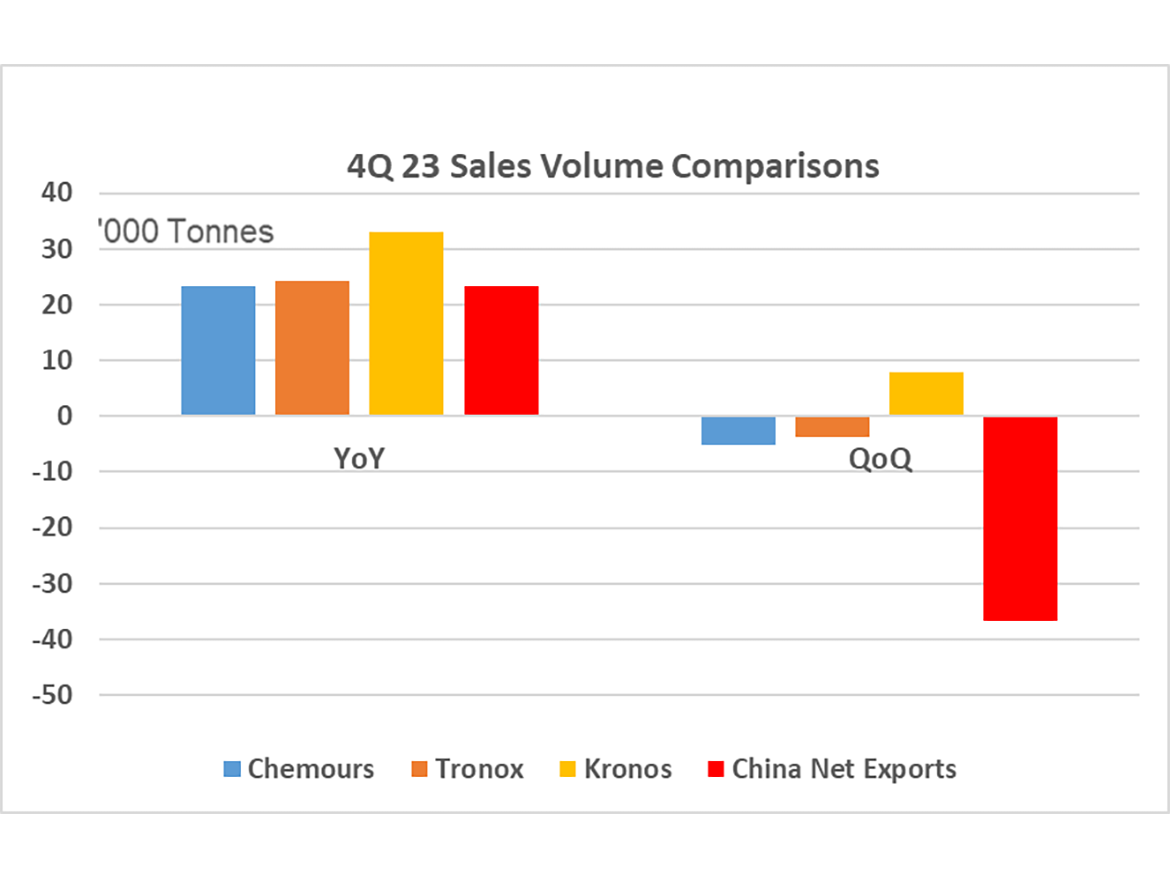

Producers reported improved fourth quarter results relating to sales volumes (Figure 1). Although 4Q22 was a weak comparison for both companies (shown in Figure 1) in terms of volumes, lack of the normal seasonal decline in 4Q23 vs. 3Q23 is a very good sign for TiO2 producers.

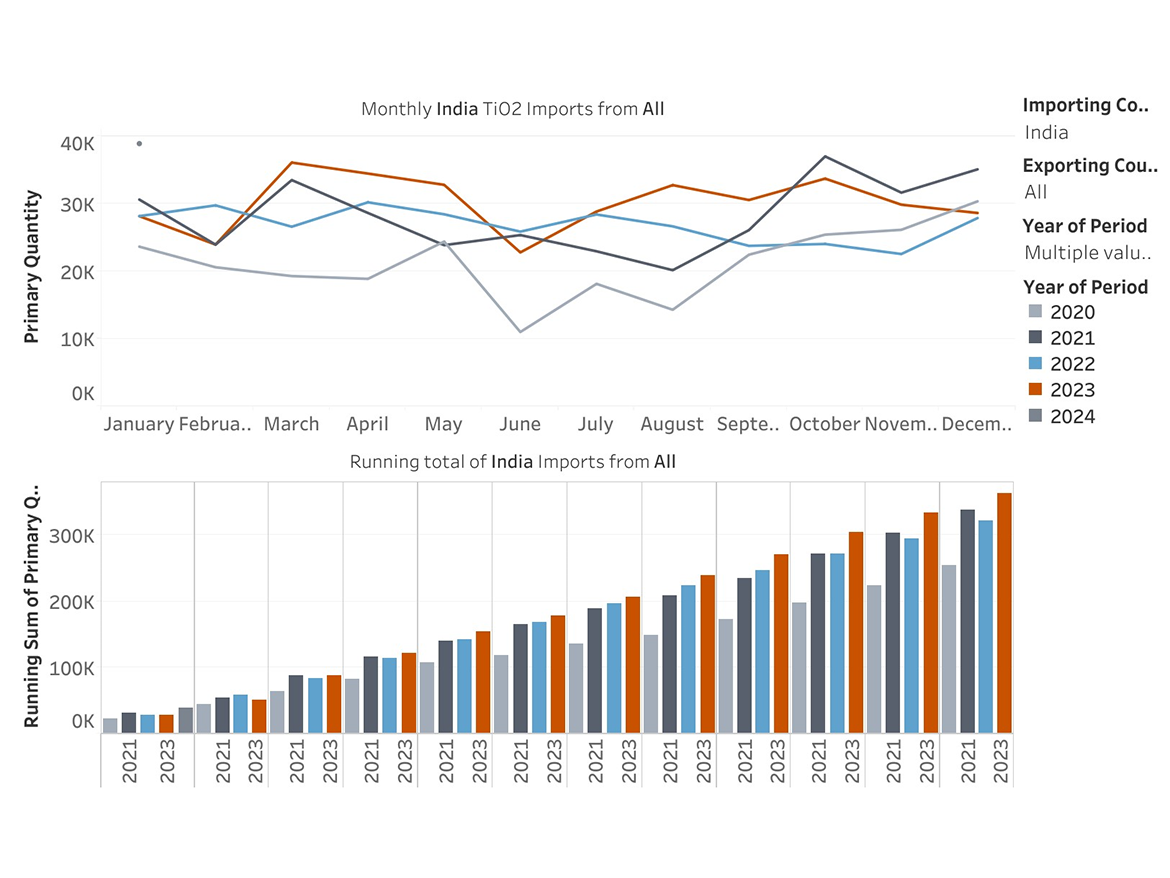

Inventories throughout the supply chain appear to be significantly lower than the previous year. Consumers are believed to have reduced their inventories to very low levels, on the back of reduced underlying demand and TiO2 prices remaining elevated among global producers. Coupled with signs in increased underlying demand throughout Asia and other developing regions, signs are for improved sales for the first half of 2024 (Figure 2).

What Does it Mean for TiO2 Consumers, and What Can Be Expected in the Future?

Pigment consumers have experienced a very long market for TiO2, as global sales volumes have remained well-below available capacity since mid-2022. Although sales volumes are improving, utilization rates remain well-below historically high levels.

TiO2 producers continue to see cost inflation, as feedstock and other key raw materials’ prices remain at historically high levels. Low utilization rates have impacted fixed-cost productivity, squeezing margins for all TiO2 producers.

As a result, all major TiO2 producers have informed customers of increased prices throughout the world for 2Q24. Customers have been informed of price increases ranging from USD 100-250/t, depending on region and producer.

TiPMC expects underlying demand to continually improve throughout 2024. The impact of reduced interest rates and improving housing markets throughout the world will stimulate demand for architectural coatings, the leading consumer of TiO2. TiPMC expects operating rates to continually increase, with a significantly improved coatings season for 2025.

For more insights into the TiO2 and mineral sands markets, visit TiPMCconsulting.com, or see our ad in this issue for more details.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!