Formulating Coatings For The Future

In the Steven Spielberg movie "Back to the Future," Marty McFly travels to 1955 and sees a world that differs greatly from the one he left behind. If a coatings expert from the future traveled back in time to today, that person would see a coatings world that differed from the one he or she left behind. That person would see a world where changes are underway that will shape the way coatings will be formulated in the future.

This article will examine the drivers behind change in architectural and industrial coatings today and provide insight into formulating coatings for the future.

Today's Landscape

Change in the architectural and industrial coatings markets is being influenced by many factors. These factors may be grouped into three centers of influence - paint-purchasing trends, compliance to new or upcoming regulations, and performance issues surrounding synthetic substrates. While these centers of influence affect change in architectural and industrial coatings in different ways, the fact is that change is occurring, and in many areas it is occurring rapidly.Paint-Purchasing Trends

Trends affect both the architectural and industrial coatings markets, but they influence the architectural coatings market to a greater degree. Paint, once perceived as only a tool for protection, is now perceived as a friendly, cost-effective tool for redecorating a home. Home-decorating television shows such as those on Home & Garden Television (HGTV), magazines such as Consumer Reports, mass merchandisers such as Home Depot and Lowe's, local decorating centers - these are all painting a new picture for the role that paint plays in architectural settings.So what's the key factor in consumer interest in paint? Color. Color is driving change in the architectural coatings market today more than ever before. It is through color that paint has become a decorating tool in architectural coatings. Color enhances one's living space, but it is much more than "what's the hottest new color on the block?" It is showing consumers the effects that can be achieved when different colors are put together, showing and demonstrating a room painted in different color combinations, showing color as a tool for painting, showing consumers you can put beige and green together. This concept is not new, but putting colors together to achieve new influence over one's surroundings is new and is great for the industry.

In addition, faux finishes, a decorative paint technique that imitates patterns found in nature, such as marble, wood, sand and leather, offer consumers an "earthy" alternative to wallpaper. Faux finishes, done through complex coatings, create unique effects on walls and expand what can be done with paint. Color plays an important role here too.

In the industrial coatings market, trends affect change to a lesser degree. Performance needs, including coatings designed for specific jobs or projects with defined applications and specifications, may be viewed as a driver for change in this area. However, these performance drivers often relate better to regulatory compliance and coating new substrates, which we'll cover in-depth in the next two sections.

Regulatory Compliance - What's On Deck

The need to comply with new and upcoming regulations is a key driver for change in the architectural and industrial coatings markets. Regulations have always driven change, but the wave of standards today is driving change faster than ever before.Regulations designed to limit the emission of volatile organic compounds (VOCs) into the atmosphere are at the forefront of regulatory change. The coatings market contributes a small amount of VOC into the air compared to other industries, but the need to reduce VOC emissions is still paramount. In industrial coatings, VOCs emanate from facilities involved in the coating of substrates. In architectural coatings, VOCs are added to allow better application and performance properties and are emitted during the application process.

The key consideration with VOC reduction is maintaining performance characteristics. It is not easy to reduce VOC emissions. VOCs are added to latex paint as coalescing solvents used in film formation, which give coatings their protective properties. In non-waterborne technologies they are added to aid in application properties and reduction of solvents. Simply reducing or eliminating the solvents can reduce your VOC emissions. The problem is that by doing this you're also reducing or eliminating performance characteristics, such as film formation, freeze thaw stability, exterior durability, open time, adhesion, rheology, cleanability, and numerous other performance properties.

The reduction of VOCs is a challenge for the industry, especially in more extreme environmental conditions. The industry is addressing this challenge head on by examining the problem in its basic form. For example, to illustrate further the role that coalescing solvents play, imagine latex in relation to jellybeans and coalescing solvents in relation to water. If you mix water and jellybeans together, eventually you'll get a sugar mass; the jellybeans soften, adhere to each other, and form a cohesive layer similar to a polymer film. By mixing latex and coalescing solvents together you get a stable coating, like the softened jellybean film with many desirable properties, including protection. The industry is trying to address film formation from different aspects. The key to success in the future will be to develop unique solvents and polymers that do not emit VOCs. These unique solvents and polymers will most likely be specialized for individual applications.

In North America, three main organizations are driving VOC restrictions. They include the EPA's Clean Air Act with proposed emissions standards for coatings applicators; the South Coast Air Quality Management District (SCAQMD) with various regulations in effect; and the Ozone Transportation Commission (OTC), with regulations that affect the 13 Northeast and Mid-Atlantic states.

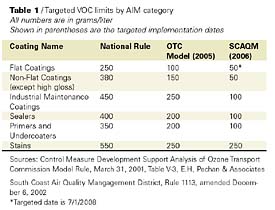

The SCAQMD's proposed regulations are by far the strictest, with as little as 50 g/l limits proposed for some categories of architectural coatings, as opposed to 380 g/l limits on the national level. The OTC regulations will have an impact on alkyd architectural paints, which are solvent-rich. The decline of these paints falls in line with industry positioning, which is shifting away from most solventborne paints for architectural coatings. (Table 1)

With regard to wood building materials, standards have been proposed to reduce Hazardous Air Pollutants (HAPs) by 61 percent. These standards require all major source facilities that apply wood surface coatings to meet HAPs standards for emission reflecting maximum achievable control technology. This will most likely be done through polymer changes and major reformulation changes, including changes from solvent to other types of technology.

Raw material suppliers and coatings formulators are developing new polymers and technology today that will enable the reduction of VOCs from the coating process while maintaining key properties. Suppliers are already delivering low-VOC products to the market, and product reformulation and new product development are underway.

The Dow Chemical Company's UCAR Emulsion Systems (UES) business has a long history of offering paint formulators access to multiple latex technologies. UES is actively developing polymer technology for meeting the lower VOC demands of the future, and evaluating other ingredients to create optimized formulations.

In architectural coatings, UES is creating new polymers and continually introducing new products. In industrial coatings, UES is developing new products on a customer-specific basis. These products include low-VOC coatings for direct-to-metal applications. Several specific products that UES has introduced to address and improve film formation, with regard to lower VOC demands, include:

- UCAR Latex 629 - a 100-percent acrylic with excellent film-formation properties and reduced VOCs;

- NeoCAR Latex 2302 - a unique technology that gives film formation with zero VOCs.

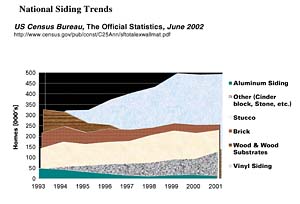

Source: U.S. Census Bureau, The Official Statistics, June 2002

New Substrates - A Whole New Ballgame

At one time wood was the most common substrate in the architectural coatings market. According to U.S. Census data, in 1991, 45% of all new home exteriors were made of wood. Today it is merely a player, with the number of new home exteriors made of wood dropping to just 15% by 2001. Masonry and synthetic building materials such as cement fiberboard and wood composites have taken up this slack. (See Figure 1)The national trend of moving to masonry and synthetic substrates is creating some unique problems. Most exterior coatings are not designed for these specific substrates. However, as we move to waterborne and higher-solid coatings, the unique issues of synthetic substrates are being addressed by the coatings and polymer manufacturers. For example, unlike wood, new substrates such as cement fiberboard have new requirements, including efflorescent and alkali resistance.

To solve problems associated with coating synthetic substrates, new technologies need to be focused on formulating for performance characteristics. So instead of formulating products that do it all, products are focused on meeting the needs for the specific substrates they will coat. This focus is being accomplished through the development of new polymers that offer inherently better performance. UES is actively involved in this new polymer development. We've come a long way; however, continued innovation is required in order to maintain paint properties, such as durability and adhesion while meeting the challenges of the changing market and regulations. c

For more information, visit www. ucarlatex.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!