Sustaining the TiO2 Cycle Rather Than Exploiting It

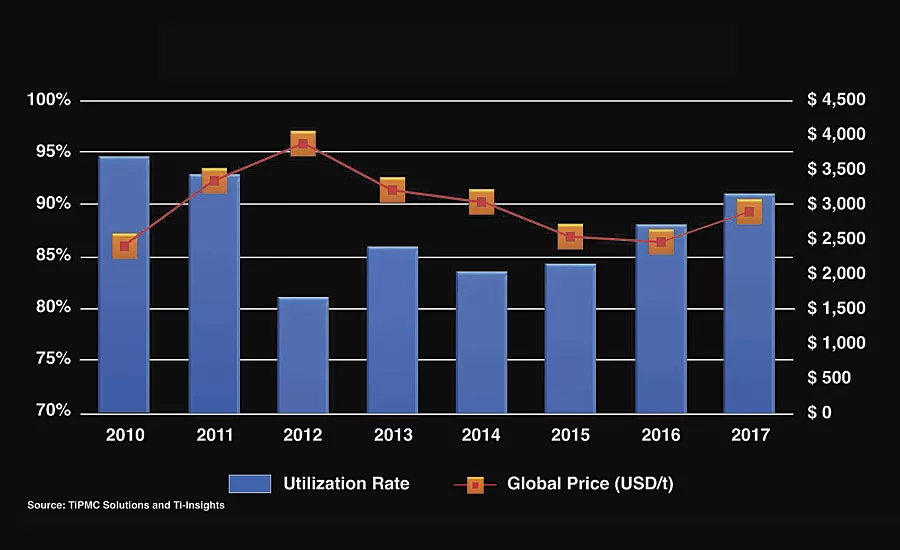

Titanium dioxide (TiO2), the most coveted pigment in coatings, efficiently scatters visible light, thus increasing brightness, whiteness and opacity. The juxtaposition of TiO2 demand and the availability of this white compound led to unprecedented price increases during 2010-2012, followed by slashed prices from 2012-2015, leaving the industry reeling. TiPMC Solutions calls this recovery the Super Cycle, and offers insights showing how the big producers are sustaining the current cycle going forward.

The Multinational Producers (MNPs) – Chemours, Kronos, Tronox, Cristal and Venator – have significantly changed their strategies in expanding TiO2 markets and imposing higher prices. In earlier up cycles, they poured capital into new plants to increase production when business was booming. When the cycle downturned, they competed on price. Then, producers in China flooded global markets with low-cost, low-quality product, leaving the MNPs with a no-win situation.

Now that the market is flourishing again, rather than risking unfavorable competitive response, MNPs are implementing newer, vigorous strategies. They are also executing aggressive changes in managing, marketing and manufacturing TiO2 products.

Today, the MNPs are changing emphasis, applying strategies such as longer-term contracts with customers to help them pass along price increases downstream. Their current strategies also include focusing on quality, avoiding excess inventory and developing latent capacity versus capital expansion.

In a stratagem to compete with Chinese TiO2 producers, MNPs are also marketing the long-term value of their high-quality grades that deliver greatly desired characteristics – maximized whiteness, opacity, brightness and more, rather than racing to the bottom on price.

MNPs consider both the risks and required investments of expanding production facilities. Based on TiPMC analyses for greenfield or brownfield expansion, the required investment per tonne of TiO2 produced does not justify the expense given the impact on capacity utilization and the potential for competitive response, particularly from China. Therefore, manufacturers, especially the MNPs, are moving in different directions.

Our review and evaluation of industry data show growth of 2.5 to 3% per year for the foreseeable future. We expect 160t to 190t in TiO2 growth to come from higher unitization rates as well as use of latent capacity and smaller capital expansions that involve less risk and lower capital costs. The lone exception seems to be Lomon Billions, China’s first multinational producer, which plans to grow capacity by approximately 650 ktpa by the middle of the next decade.

Demand for TiO2 tends to follow GDP trendlines. As developing countries provide higher standards of living for their citizens, the market for TiO2 increases dramatically. New, improved housing in particular drives demand.

Looking forward, we see potential threats to the industry from feedstock issues, continued Chinese unpredictability and macroeconomic events.

The essential feedstock component, TiO2-bearing mineral sands, is increasingly untenable because mines are reaching the end of their productive lives, and new projects do not offer the high-quality reserves of traditional mining operations. In addition, any disruption as a result of labor or environmental issues can cause serious problems for TiO2 producers.

In China, the central government has tempered TiO2 expansion. Environmental enforcement and regulations that favor chloride expansion vs. sulfate expansion have reduced growth in production from less environmentally friendly sulfate producers, which has the effect of concentrating the industry.

Central government attempts to cool housing construction in major cities have lowered demand growth in the largest urban areas. Current trends in housing prices suggest the potential for a bubble will be averted as lower-tier cities grow and housing prices stabilize.

However, stronger Chinese producers have responded by increasing their utilization rates and exporting more TiO2, especially to Europe where favorable exchange rates and short supply conditions have created a very attractive market.

Finally, macroeconomic events could upset the upward expansion and increasing prices of TiO2. Based on our analyses and insights developed through our hands-on experience in the industry, we do not see a major upset for the rest of this year or in 2019. Beyond that, however, it is difficult to predict.

The good news is that TiO2 manufacturers around the world – especially the MNPs – have learned the lessons from the down market cycle that lasted so long and had such a negative impact on their profitability. They have implemented new strategies to maintain prices and market position through ups and downs in demand.

Going forward, high-quality TiO2 and feedstocks will require coatings and other customers to share value with suppliers of both.

To subscribe to TiPMC industry reports and forecasts, visit www.TiPMCconsulting.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!