High-Performance Pigments to Make Gradual Recovery in Post-COVID World

The production and distribution of high-performance pigments from 2015 to 2025 is subject to an unprecedented set of circumstances that are creating dramatic change in business conditions. These critical changes, including the impact of COVID-19, are outlined in a recent report from Smithers, The Future of High-Performance Pigments to 2025.

The market intelligence identifies global demand for high-performance and special-effect pigments at an estimated 217,100 tonnes, with a value of $6.22 billion in 2020, the year the study was published. Due to the pause created by the global coronavirus outbreak, the report identifies a 12% drop in 2020 value when compared to 2019, caused by restrictions on economic activity and industry closures across the world.

Moving beyond the pandemic, Smithers forecasts a gradual recovery for the pigments industry across the first half of the decade. The business intelligence firm has forecast a 5% recovery in the market in 2021 with demand not returning to 2019 levels until 2023 or 2024. Having negotiated the short-term shock of a post-COVID world, consumption of high-performance pigments is forecast to reach 255,770 tonnes, with a value of $7.58 billion in 2025.

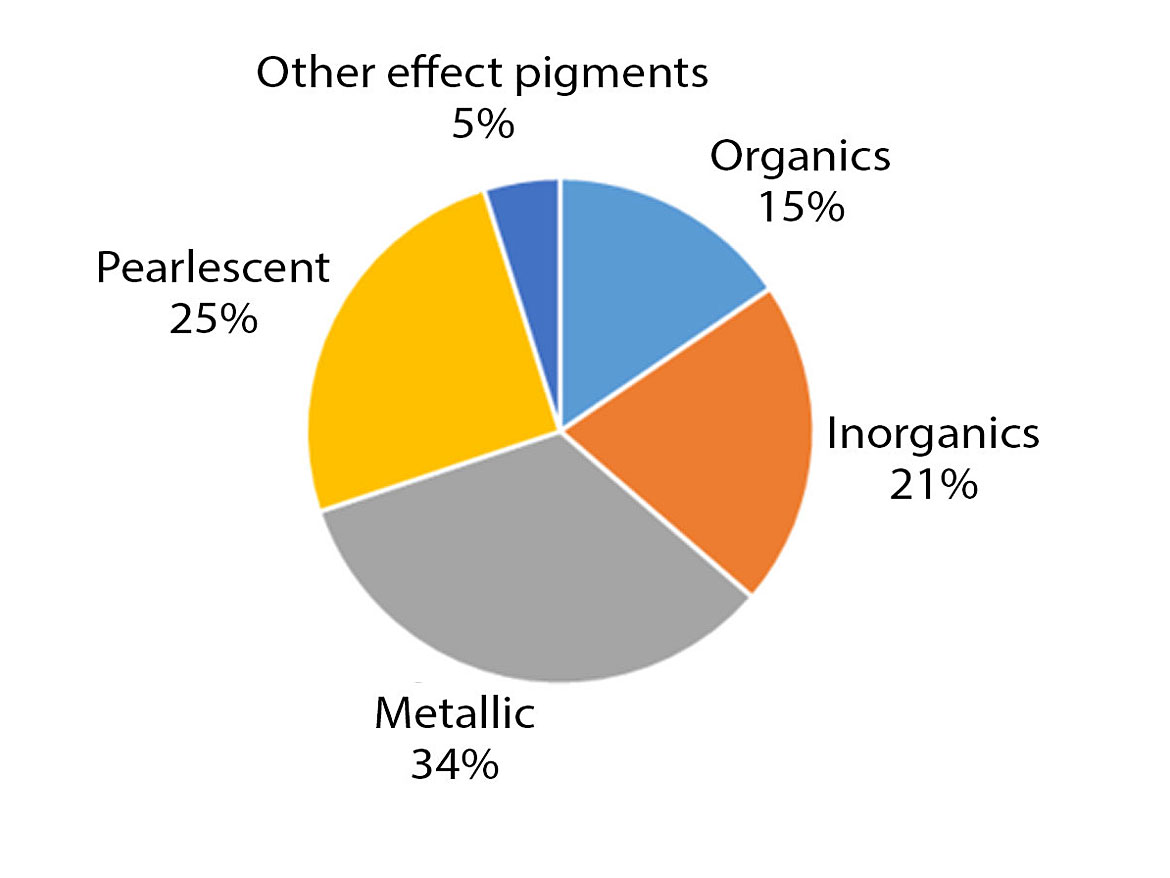

The study published by Smithers provides qualitative and quantitative analysis for 16 organic, inorganic and special-effect pigments. Research shows that the largest market shares remain for pearlescents, and aluminum and bronze metallic products, which combined in 2019 accounted for 59% of the market by weight (Figure 1). The 2019-2020 decline has affected all pigment classes, but was most pronounced in the special-effects sector.

The Impact of COVID-19 on End-Use Trends

The leading uses for high-performance and special-effect pigments are in plastics and coatings; with smaller shares going to inks, cosmetics and textiles. The impact of COVID-19 is not uniform across or within these, however. For example, decorative paints performed well in 2020, as locked down consumers spent time on home improvement; while in contrast demand for automotive coatings fell by around 25% worldwide during 2020.

The Dominance of Effect Pigments

Effect pigments make up the largest market for high-performance coatings, with demand of 155,287 tonnes and $3.21 billion in 2019. Metallic and pearlescent pigments dominate this class of pigments with 56% and 25% of volume demand respectively in 2019. However, these pigments are widely used in two end applications that were significantly impacted by the pandemic, transportation coatings and cosmetics, such that volume for effect pigments dropped by nearly 13% in 2020 to 135,422 tonnes, with a value of $2.71 billion. Recovery up to 2025 will see a demand for 159,612 tonnes, $3.37 billion. The choice of metallic pigment in automotive topcoats is also believed to affect the efficiency of LIDAR detection.

M&A Activity Reshapes the Industry

High-performance pigment suppliers will need to react to multiple business and evolving technology requirements, including the impact of major M&A activity reshaping the industry. The industry is being reshaped by DIC buying BASF’s pigment division and Clariant selling its masterbatch business to PolyOne to create the new company Avient. Further consolidation in the industry is a distinct possibility in the future as indicated by the June 2021 divesting of Clariant’s pigments business to Heubach Group.

Regional Patterns

The global leaders for high-performance pigments are still suppliers based in Europe and North America, but they are facing increasing competition from pigment manufacturers in China and India. Asian companies are starting to extend their reach from the standard, commoditized products that make up the bulk of their current production. This more competitive landscape is driving the Western suppliers to further develop their product ranges to increase the value of their products to both the suppliers and their customers.

Evolving Technology

Over the 10-year period covered by the report, the industry will increasingly need to respond to the increasing sophistication of performance pigment suppliers based in China, which will impact the global market.

Other technology trends outlined in the report include the demand for pigments with higher chroma that enable superior color options; improvements in pigment grades to speed the transition from traditional milling to high-speed stirring; and pursuing greater portfolio diversification through integrating nano-pigment and smart pigment innovations. Renewable or bio-based performance pigments will also be introduced to meet end-user demands for more sustainable solutions.

To download a brochure on The Future of High Performance Pigments to 2025 from Smithers, click here.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!