Trade, Tariffs, and Taxes

How the 118th Congress Can Support the Recovery and Growth of American Businesses

Creatas Video+ / Getty Images Plus, via Getty Images

From supply chain breakdowns to record-high inflation and an increasingly tight labor market, it’s no surprise businesses have faced incredible challenges over the last three years. However, with the start of a new Congress, many issues will be up for consideration that will be central to the economic recovery and future growth of vital American industries.

One of these vital industries is the nation’s chemical supply chain, which delivers essential products to the paint and coatings industry. This includes coatings for life-saving equipment, such as ventilators and vital signs monitors, cleaning products, mold-mildewcide treatments, the interior coating of steel and aluminum food and beverage cans to ensure food safety, and more. The continuous production and transportation of chemicals is critical to our nation’s economic security and allows American businesses to compete in the 21st century global economy.

Following an unexpected midterm election cycle where Democrats retained control of the U.S. Senate and Republicans flipped the U.S. House of Representatives with the narrowest of majorities, we have begun to see policy roadmaps from both parties as they determine their priorities over the next two years.

The paint and coatings industry and its supply chain partners, like chemical distributors, will be impacted by the outcomes of these policy discussions and anticipated changes, particularly in the areas of trade, tariffs, and taxes. We must all raise our voices to advocate for policies that ensure the continued recovery and growth of our essential industries. The stakes are high, and the policies considered over the next two years will determine what the future of our businesses look like.

Renewal of Free-Trade Programs

For decades, free-trade policies have kept costs low and increased the access to many chemical products that are no longer manufactured domestically. Unfortunately, some of these trade programs, like the Generalized System of Preferences (GSP) and Miscellaneous Tariff Bill (MTB), have expired, adversely impacting the ability of U.S. companies to compete globally, supply the nation with critical materials, and contribute to the economy.

As one of the most effective trade preference programs, the GSP is designed to both reduce prices for American importers and promote economic development in developing nations. Under the program, the Office of the United States Trade Representative (USTR) provides non-reciprocal, duty-free tariff treatment on certain imported components, parts, or materials from developing nations. But with the expiration of the program in 2020, nearly 5,000 products that were eligible for duty-free importation into the U.S. became subject to duties upon entry.

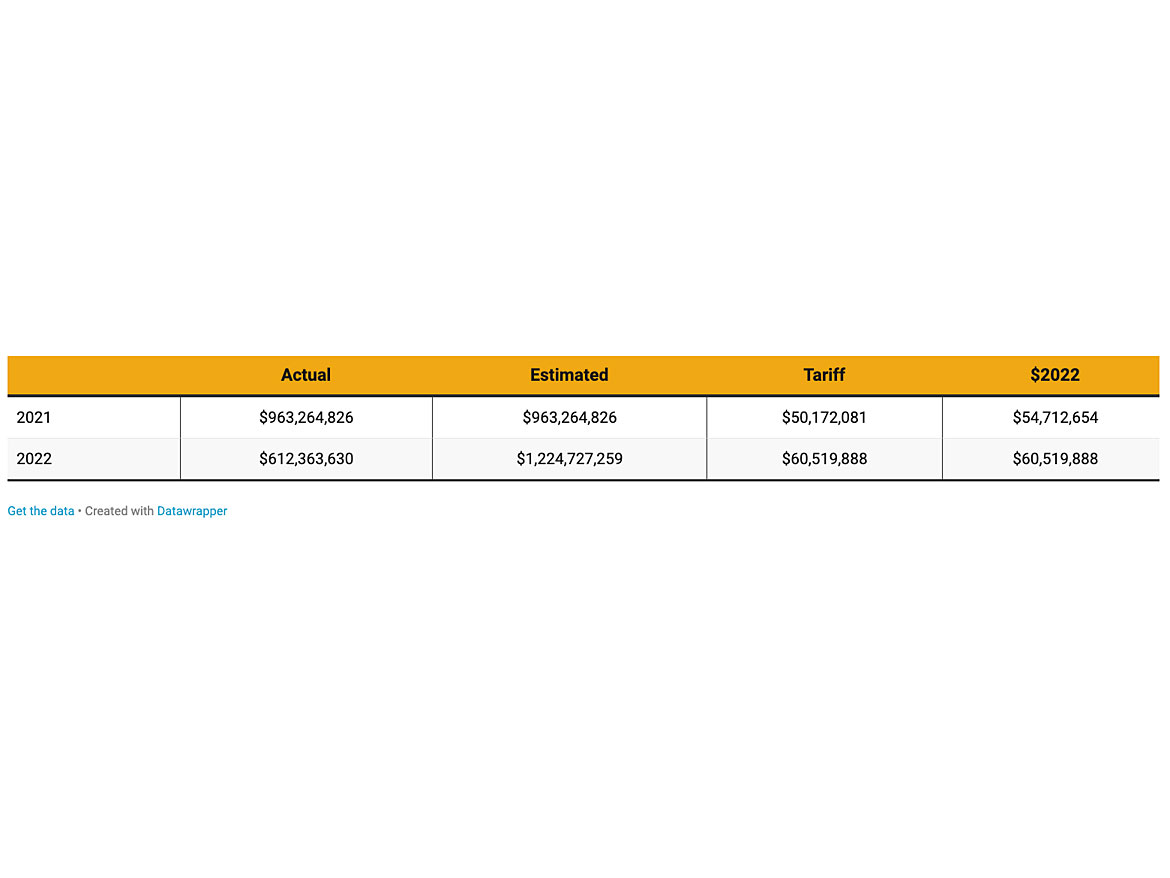

Based on National Association of Chemical Distributors’ (NACD) economic analysis, conducted by John Dunham and Associates (JDA), chemical products that were no longer able to be imported duty-free were subject to tariffs of $50.2 million in 2021 and were projected to be more than $60 million in 2022. For importers of these chemical products, this is a price increase of 5.3% – costs that are ultimately passed onto consumers, including customers of the paint and coatings industry, and typically lead to a drop in demand, meaning fewer sales and less direct and indirect jobs in the industries that rely on these products.

Another trade program that has lapsed, and remains a concern to chemical distributors and the broader chemical industry, is MTB. Similar to GSP, this program offers a temporary reduction or suspension of duties on certain U.S. imports that are not competitive with domestically manufactured products. Since many chemicals have had their production shift offshore or have never been produced domestically, MTB has been an important tool in keeping essential chemicals from being needlessly expensive.

However, because of Congress’ failure to renew the program after its expiration in 2020, many chemical products are now subject to a significant increase in tariffs, costing distributors $170.3 million in tariffs by 2023 and increasing the price of chemicals handled by distributors by 0.71%. These higher prices will, again, inevitably be passed onto manufacturers, distributors, and finally consumers. According to JDA, this will continue to cost the economy over time, resulting in 1.18 million tons in lost sales, a loss of more than 900 full-time equivalent (FTE) jobs in the chemical distribution industry, and a loss of nearly 4,220 FTE jobs throughout the entire U.S. economy.

Removing Additional Tax Burdens on Business

In addition to advocating for GSP and MTB renewal, the NACD continues to monitor the implementation of the reinstated Superfund tax. With the passage of the Infrastructure Investment and Jobs Act in November 2021, Congress resurrected the long-expired Superfund excise tax on 42 chemicals and an additional 151 substances. The return of this tax doubles the tax rate on taxable chemicals per ton, lowers the threshold for taxable substances from 50% to 20%, and increases the default tax rate from 5% to 10% for taxable substances. The scope of this reinstated tax is far-reaching and complex, and has placed significant compliance challenges and financial burdens on companies, including numerous small businesses across the nation. JDA projects that the overall costs to buyers will be more than $800 million after accounting for costs passed through the supply chain.

Furthermore, Congress reinstated taxes on crude oil and petroleum products through the Inflation Reduction Act of 2022, which went into effect on January 1, 2023. This reinstated tax of 16.4 cents per barrel of crude oil and petroleum products could have a significant impact on costs for suppliers like those in the paint and coatings industry – and your customers.

In addition to further tax burdens on already-strained businesses, navigating this reinstated excise tax has proven difficult. NACD was relieved in late March to see the Internal Revenue Service (IRS) extend its penalty relief of the Superfund tax through the end of 2023 as well as receive notice that the IRS issued proposed regulations to provide more clarity on implementation. Since 2021, NACD has repeatedly called on the IRS to address the industry's compliance concerns and ease the tax's implementation burden through penalty relief and guidance. All impacted industries should read this proposal closely for any clarity it may provide, as well as remaining questions, and provide detailed comments to the agency.

Prioritizing Solutions

With the start of a new Congress, chemical distributors, our customers in the paint and coatings industry and beyond, and consumers are looking to lawmakers and regulators to tackle some of the toughest issues facing our nation. It is imperative for them to recognize this opportunity and address the negative impacts onerous regulations have on businesses of all sizes.

Failing to renew effective programs like GSP and MTB and reinstating decades-old taxes while adding more uncertainty to companies’ business planning is not the answer.

First and foremost, we must gain support on policies that reinvigorate the economy, help businesses get back on track, and address our nation’s ongoing supply chain and labor challenges. Although that is a substantial to-do list, supporting free-trade policies and removing onerous taxes is logical in order to help lower the costs of essential products that are central to Americans’ everyday lives.

All segments of the chemical industry will continue to play a significant role in our nation’s economic and national security. That’s why it is critical we have policies in place that support the future growth of American businesses while also maintaining and enhancing our nation’s competitive edge in an increasingly global economy.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!