What’s Going On with the TiO2 Pricing Momentum?

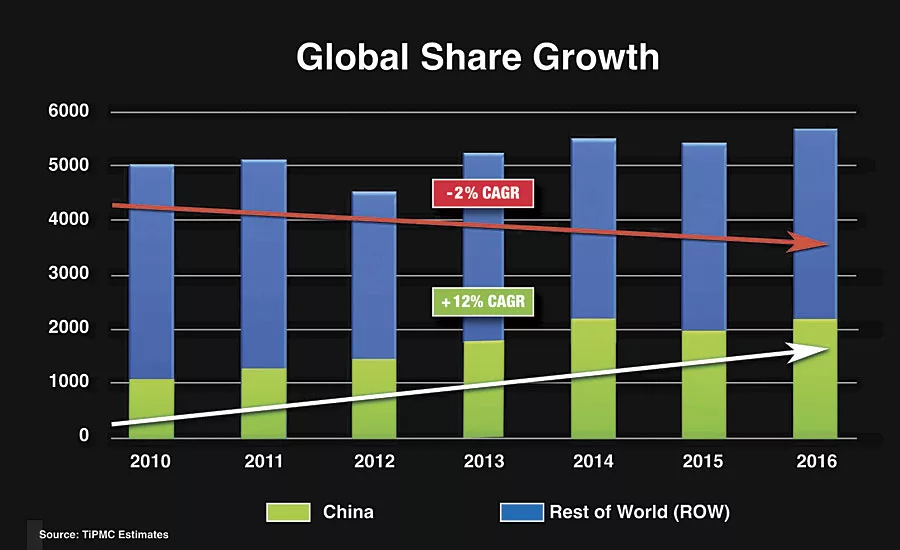

FIGURE 1 » The increasing growth of Chinese TiO2 market share as compared to producers in other global regions. (CAGR: Compound Annual Growth Rate)

TiO2 forecasts for 2018 looked strong worldwide. Then yellow flags signaled warnings by early summer. What happened? And what can we expect in the near future? CEOs of major TiO2 producers are still upbeat, because they see a strong industry and growing demand without significant capacity expansion.

However, as usual, China demands our attention and remains the central issue for TiO2 worldwide. To reduce environmental damage, the central government has not only imposed environmental regulations and stepped up enforcement, but it has also severely restricted expansion of sulfate process TiO2 production.

Sulfate TiO2 expansion is limited to larger projects or to existing facilities. The goal is two-fold: for one, the chloride process is more environmentally friendly, uses less energy and produces less waste per tonne of pigment produced.

Secondly, the chloride process commands higher prices along with higher grades of TiO2 products needed for many applications.

These actions are occurring because the government favors chloride process TiO2. However, producers in China have little track record with the chloride process, and it will take time, investment and experience to bring the industry to levels that are competitive with multinational producers (MNPs).

Chinese producers are attempting to create a “net” expansion of cleaner sulfate plants; thus, the better operators expand while the smaller operators with large environmental footprints shut down. The outcome will determine supply – and all that implies in terms of competition at the global level.

Unchecked Chinese expansion was responsible for the last, lengthy TiO2 downturn, which cut so drastically into MNP profitability. In 2010, China became a net exporter of TiO2, reaching 409ktpa by 2014. Inventories grew, reducing demand. Industry profitability plummeted, leading to utilization rates dipping to 82% in 2015 and severe price deterioration.

In 2016 when inventories came in line and demand recovered dramatically, MNPs increased sales volume and made significant price gains that have lasted for two years. Having regained profitability, the MNPs are engaging new strategies.

Today, MNPs are focused on growth through consolidation rather than capital expansion. The proposed Tronox acquisition of Cristal and the proposed acquisition of the Ashtabula facilities by Venator, which may be required to meet U.S. anti-trust regulations, are aimed at capturing synergies as well as growing regional and product portfolios.

Rather than rushing to invest to expand capacity, the MNPs have primarily focused on maximizing available capacity. They are being cautious, making small investments and increasing latent capacity. Improved utilization of the existing Cristal assets is a primary synergy behind the proposed Tronox acquisition.

Chemours has not participated in consolidation, but has focused on price stabilization, leading to less variability. This strategy allows both customers and the company to improve planning and make asset decisions that increase supply reliability. This strategy also enables expanded capacity through improved utilization and small capital investments through 2021.

In China, we have seen what happens when production exceeds supply. During the first quarter of 2018, Chinese TiO2 manufacturers operated at high utilization rates, while domestic demand slumped. Producers dramatically increased exports to take advantage of demand and higher pricing outside China.

Chinese exports in the fourth quarter 2017 and first quarter 2018 increased by 32% compared to the same periods one year earlier. As more supply became available, pricing momentum in Europe and Asia slowed.

In agreement with multinational CEOs, TiPMC believes that long-term fundamentals are sound. Demand will increase 2.5-3.0%, and new capacity outside China will be limited, while Chinese inability to operate chloride plants and convert to more environmentally friendly sulfate operations limit capacity growth.

However, because demand and capacity growth are not always synchronized, pricing instability will probably occur. Thus, the MNPs following the Chemours lead are likely to seek more price stabilization to lead the market more effectively.

To subscribe to TiPMC industry reports and forecasts, visit www.TiPMCconsulting.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!