Emerging Trends Impacting the Global Coatings Market

According to the World Bank, the global economy reportedly contracted 4.3% in 2020 – a 0.9% smaller contraction than anticipated earlier in the year and projected as late as mid-2020. As the crisis continues to abate, policy makers are urged by the World Bank “to balance the risks from large and growing debt loads with those from slowing the economy through premature fiscal tightening.”

The U.S. economy continues to recover from the GDP losses incurred during the COVID-19 shutdowns. Economists view a complete (sustained) recovery as unlikely until the pandemic is behind us, although the national roll-out of three promising vaccines and new treatment options, combined with pent-up demand, have restored hope of at least a partial rebound in 2021 (barring the unlikely impact of politically motivated or economically devastating headwinds).

In 2020, the Wall Street Journal reported infrastructure deals valued at ~$89 billion in North America, a decrease over the record $226.5 billion in 2019, but above the full-year total in 2018, according to Preqin. Digital and communications infrastructure, renewable energy and ports are strong performers, with mostly private sector investments. Last year, private-equity firms broke records for North America-focused infrastructure fundraising, and that trend is expected to grow.

Between 20% and 35% of FreightWaves survey respondents in 2020 expect manufacturing activity to ramp up in the home and furniture, auto and parts, chemicals, and oil and gas sectors, with the vast majority convinced that domestic manufacturing activity will be either slightly or significantly higher over the next 12 months. Moreover, the October ISM Manufacturing Purchasing Managers Index made headlines when it jumped to 59.3 last year, its highest value in over two years, with heavy growth seen in new total orders, new export orders, higher production, inventories and employment rates.

Assembly Magazine’s 2020 Capital Spending Outlook portends cautious optimism: domestic producers of vehicles, durable goods, fabricated parts and medical devices plan to continue to upgrade their plant operations and equipment in 2021, barring those subsegments that have been curtailed by the global pandemic, notably aerospace.

Global chemicals are accordingly positioned to benefit from the early cycle post-COVID economic recovery. Consensus of the global chemical sector has been that end market demand and the lift in durable goods will likely outweigh some of the pockets of weakness in certain industrial end markets. This generally played out as those exposed to consumer (coatings) and durable goods (petrochemical names) saw the rebound pull through earnings and cash flow.

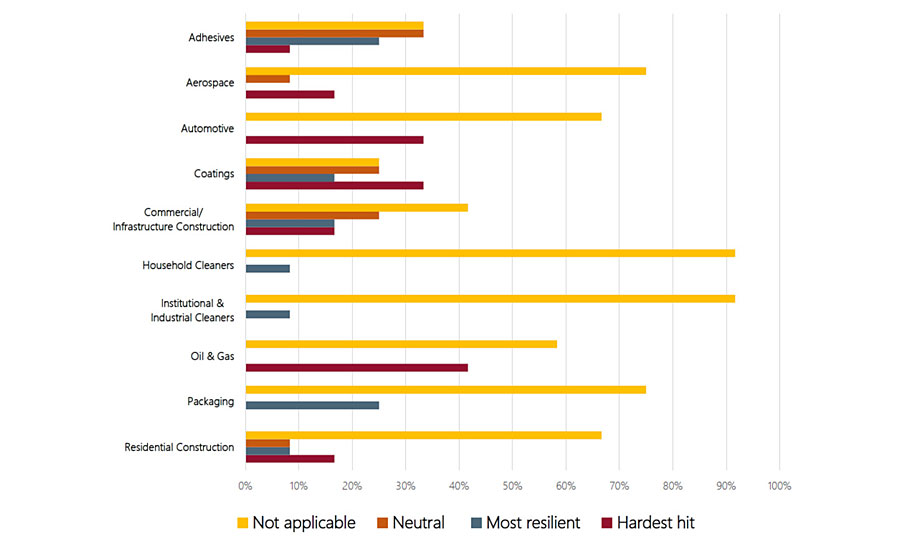

However, the coatings industry's perception has not caught up to this newfound confidence. In the latest ChemQuest monthly industry survey (released in Oct ‘20), respondents maintained that Automotive, Coatings, and Oil & Gas were reported “hardest hit” (Figure 1).

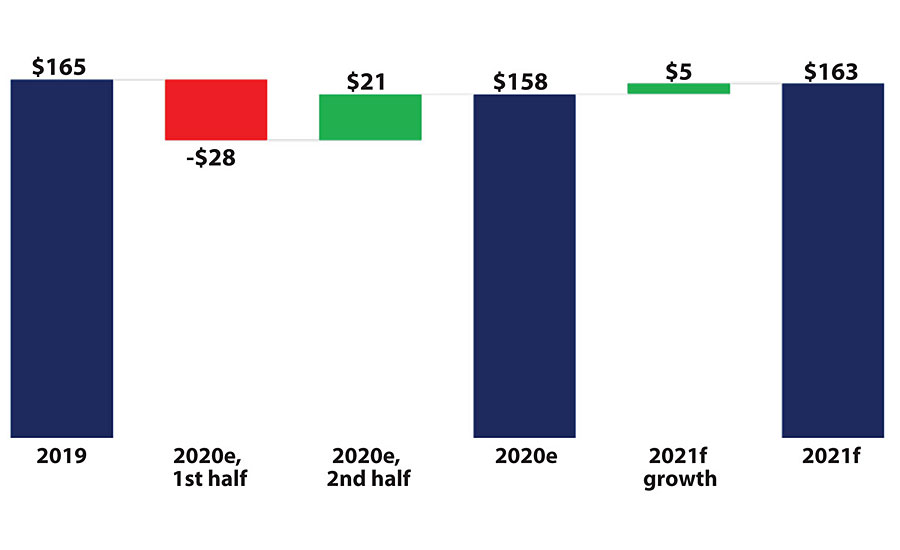

In the first half of 2020 we saw a drop of $28 billion in the global market. However, in 2H20 a rebound of $21 billion supported an end-of-year market size of $158 billion. Looking forward we are expecting the market to reach $163 billion in 2021 (Figure 2).

Although we expect a slight decline in specialty chemicals’ market growth moving forward, some key positive trends have emerged, attesting to both the intrinsic value and resilience of specialty materials.

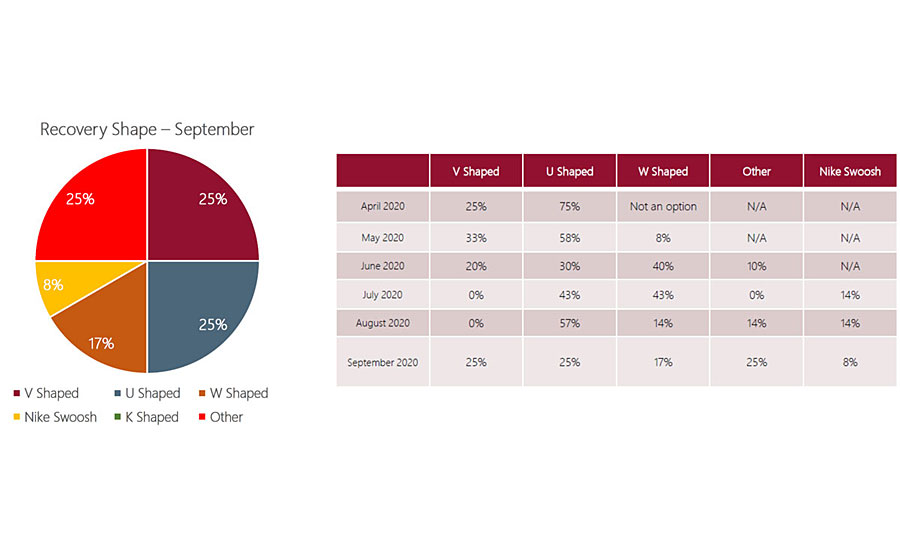

Respondents to ChemQuest’s survey also reported that the impacts of COVID will be less painful than first anticipated, with more than 50% of respondents anticipating a V- or a U-shaped recovery (Figure 3).

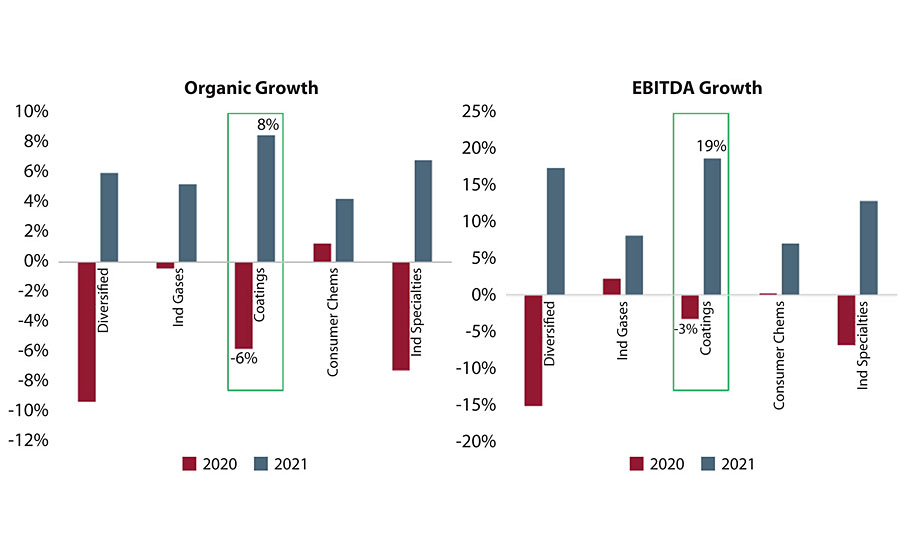

Furthermore, the overall coatings market EBITDA profile was not that far away from the more defensive areas of industrial gases and consumer chemicals, thanks to gross margin expansion (Figure 4).

Ultimately, we maintain an upward bias for the coatings space in a “post COVID-19 world.” Put very simply: paint demand is higher in many segments post-COVID than it was pre-COVID, costs of production are lower on average, and market discipline prevails in average selling prices.

The primary emerging trend that defends our confidence in the global coatings market is the strength and fortitude of architectural paints.

Primary Trend: Architectural Paint

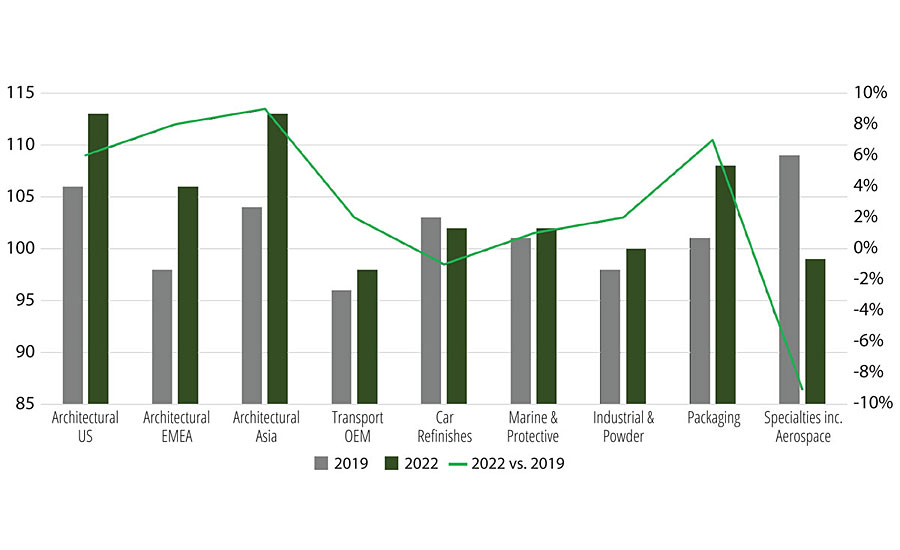

Global coatings players had a very mixed year in 2020, with noticeable divergence between the top and bottom performers – a clear trend though is that companies with more architectural exposure generally fared better than those with more industrial (especially more automotive exposure) (Figures 5 and 6).

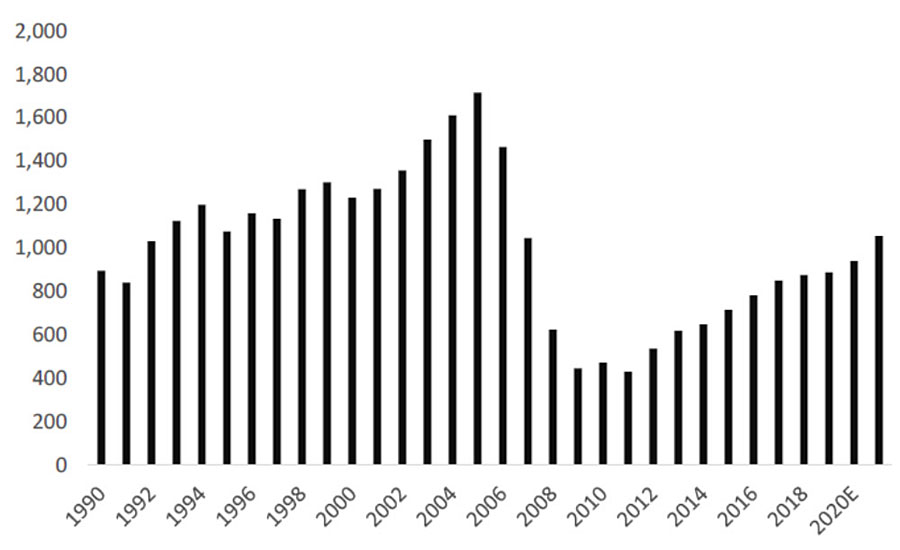

Architectural paints are likely to continue to be supported by favorable housing market dynamics in the U.S. and beyond (Figures 7 and 8).

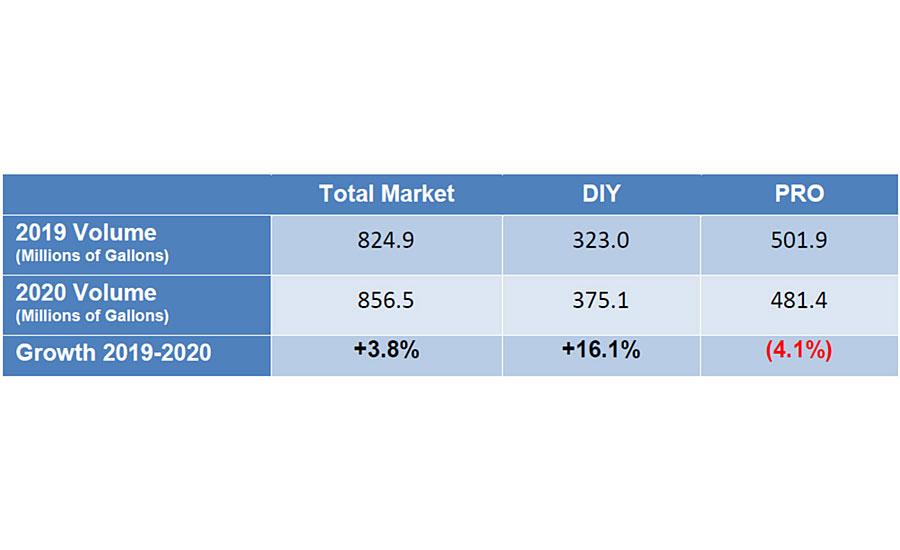

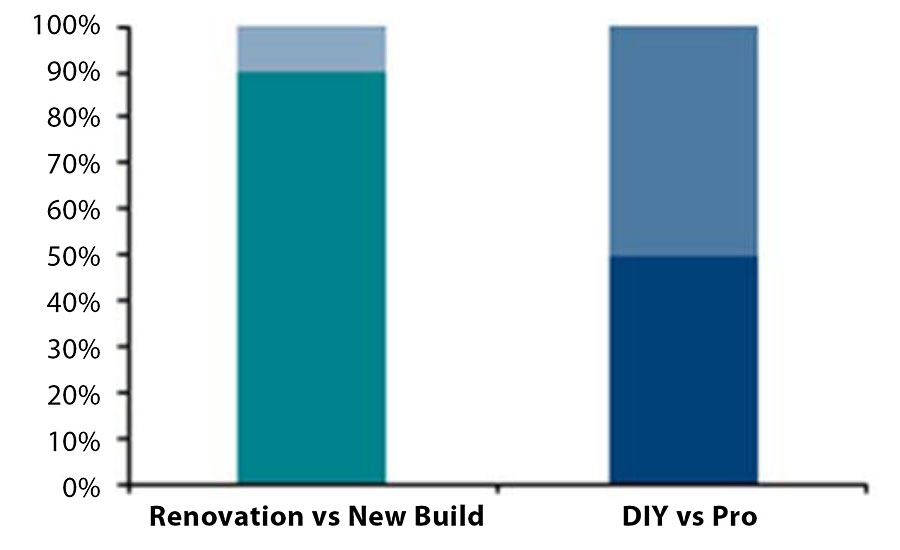

According to the American Coatings Association, the PRO market in the U.S. for commercial property and multi-unit maintenance declined in 2020, as expected, due to business shutdowns, budget cuts and limited access to facilities for contractors. Even though this portion of the market represents 30-35% of total gallons, the decline was offset by a huge surge in DIY painting projects and PRO market growth in residential repaint jobs and new residential construction (Figure 9).

The COVID-19 pandemic resulted in a significant market shift towards residential construction, sales of new and existing homes, and home improvement projects for owner-occupied homes. The housing market is the driver of 2020 growth and will continue to deliver coatings growth through 2022.

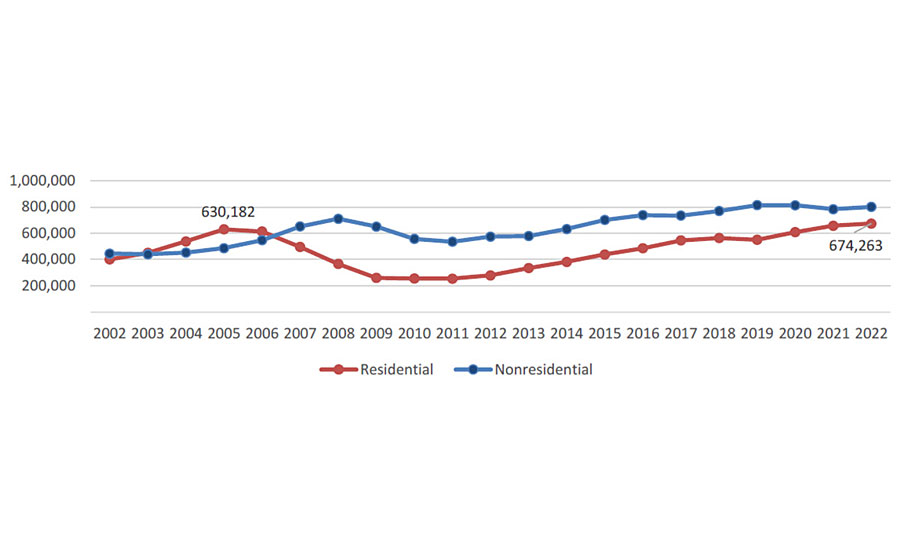

The construction value trend (U.S. Census series, “Value of Construction Put in Place” 2002-2019, forecast from Dodge and Mortgage Bankers Association) most accurately shows the return to a strong housing market. In 2009-2011, residential construction dropped more than 50% from the 2005 high – and recovered very slowly. Only in 2022 will the residential construction value return and exceed that 2005 high (Figure 10).

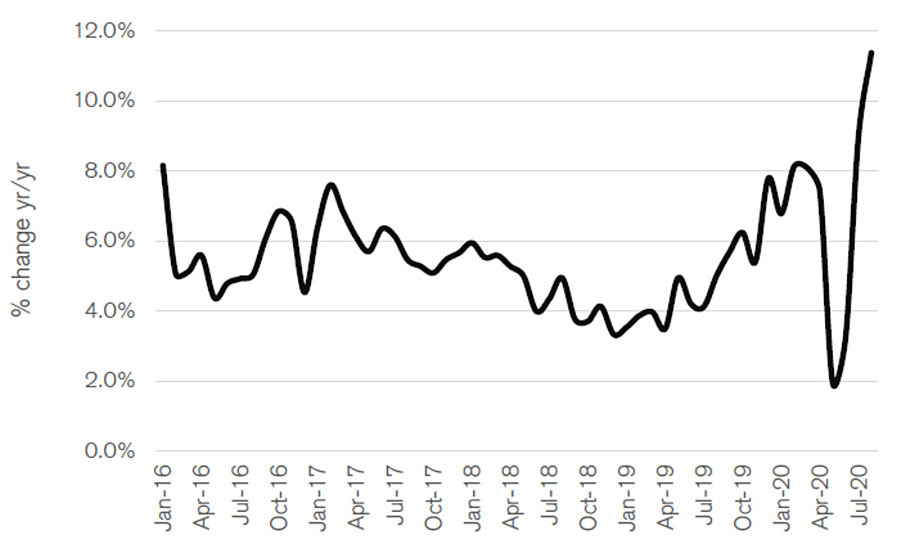

The positive housing dynamics support further a new COVID-inspired paint cycle, which is expected to transcend the DIY paint frenzy of lockdown in the U.S./post-lockdown in the EU.

Significant demand is expected to come from consumers who simply did not want to paint themselves and therefore deferred their project needs until local protocols allowed for onsite professional work to resume and/or they were able to have/were comfortable with third parties in their homes. Macro data also increasingly suggests that paint demand is building from new home sales, existing home sales and housing starts, the vast majority of which are expected to be completed by DIFM rather than DIY.

This is not to say that the DIY frenzy is over, nor that it was all just a pull-forward; rather, many believe that the overall pie is growing and that DIFM growth in 2021 will more than offset DIY give-backs, as DIFM was a bigger slice of the pie to begin with.

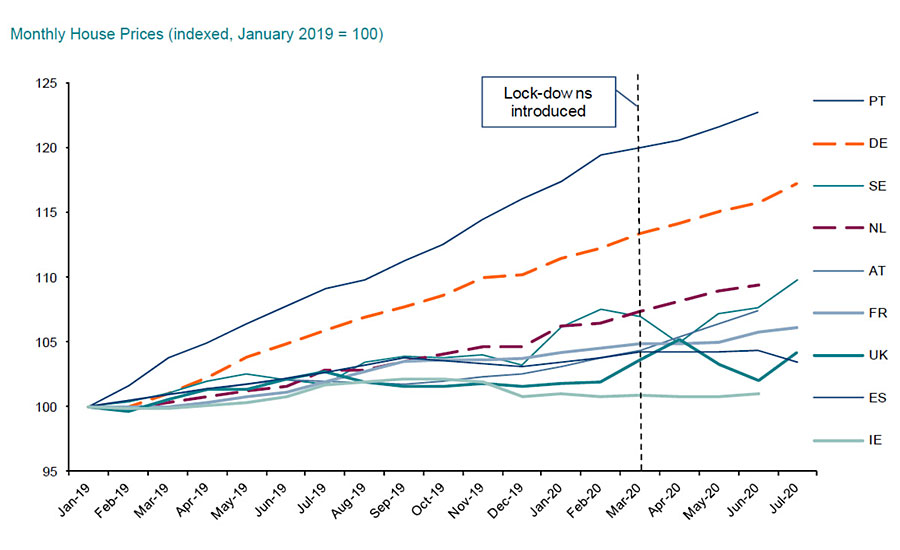

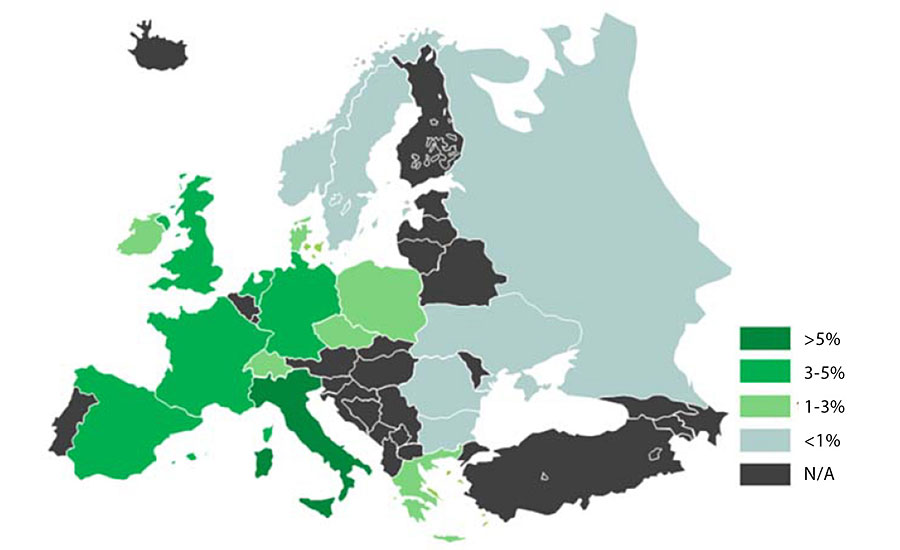

Europe is experiencing similar housing strength (Figure 11). While GDP in the Euro zone has been materially impacted by COVID, some of the factors above have been surprisingly resilient, and the last one has clearly been positive for paint (with many people embracing DIY activity during lockdown, Figure 12). Housing markets across key countries have indeed firmed up in many cases since the beginning of the COVID crisis.

Finally, in Europe, RMI (Renovation Maintenance Improvement) sector is expected to grow by 4% in 2021 and 2% in 2022.

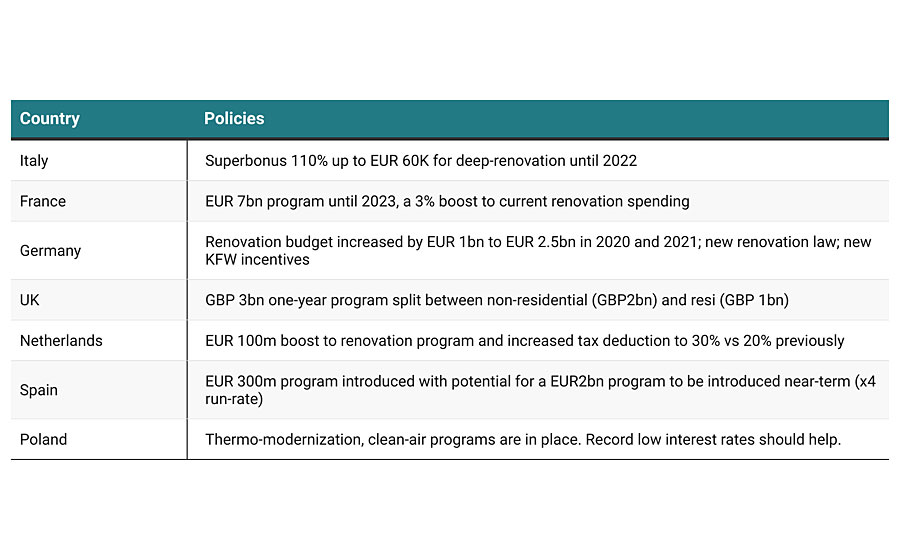

This bright outlook is further fueled by newly introduced renovation policies across many member states highlighted in Table 1.

Similarly, attractive DIY and DIFM drivers are visible in the EU architectural market also. Post strict lockdown measures and with stores reopened, demand for paint has been strong, as EU consumers have prioritized spending on their homes during the pandemic.

COVID-19 has led many consumers to spend more time at home in recent months – this is driving a strong "nesting" trend that is benefiting producers that sell goods for the home, whether they be DIY products such as paint or furnishings, furniture, or even consumer electronics.

Although it is prudent to assume that some of these "nesting" trends will normalize, backlog of home improvement work is likely to continue to support ongoing strong demand for EU architectural paints.

Lastly, it is very likely that housing transaction volumes (a key driver of home improvement spending) will also increase significantly over the next few years, driven by increased levels of working from home, which we think will cause many office workers to reassess where they want to live.

Overall, architectural paints in the U.S. and beyond should see momentum into 2021.

Secondary Trends

In addition to the strength of the architectural paint subspace, other secondary trends provide optimism for the overall coatings market:

- Packaging coatings (primarily coatings for beverage/food cans) are poised for solid growth through at least 2022.

- Antiviral and antimicrobial paints will grow (some of these paints have seen four to five times demand increases this year).

- Traffic patterns in China and elsewhere in Asia are returning to pre-pandemic levels as people shy away from using public transportation options. This may lead to stronger automotive sales going forward.

- Some niche coatings markets that will do well this year and next year are recreation vehicles (RVs) in North America, coatings for bikes, fishing rods and poles, and other outdoor sporting and recreational equipment.

- There may be opportunities for growth with green or sustainable coatings as some of the major governments have been discussing whether to increase environmental regulations.

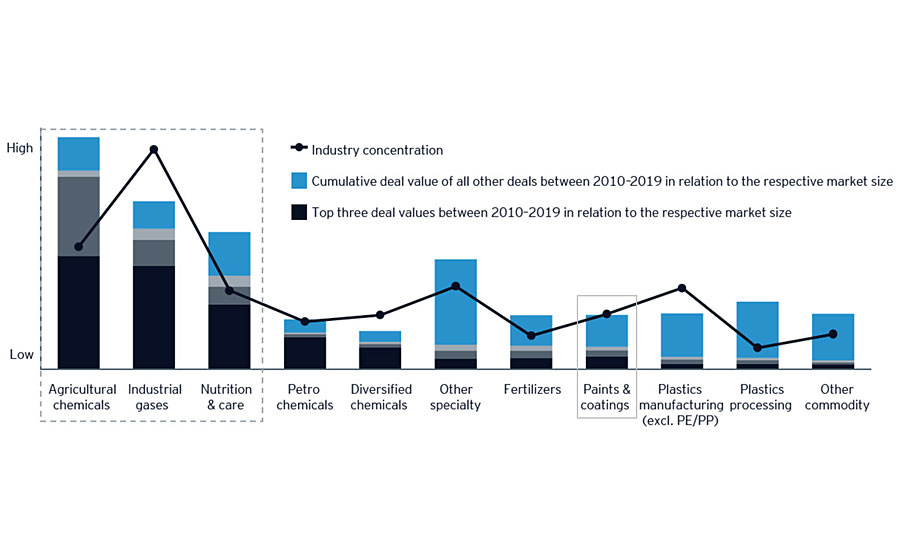

Apart from these trends, we also expect COVID to increase consolidation pressure in an already fragmented paint and coatings market. In general, coatings industry consolidation has been positive for the stocks historically, as the market views synergies as low risk with growth opportunities apparent.

Expect Further Consolidation in Coatings

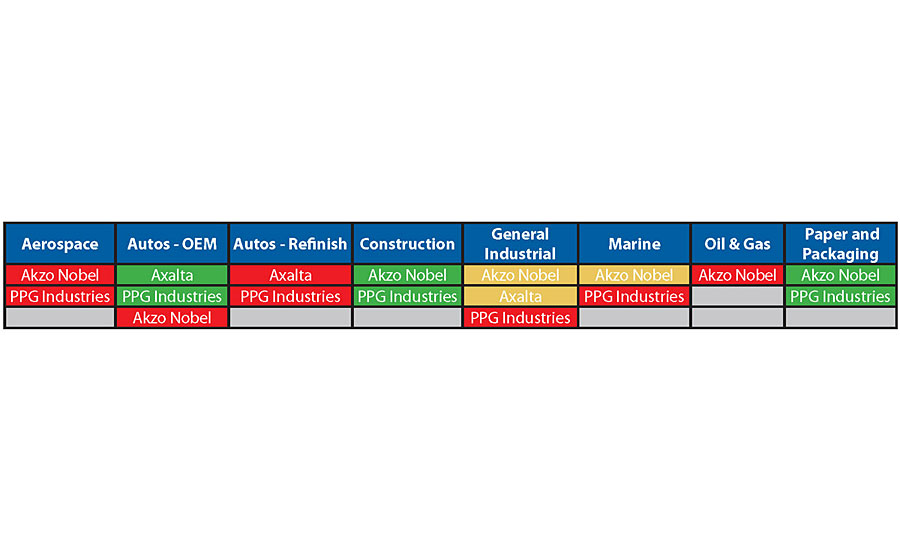

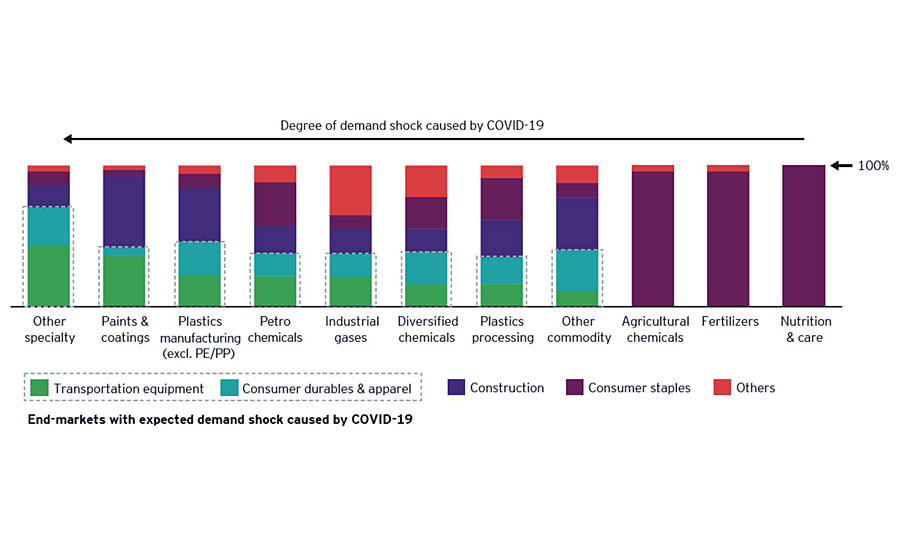

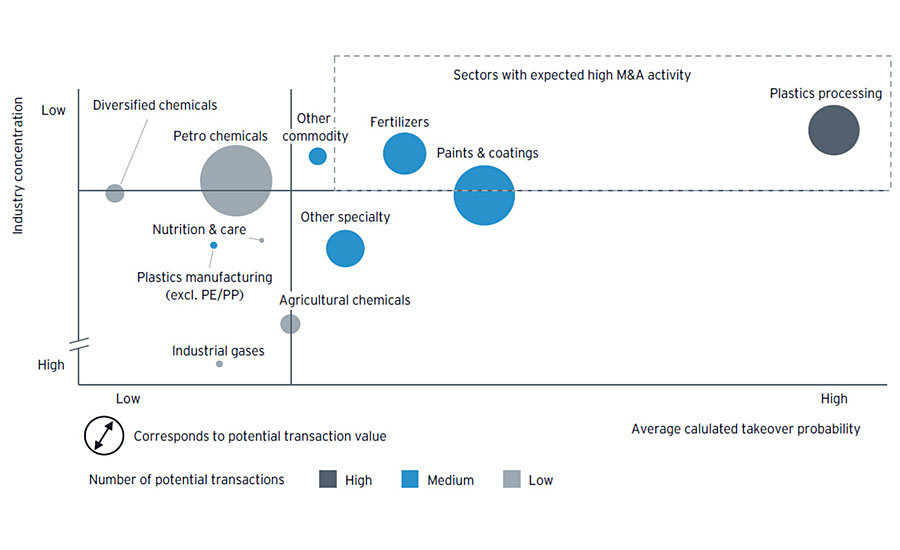

The coatings industry has been in consolidation mode for as long as we can remember – yet it is still quite fragmented, with hundreds of players below $1bn in sales. Considering the impact of the COVID-19 pandemic, many expect an acceleration of the ongoing consolidation in paints and coatings due to a demand shock in transportation equipment as one of its major end markets (Figure 14). Consequently, in paints and coatings, the declining profitability and liquidity, as well as the increase in debt, is expected to extend and accelerate.

These characteristics increase the takeover probability; so, in this respect, the COVID-19 pandemic may act as a catalyst for consolidation (Figures 15 and 16).

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!