Emerging Trends in the Powder Coatings Market

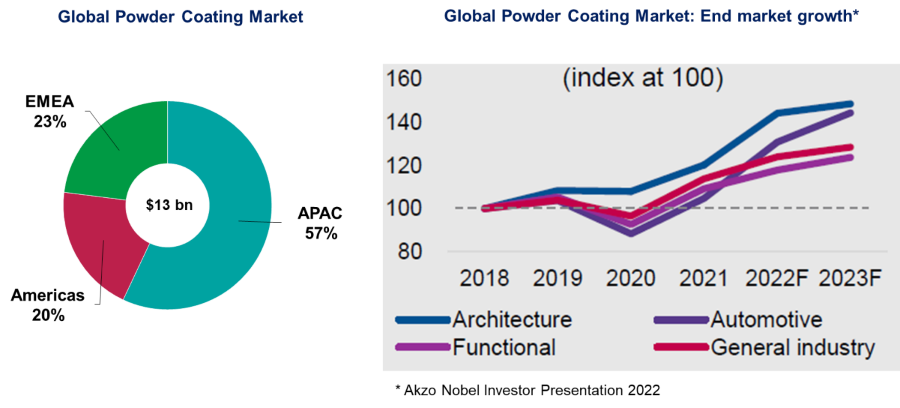

Globally, the powder coatings market is estimated to be ~$13 billion and ~2.8 million MT in volume. It accounts for ~13% of the global industrial coatings market.

FIGURE 1ǀ The global powder coatings market.

Asia accounts for close to 57% of the total powder coatings market, with China roughly accounting for ~45% of global consumption. India accounts for ~3% of global consumption in value and ~5% in volume. Despite its smaller size, India remains a fast-growing market for powder coatings.

Europe and the Middle East and Africa region (EMEA) is the second largest region after Asia-Pacific (APAC), accounting for ~23% share, followed by the Americas at ~20%.

The end markets for powder coatings are fairly diversified. There are four broad end segments:

1. Architectural |

|

2. Functional |

|

3. General Industry |

|

4. Automotive & Transportation |

|

Overall, the global powder coatings market is expected to grow at a CAGR of 5-8% over medium term.

Powder Coatings Industry Structure

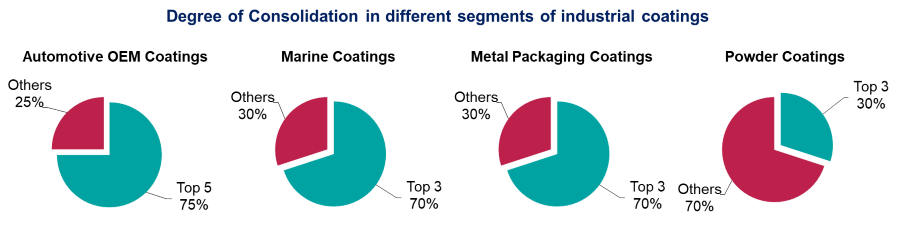

Typically, the market for industrial coatings is fairly concentrated. In automotive OEM coatings, the top five producers account for ~75%+ of the global market. In marine coatings, the top three producers account for ~70% of the coatings sales. In beverage can coatings, the top three producers account for ~70% of market share. However, the powder coatings segment is an exception. It is a fragmented market, with the top five players accounting for only ~30% of market share.

FIGURE 2 ǀ Degree of consolidation in different segments of industrial coatings.

One reason for the fragmented nature of this market is the diversity in the end markets and how the customers in these markets need to be served. Select segments such as automotive, ACE, and high-end architectural are OEM dominated; extensive qualifications are needed in such segments, and performance requirements are stringent. In these segments, it is important to have a track record and credentials to gain business.

However, there are smaller segments with a fragmented customer base. Smaller producers would thrive, in say, general finishes, including the after sale market. Such segments are better served by smaller, nimble suppliers. Such segments are typically less capex intensive, the powder technology is relatively simpler (compared to liquid, which has multi-coat formulations and uses solvents) and, hence, has lower entry barriers.

Thus, there are more than 1,200 companies involved in production and sales of powder coatings globally. Here are some of the emerging trends impacting this industry.

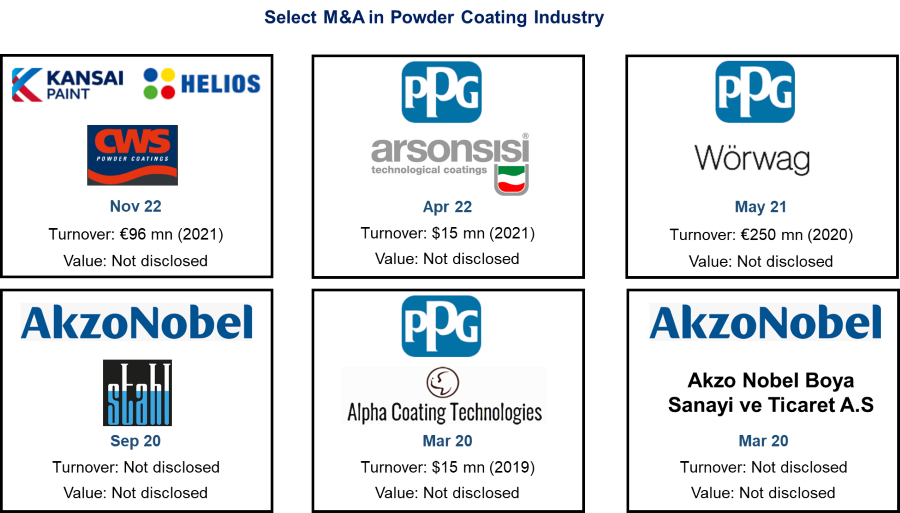

Trend #1: M&A/Consolidation in the Industry

The industry structure has a bearing on the number of mergers and acquisitions that happen in the sector. A fragmented industry such as powder coatings will have more M&A. In the last two to three years, there have been several large moves in this sector, as seen from Figure 3 below. (This is not an exhaustive list of M&A in this sector).

FIGURE 3 ǀ Select M&A in the powder coatings industry.

Kansai acquired Helios in 2016. In November of 2022, Kansai-Helios announced the acquisition of CWS Group, headquartered in Germany. This division has been in existence for more than 150 years, with sales in Europe and the United States. In addition to powder coatings, the target company is also involved in the manufacture of solid synthetic resins and liquid coatings.

PPG has been quite active in this space, with three acquisitions in the past few years. In April of 2022, PPG completed its acquisition of the powder coatings business of Arsonsisi, an industrial coatings company based in Milan, Italy. The transaction provided PPG with a manufacturing base in Italy and sales enhancement in the Europe, Middle East, and Africa (EMEA) region.

In May of 2022, PPG acquired Worwag, a family owned company headquartered in Stuttgart, Germany. Worwag was a 100-year-old company, with sales of ~220 million euros and ~1,100 employees across Germany, China, South Africa, Spain, Switzerland, Poland, and North America. This deal helped PPG obtain a wider geographic reach and an expanded portfolio of products and technology for the automotive, metal furniture, and ACE (agricultural, construction, and earthmoving equipment) markets.

In March of 2020, PPG announced the purchase of Alpha Coatings, a custom powder manufacturer in West Chicago, for an undisclosed amount. Alpha Coatings filled a gap in PPG’s powder product portfolio with its leading low-temperature-cure technology, designed for the MDF market.

In September of 2020, AkzoNobel acquired Stahl’s powder coating business. Stahl has developed both UV and thermoset powders that can cure at temperatures as low as 80 oC, which allows application to MDF, natural wood, plastics, and composites.

There are few learnings from these mergers and acquisitions:

- There are some common strategic drivers for M&A activity: geographic expansion, product line extension, and access to niche technology.

- There are smaller, more nimble firms (rather than traditional industry behemoths), with access to unique capabilities such as differentiated technology or differentiated products. Such companies have been acquired by the global MNCs, via bolt-on acquisitions.

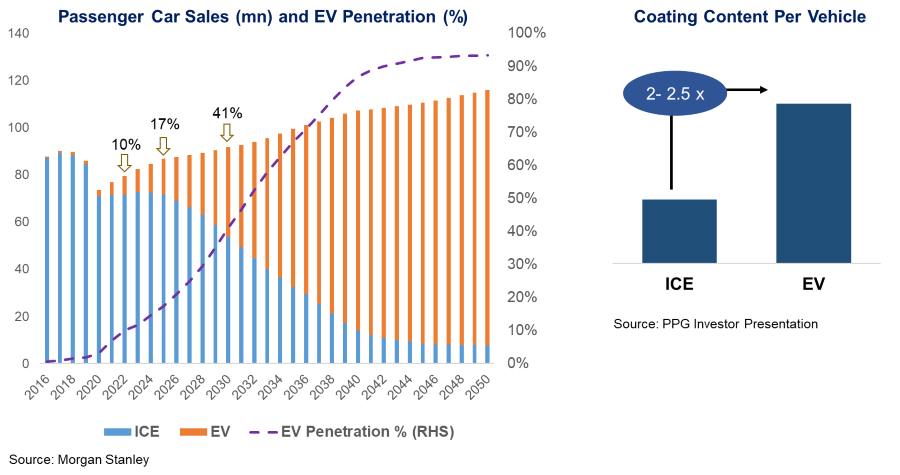

Trend #2: Powder Coating in Electric Vehicles (EVs)

The electric vehicles segment is expected to grow exponentially in the medium-to-long term. In 2022, ~8 million electric vehicles were sold, out of total vehicles sales of ~$80 million, indicating a penetration level of around 10%. However, by 2030, this penetration is likely to go up as high as 35-40%, with around 38 million EVs anticipated to be sold in 2030. This would indicate a CAGR of 15-20% over the next 10 years.

China and the EU will lead the way with EV penetration of more than 50% by 2030. But the United States and India will not be far behind and are likely to have EV penetration of ~25-30% by 2030. All this is driven by decarbonization targets committed to by various countries, coupled with aggressive legislations supporting these targets.

However, from a coatings industry perspective, this is not the most interesting aspect of this disruption. What is interesting to note is that the content of coatings that is needed in an electric vehicle would be significantly higher (almost 2-2.5 times, in value terms) compared to a normal ICE-based vehicle. Why is this so?

FIGURE 4 ǀ Passenger car sales, EV penetration, and coating content per vehicle.

In a typical fossil fuel-based passenger car, liquid coatings are primarily required for applying the traditional four coats on the exterior side, and powder coatings are applied on select underbody parts (wheels, etc). However, this will change in an EV.

Each EV manufacturer has its own battery pack design, however, what is common is that they all need fire protection, corrosion and impact protection, temperature management, and electrical shielding.

- Fire protection: EV charging points generate considerable heat; fast chargers can push battery pack temperatures to 270 ºC after just a few minutes of charging, so being able to protect the battery and vehicle components from such extremes supports the longevity of the vehicle, and its operational safety.

- Dielectric protection: Battery packs also require protection from electromagnetic interference. Coatings with dielectric properties can help prevent arcing between metal parts.

- Thermal management: In addition, battery packs will also require capability to manage temperature extremes. If the temperature is too low, the battery’s power is decreased, reducing capacity and, ultimately, vehicle range. If the temperature is too high, the battery degrades at an accelerated pace.

For EVs, powder coatings would provide significant advantages:

- Because of their toughness, chemical resistance, and high dielectric strength, epoxy powder coatings are an ideal fit for bus bars, stators, rotors, and covers for battery packs. They also support the longer-term performance of the battery by protecting it against corrosion and other threats.

- Traditionally all these requirements can be fulfilled by multiple layers of liquid coatings. The primer layer addressing corrosion and dielectric protection, and top coats addressing weatherability and impact resistance. However, certain powder coatings can meet all requirements in a single coat. With newer EV technologies and designs, having a single coat able to deliver multiple functions will gain popularity due to both cost and performance.

- Powder coatings are known for their inherent advantages related to sustainability such as no VOCs, minimal waste, and faster processing times.

Thus, electric vehicles will be a good growth area for powder coatings.

Trend # 3: Powder Coatings in Architectural Coatings

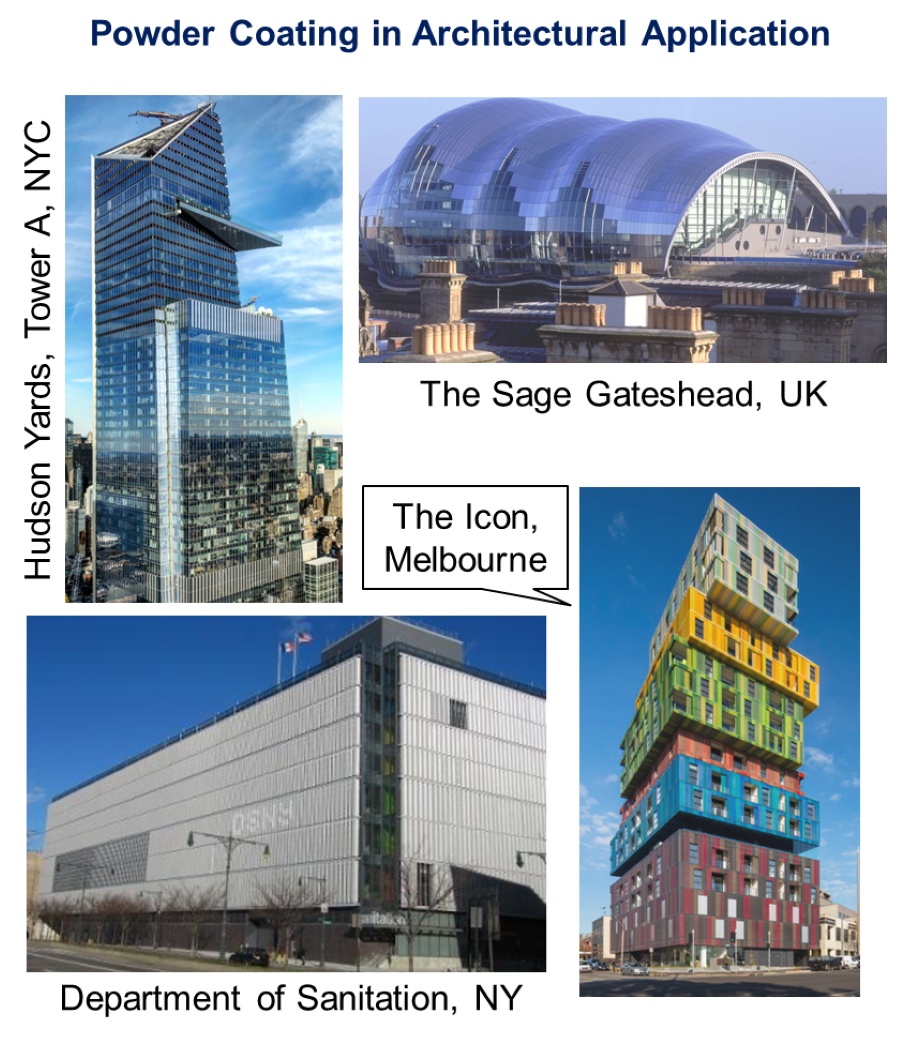

The performance and asset protection requirements will only go up in the future. The increasing demand of powder coatings for architectural applications proves this. They are used for interior and exterior aluminium extrusions such as windows, facades, etc. Figure 5 shows examples of landmarks and buildings where powder coatings have been used.

FIGURE 5 ǀ Powder coating architectural applications.

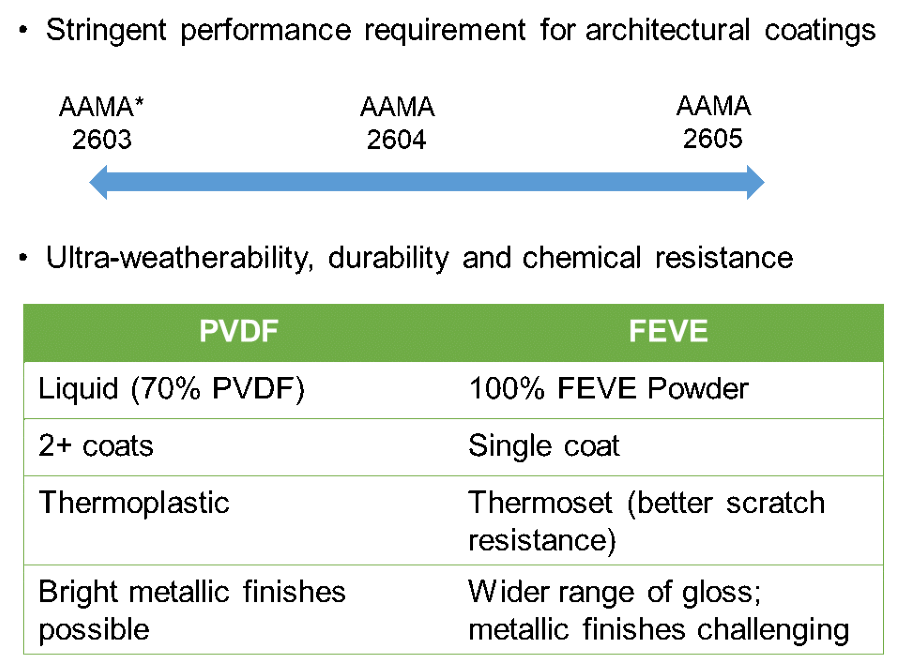

Hyper-durable powder coatings are the most weather-resistant coatings available today. These coatings need to meet the architectural standards, which may vary from region to region such as the AAMA (American Architectural Manufacturing Association) in the United States and Qualicoat specifications in Europe.

As highlighted in Figure 6 below, the standards have become more stringent. For example, AAMA 2603 has to undergo salt spray testing of 1,500 hours and has a relatively relaxed weathering requirement. These specifications are primarily used for interior applications. As we move towards AAMA 2605, it requires an aggressive 2,000 hours cyclical salt spray test. This also requires a color and gloss warranty of 20-25 years, depending on the project requirement. These specifications are used for exterior applications on high-value residential buildings, monumental buildings, etc.

FIGURE 6 ǀ AAMA standards.

For hyper-durable applications, usage of liquid coatings has been quite prevalent, especially for the most stringent of specifications. This is typically based on 70% PVDF liquid coatings (30% acrylic). Hyper-durable powder coatings are increasingly recognized as a relevant alternative to liquid PVDF. The powder technology is also based on fluoropolymer technology (i.e. FEVE or fluoro-ethylene vinyl ether) and has some advantages:

- It achieves the same performance in a single coat.

- The thermosetting properties of FEVE-based powders mean far superior scratch resistance and a significant reduction in susceptibility to dirt.

- PVDF resins act like a matting agent and hence the PVDF coatings are much more limited in the range of gloss they can achieve. With FEVE powder coatings, a wider range of gloss finishes is available, though there are some challenges in getting metallic finishes.

Due to these advantages, there is increasing demand for hyper-durable powder coatings for architectural as well as in the ACE (Agricultural, Construction & Earthmoving equipment) segment.

Powder coatings have been the preferred coating for aluminum substrates in Europe for decades. Europe requires coatings with significantly less UV resistance, and the Qualicoat standards are different than the American standards. Because of the difference in standards, most European extrusion coating infrastructure is dedicated to powder coatings, using different chemistries such as super-durable polyesters, amongst others.

In North America, buildings are exposed to significantly higher quantum of UV radiations, hence the need for higher performance. Fluoropolymer-based liquid coatings have been the standard in the United States, based on prevalent specification practices and supply chain infrastructure. Next-generation powder coatings, based on FEVE, complement the existing liquid coating technologies and are gaining traction in the North American markets.

As a note of caution, however, fluoropolymers are under increasing regulatory scrutiny. The carbon-fluorine bond is extremely difficult to break and this provides the super-durable properties to the coatings. However, the flip side to this is that recent studies reveal that a specific class of fluorochemicals (PFAS, per-and polyfluoroalkyl substances) are resistant to heat, stains, oil, grease, and water. They are ‘forever chemicals,’ which means they are difficult to destroy. They can leach from coatings into water and enter the human body. The European Union is considering a ban on PFAS chemicals from 2026-27, onwards.1 The impact of such regulations needs to be studied in regards to relevant powder coating formulations.

Trend # 4: Smart Powder Coatings

Smart coatings are the coatings that respond in a controlled manner to a specific external stimulus and provide functionalities beyond the decorative or protective field.

- Anti-microbial coatings inhibit the growth of bacteria and microbes on the coating surface. These coatings may have ingredients that are pesticides and, hence, require special regulatory approvals. With increasing health consciousness post Covid, there is likely to be a demand for such coatings. Possible applications include hospitals, fitness equipment for gymnasiums, home appliances, and more.

- Retro-reflective coatings are the coatings that improve visibility of riders at night by reflecting the maximum light back to its source. Such coatings, in liquid form, have been used for a long time for pavement markings and street signage. However, retro-reflective powder coatings are a relatively recent phenomenon. Formulation involves embedding reflective glass beads in the powder coating, such that they stay on the surface. Such coatings were launched by a United States coatings manufacturer in 2021, in partnership with bike-share company, Lyft. Abel Lopez, a Lyft engineer, was struck and killed by a vehicle while riding his bicycle in October of 2020. So, when Lyft first launched its new fleet of e-bikes coated with retro-reflective coatings, they did so in the color, ‘Abel Gray finish,’ as a tribute to its deceased employee. In India, ~20,000 bicyclists die due to road accidents every year, the majority of which happen at night or in low light. As of now, in India, some of the cycles have retro-reflective tapes fixed onto them, but powder coatings would definitely be a more durable and effective solution.

- Anti-graffiti coatings are easy-to-clean coatings that can enable the removal of unwanted graffiti from metal surfaces. Application areas include, but are not limited to, lockers, mailboxes, restroom structures, public transport, and playground equipment.

In addition to these, there are other variants such as thermo-chromic coatings that change color on exposure to heat, mosquito-repellent coatings, and others. These are some interesting developments, and one must study the market potential in the local market before venturing into such niche areas.

Trend # 5: Heat-Sensitive Substrates

A reduction in baking temperatures means powders can be applied on more and more substrates, resulting in lower energy consumption, no VOCs, and, therefore, a more-sustainable alternative to liquid coatings and anodizing. This can open up newer markets such as MDF, wood, thermoplastics, and composites.

There is renewed interest in this area. This is also evident from the list of recent mergers and acquisitions that have happened with the intention of getting access to technology for low-temperature curing such as PPG’s acquisition of Alpha coatings and Akzo Nobel’s acquisition of the Stahl Powder coatings business. Both were driven by their intention of penetrating the low-temperature curing market.

Now there are at least two technologies that are available:

- Thermosetting powder coatings for low cure temperature based on different chemistries.

- UV and infrared technology: UV curing was introduced in the 1990s, but hasn’t taken off as per the expectations due to several challenges such as high resin cost, requirement of special UV lamps, red and yellow pigments not being compatible with photo-initiators, etc. Complex geometric-shaped objects require special handling as hidden parts are not readily visible to curing UV light energy.

With technological developments, we see more potential in application to MDF, but there are still many obstacles to overcome in applying powder onto wood substrates. In addition, low-bake applications would require special binders and special application equipment, mainly different ovens. Improvements in equipment coupled with further developments in raw materials and formulations will help these powder coating products enter newer markets.

This article covered five key emerging trends in the global powder coatings market. All these trends highlight the growth opportunities for the market as well. Industrial coatings producers have entered 2023 in a much more sombre mood, as compared to the beginning of 2022. This is primarily on account of a slowdown in economic and industrial growth across different regions. These may be short-term hiccups, but over medium to long term, the powder coatings industry is poised for strong growth, driven by conversion from liquid to powder and newer growth opportunities such as electric vehicles, architectural applications, smart coatings, and the usage of powder coatings on heat-sensitive substrates.

References

1 https://www.reuters.com/article/europe-chemicals-pfas-time-idUSL8N34N32P

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!